Borrowing v austerity: take your pick on 7 May, says IFS

Think tank warns of £170bn extra debt under Labour but paints a miserable picture if Tories succeed

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

An independent think tank is warning that Ed Miliband will unleash a wave of extra borrowing by 2020 if he wins the general election - £50 billion a year more than the Tories are planning. But there’s a stark warning about life under the Tories, too.

Paul Johnson, director of the Institute for Fiscal Studies, writes in The Times that the extra funds Miliband would need to balance the books under his plans risk adding £170 billion to the national debt by 2030, leaving little room for the government to offer emergency help if there is another economic crash.

This all sounds like a boost for Chancellor George Osborne who received good and bad news this morning when the latest figures from the Office for National Statistics showed inflation dropping to 0.5 per cent in December – a record low. (Good news in that households feel better off, bad in that tax receipts for the Treasury go down and the threat of Japanese-style deflation increases.)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Meanwhile, Osborne was due to use a vote later today in the Commons on a charter for budget responsibility to try to bind Ed Miliband and the shadow chancellor Ed Balls to his strategy for future cuts in public spending.

Miliband and Balls will go along with the Chancellor’s game by voting in favour of the charter to avoid being cast as the binge spenders that the Tories claim they are.

The difference between the two plans is that the Tories have said they want to get to budget surplus before the end of the next Parliament whereas Labour want to borrow to pay for investment spending. Johnson reckons this implies Labour would need to make cuts of £30bn less over the next Parliament than the Conservatives.

That would make a “really big difference to the extent of the cuts” which Johnson foresees as being grim under the Tories. “If you take the plans set out in the Autumn Statement at face value, spending cuts of more than £50 billion could be required after 2015-16.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

He told Radio 4’s Today programme this morning: “If we go down that line we have cuts after the election that are at least as significant, year on year, as the cuts we have had in this Parliament which could take spending on non-protected bits of public spending - police, home office, environment, defence - to an average of at least 30 per cent less than they were in 2010.

“So if we follow the Conservative route, we have got some really big spending cuts to come… the effect would be less good public services, and some risks to the delivery of public services.”

For the voters it offers a stark choice - a future of higher borrowing and debt under Labour or cuts that will damage public services under the Tories. You pays your money and you takes your choice…

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

How long can Keir Starmer last as Labour leader?

How long can Keir Starmer last as Labour leader?Today's Big Question Pathway to a coup ‘still unclear’ even as potential challengers begin manoeuvring into position

-

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

‘They’re nervous about playing the game’

‘They’re nervous about playing the game’Instant Opinion Opinion, comment and editorials of the day

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

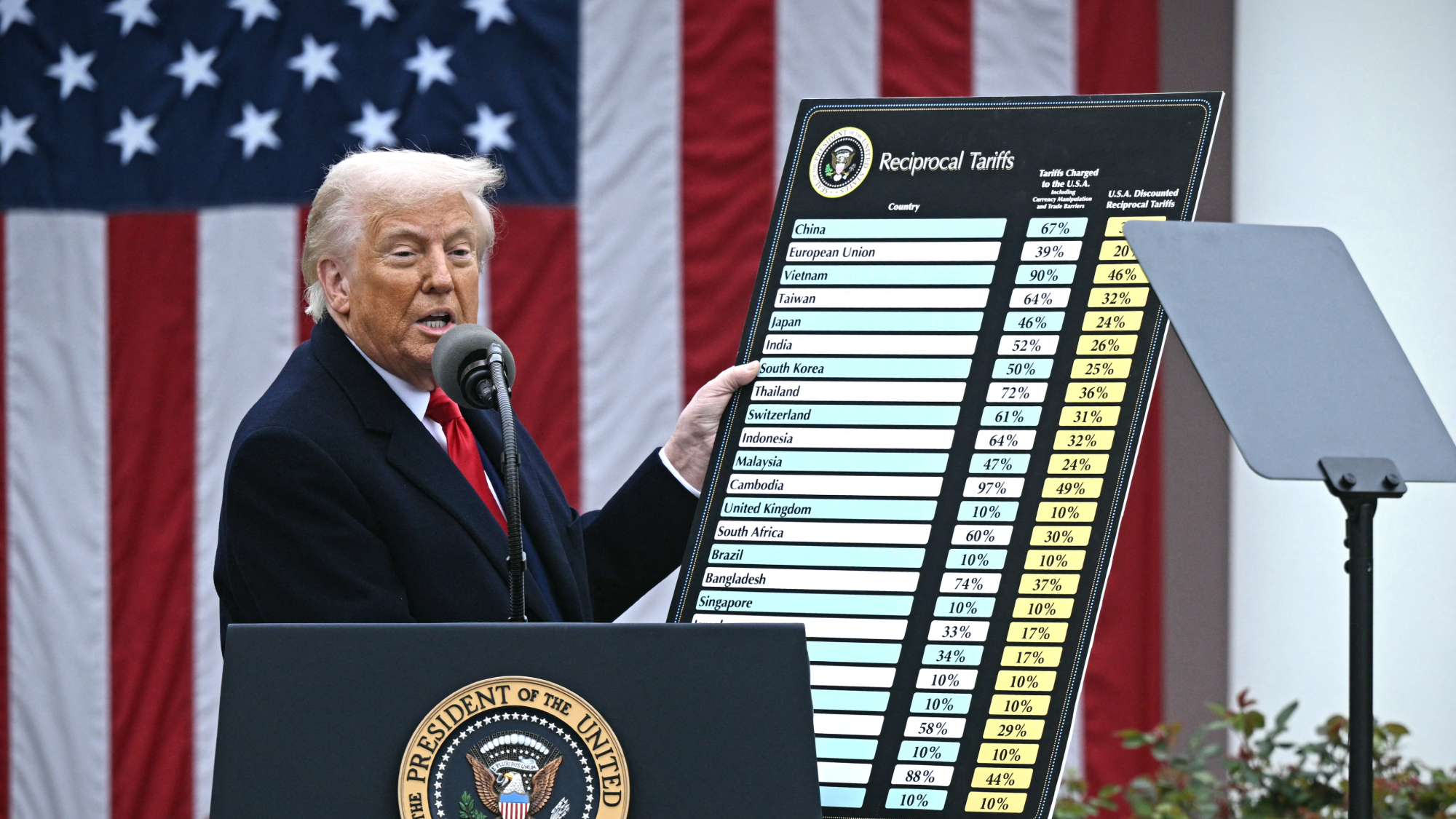

Tariffs: Will Trump’s reversal lower prices?

Tariffs: Will Trump’s reversal lower prices?Feature Retailers may not pass on the savings from tariff reductions to consumers

-

Taking the low road: why the SNP is still standing strong

Taking the low road: why the SNP is still standing strongTalking Point Party is on track for a fifth consecutive victory in May’s Holyrood election, despite controversies and plummeting support

-

Inflation derailed Biden. Is Trump next?

Inflation derailed Biden. Is Trump next?Today's Big Question 'Financial anxiety' rises among voters