How to free yourself from credit card debt

Has your balance gotten out of control? Personal finance experts have some solid tips and tricks to help you get on top of your credit card debt.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

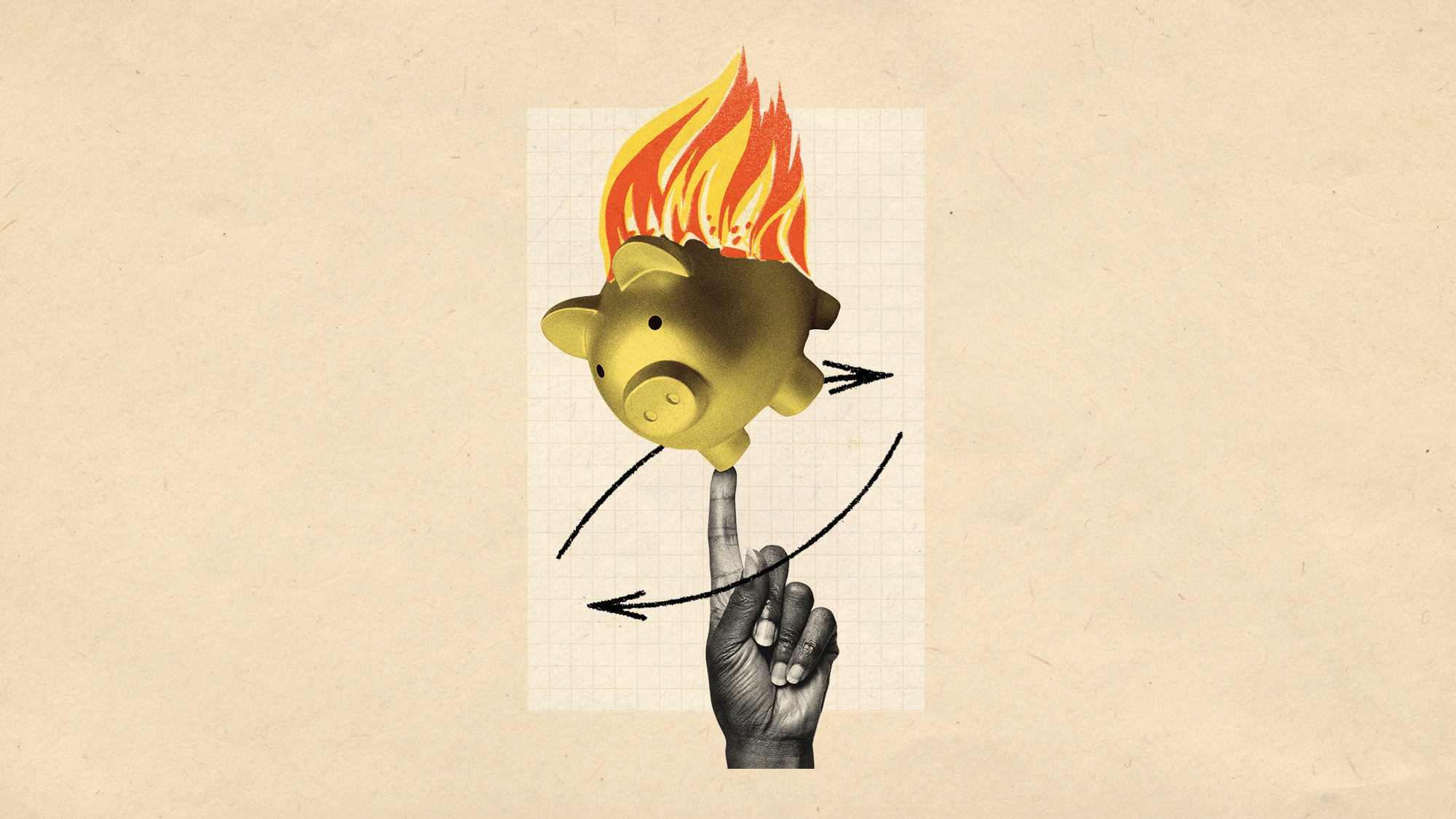

America's credit card debt hit a new high in 2022. The credit bureau TransUnion revealed in the final quarter of the year that total U.S. credit card debt now stands at a record $930.6 billion, CNBC reports. It's expected that credit card delinquencies — which occur when a debtor is more than 30 to 90 days late on payment — will jump to their highest levels since 2010, according to Kiplinger.

If you're a contributor to that mountain of credit card debt, start by taking a deep breath — most Americans were hit hard by the recent combination of inflation and increasing interest rates. Then, realize that there are action steps you can take to get a handle on your credit card debt and work toward paying it down, rather than falling into delinquency.

Figure out how much debt you actually have

It might not feel fun to look at this number, but taking stock of your total debt is a necessary first step to determining how to pay it down. If you have more than one credit card, jot down how much you owe on each credit card, as well as the interest rate and minimum monthly payment. You might consider using a spreadsheet or a budgeting app, "but pen and paper work just as well," Kiplinger says.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Talk to your creditor

If you've fallen behind on payments or are unsure of whether your minimum monthly payment is realistic for your current budget, reach out to your credit card company, even if it's not clear they offer assistance programs. "It's a known fact that creditors offer relief programs off the menu," Bruce McClary, a spokesman for the National Foundation for Credit Counseling (NFCC), tells Kiplinger. "You'll have to show that you're facing a hardship, but companies may be able to provide some kind of solution for you, at least in the short term."

If you've been a customer for a while and your account is in good standing, your creditor may be more likely to help. For instance, they might negotiate payment terms, offer a lower interest rate, or figure out a hardship program that you can both agree upon.

