Tesla shares slide as Elon Musk cuts 3,000 jobs

Electric carmaker claims lay-offs are ‘crucial’ to Model 3 production

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Shares in electric carmaker Tesla have tumbled in the wake of company chief Elon Musk announcing that around 3,000 jobs are to be cut.

In an email to staff, posted by Teslarati, the South African-born billionaire said that the firm is finding it difficult to develop EV technology cheaply enough, leaving it with “no choice but to reduce full-time employee headcount by approximately 7%”.

Given that the California-based company employs 45,000 people, the cuts equate to a loss of a little over 3,000 jobs, according to the BBC.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Musk said Tesla’s workforce had grown by 30% in 2018, but stressed that the firm had taken on more people than it could support and that “only the most critical temps and contractors” would be retained.

He assured employees that, despite the cuts, Tesla had had its most “successful year” in history in 2018, delivering as many cars in the final quarter as it did over the whole of 2017.

However, the news rippled through the stock markets this morning. Share prices slid by around 7.2%, Bloomberg reports, lowering values to $322.40 (£249.22).

Although Tesla is one of the most prominent producers of electric cars, Musk acknowledged in the email that its products are “too expensive” compared with those offered by other EV makers.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

According to The Daily Telegraph, Tesla is currently producing only highly-specced versions of the Model 3, costing around $44,000 (£34,000) each, instead of the entry-level - and less profitable - $35,000 (£27,000) version the company has promised.

Musk said the cuts were “crucial” for increasing production of its budget Model 3, which would help it retain its $35,000 price tag and still be a financially viable product for the company.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

Elon Musk’s pivot from Mars to the moon

Elon Musk’s pivot from Mars to the moonIn the Spotlight SpaceX shifts focus with IPO approaching

-

Moltbook: the AI social media platform with no humans allowed

Moltbook: the AI social media platform with no humans allowedThe Explainer From ‘gripes’ about human programmers to creating new religions, the new AI-only network could bring us closer to the point of ‘singularity’

-

Will regulators put a stop to Grok’s deepfake porn images of real people?

Will regulators put a stop to Grok’s deepfake porn images of real people?Today’s Big Question Users command AI chatbot to undress pictures of women and children

-

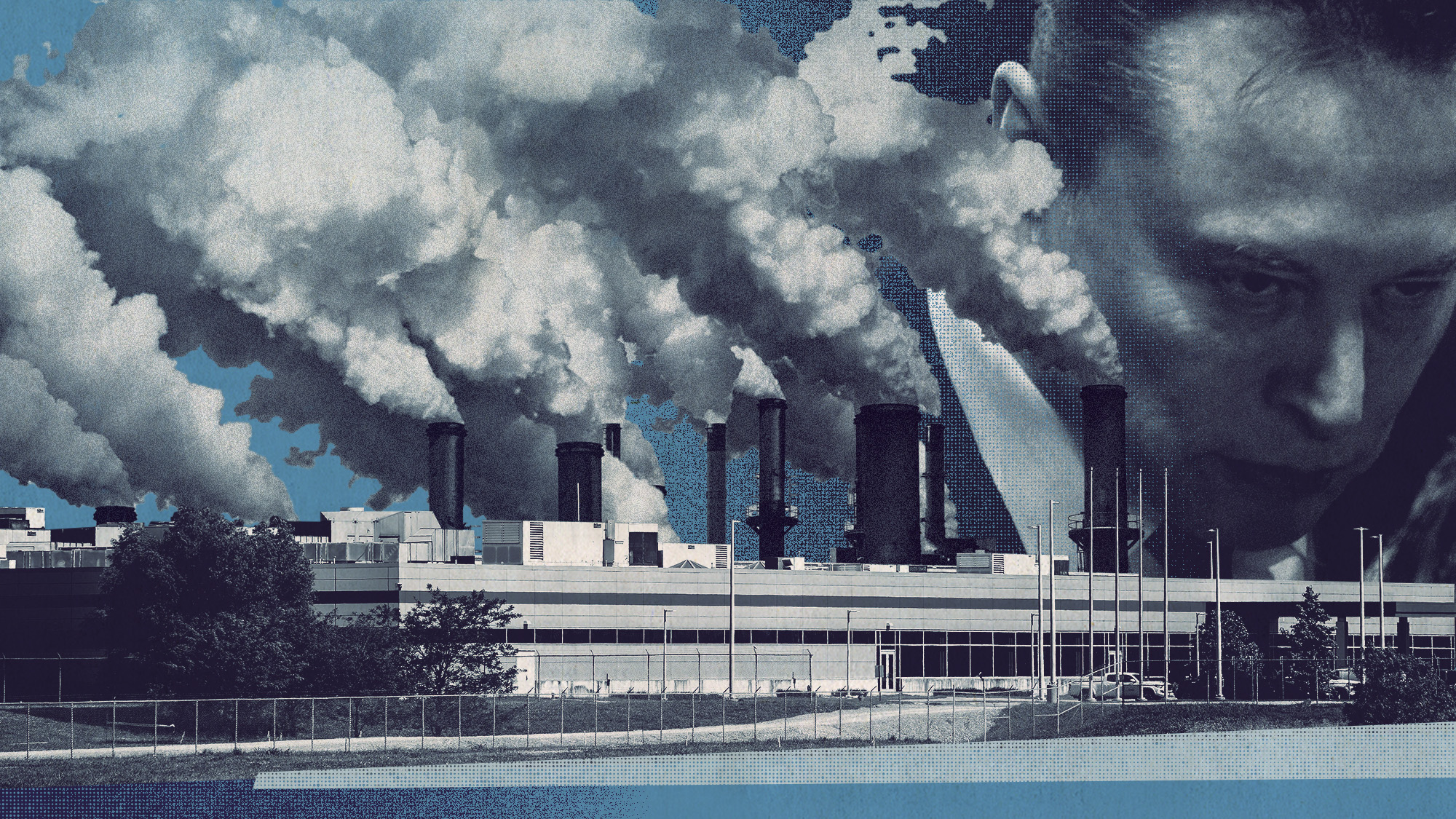

Inside a Black community’s fight against Elon Musk’s supercomputer

Inside a Black community’s fight against Elon Musk’s supercomputerUnder the radar Pollution from Colossal looms over a small Southern town, potentially exacerbating health concerns

-

X update unveils foreign MAGA boosters

X update unveils foreign MAGA boostersSpeed Read The accounts were located in Russia and Nigeria, among other countries

-

What's Linda Yaccarino's legacy? And what's next for X?

What's Linda Yaccarino's legacy? And what's next for X?Today's Big Question An 'uncertain future' in the age of TikTok

-

X CEO Yaccarino quits after two years

X CEO Yaccarino quits after two yearsSpeed Read Elon Musk hired Linda Yaccarino to run X in 2023