Pay more than the minimum

If you can't pay your card in full each month, at least aim to pay more than the "minimum" payment required. Paying the minimum is a nice way to leave "more money in your pocket each month," Experian says, but it's not a long-term solution to your debt troubles. That's because only a small amount of a minimum payment goes toward paying down your balance. The rest goes toward interest and fees. And remember, "banks make money off the interest they charge each billing period, so the longer it takes you to pay, the more money they make," according to NerdWallet.

Consider a balance transfer card

For those who still have solid credit, a balance transfer credit card might "help you get out from under your debt," Kiplinger says. These cards allow you to move your existing balance from one or more credit cards onto a new card. Often, that new card will offer an introductory annual percentage rate (APR), sometimes as low as 0 percent, for anywhere from 12 to 21 months.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"By moving debt from a credit card or loan with a high-interest rate to a card with a low-interest rate, you may be able to lower your monthly payments and eventually pay off your balance," Kiplinger explains. However, it's important to make sure you can pay off your balance in full before the introductory rate expires, or you could end up right back where you started.

Also note that "balance transfers are rarely 'free,'" Kiplinger warns. You'll likely pay a transfer fee to move over your existing balances, usually 3 percent to 5 percent of the amount transferred. Think twice before closing your old cards, too, because doing so could have an effect on your credit score.

Typically, balance transfer cards are reserved for those with good or excellent credit scores (think a FICO score of 690+). If that's not you, rest assured that you still have options. You might still qualify for a balance transfer credit card, though likely not one with a 0 percent APR. Still, the offered APR could be lower than what you currently have.

Consolidate your debt

Another option is debt consolidation. In effect, this is when "multiple debts are combined into a single, larger debt" that has a lower interest rate or monthly payment, Investopedia says. You could take out a loan from a bank or credit union, which you'd then use to pay off your credit card in full. Then, you'd pay back the loan. Paying just one lender instead of many can help "simplify" your bills, Investopedia adds. "And as long as you don't take out any additional debt, you can likely get rid of your debt faster."

Experian has a useful list of what it considers the "best" debt consolidation loans for 2023.

When you apply via links on our site, we may earn an affiliate commission

Select a strategy to pay down your debt

There are three strategies that are popular for those trying to pay down multiple credit card balances: the avalanche approach, the snowball approach, and the blizzard approach.

- Avalanche approach: Here you start by focusing on the cards that have the highest interest rates and the highest balances. While you put most of your funds toward paying those off, you make the minimum payments on your cards with lower balance or interest rates. Once that high-interest balance is paid off, you move to focusing on the card with the next highest rate and so on, until all of your debt is paid off. This "makes the most sense from a mathematical point of view," Kiplinger says.

- Snowball approach: This method can seem less daunting than the avalanche approach, because you start by paying off your lowest balances first. That can "give you the motivation you need to pay off all of your debts, even if it costs you more in interest," Kiplinger explains. Just keep in mind this isn't the approach that's most likely to save you money in interest.

- Blizzard approach: The blizzard approach is a cross between the avalanche and the snowball. You start with a small win, by paying off one low-balance debt first. From there, you move on to tackling your debts with the highest interest rates.

Reach out for help if you need it

If you're still really struggling and feel like you're drowning in debt, don't hesitate to reach out for help sorting out your situation. One option is contacting a nonprofit credit counseling agency to get a debt management plan. The Federal Trade Commission offers solid suggestions for how to choose a credit counselor.

Counselors will consolidate your debt and work with your creditors to secure new terms. You'll then pay the agency a fixed amount each month. Note that your accounts might get closed as they're paid off, NerdWallet says, and you may have to commit to holding off on opening any new accounts for a certain amount of time. Still, it can offer a real lifeline if you're in need of one.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She has previously served as the managing editor for investing and savings content at LendingTree, an editor at SmartAsset and a staff writer for The Week. This article is in part based on information first published on The Week's sister site, Kiplinger.com

New Tax Rules for 2023: Download your free issue of The Kiplinger Tax Letter today. No information is required from you.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

Ex-South Korean leader gets life sentence for insurrection

Ex-South Korean leader gets life sentence for insurrectionSpeed Read South Korean President Yoon Suk Yeol was sentenced to life in prison over his declaration of martial law in 2024

-

At least 8 dead in California’s deadliest avalanche

At least 8 dead in California’s deadliest avalancheSpeed Read The avalanche near Lake Tahoe was the deadliest in modern California history and the worst in the US since 1981

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

How your household budget could look in 2026

How your household budget could look in 2026The Explainer The government is trying to balance the nation’s books but energy bills and the cost of food could impact your finances

-

What is a bubble? Understanding the financial term.

What is a bubble? Understanding the financial term.the explainer An AI bubble burst could be looming

-

The FIRE movement catches on as people want to retire early

The FIRE movement catches on as people want to retire earlyIn the spotlight Many are taking steps to leave the workforce sooner than usual

-

Who wants to be a millionaire? The dark side of lottery wins

Who wants to be a millionaire? The dark side of lottery winsIn The Spotlight Is hitting the jackpot a dream come true or actually a nightmare?

-

How can you find a financial adviser you trust?

How can you find a financial adviser you trust?the explainer Four ways to detect professionals who will act in your best interest

-

What should you consider when choosing a financial adviser?

What should you consider when choosing a financial adviser?The Explainer The right person can be a big help with financial planning, investing, taxes and more

-

What Biden's IRA means for EV tax credits: 2024 updates

What Biden's IRA means for EV tax credits: 2024 updatesThe Explainer Which cars are eligible and how much money can owners save?

-

How to ensure you don't outlive your retirement savings

How to ensure you don't outlive your retirement savingsThe Explainer Your golden years should be enjoyed. Don't let finances get in the way.