What to know about student loan scams as payments resume

Due dates aren't the only thing you should watch out for

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As student loan borrowers readjust to making payments after a more than three-year pause, they should stay aware of more than just their payment due dates — they should also be on high alert for potential scams. Before student loan payments even resumed in October, over 350,000 student loan-related robocalls were placed within the first two weeks of September, "roughly as many as in the nine prior weeks," CBS MoneyWatch reported, citing information from Transaction Network Services.

Further, given the length of the pause and the changes it brought to the student loan landscape, it is likely easier than ever to get confused as to what's what. As Yahoo Finance noted, "During the pandemic, some servicers stopped dealing with student loans or ended their contracts, which means many borrowers are likely to restart their payments with companies they may not be familiar with." Meanwhile, other borrowers are making their payments for the first time ever.

What are common student loan scams to look out for?

- Scammers posing as student loan servicers: Fraudsters may try to pretend they're a borrower's new student loan servicer. Before engaging with any phone calls or emails, confirm who your student loan servicer is, which you can do by visiting StudentAid.gov or by calling the Federal Student Aid Information Center, advised CBS MoneyWatch.

- Fake Department of Education websites or affiliations: Another common scam is directing borrowers to a website that may appear to be the Department of Education's website but actually isn't. The Department of Education's official website is ed.gov, while the official Federal Student Aid website is studentaid.gov. Per The Motley Fool, "If you're directed to a website that ends in .com, .net, or any other extension, it isn't legit," and "the same goes for any other website that isn't one of these official sources of federal student loan information." Another red flag is "anyone stating that they are 'federally affiliated' or related to the Department of Education," according to Yahoo Finance.

- Promises of debt relief in exchange for payment: Also be on the lookout for any offers for help managing your student loans or even getting them forgiven — but in exchange for payment first. As the Federal Trade Commission (FTC) underscored: "If someone tries to charge you upfront, before they've done anything, that's your first clue that this is a scam. And nobody but a scammer will ever offer you quick loan forgiveness."

How can you avoid falling victim to a student loan scam?

- Don't give out sensitive information. This includes any personal or financial information requested by an unknown party. Never give away your FSA ID login information — "only scammers will ask for this," CNBC reported, and once they get it, "they can cut off contact between borrowers and their loan servicer, and perhaps even steal their identity.”

- Don't pay for debt relief or loan forgiveness. Similarly, don't trust anyone who is contacting you and offering a quick path toward paying down your student loan debt. As CNBC noted, "special access to repayment plans or forgiveness options doesn't exist"; all of your options are findable by logging into your student loan account.

- Don't give in to pressure. If anyone is pushing you to make a quick decision, take a step back. "Pause, do research, go to StudentAid.gov," an FTC official told Yahoo Finance.

Where can you find legitimate student loan info?

As you readjust to regular student loan payments, it's likely questions will come up. The "best source" of information on federal student loans is the Federal Student Aid website, CNBC reported. And if you do spot a scam, be sure to submit a complaint, either through the Federal Student Aid website or the FTC.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

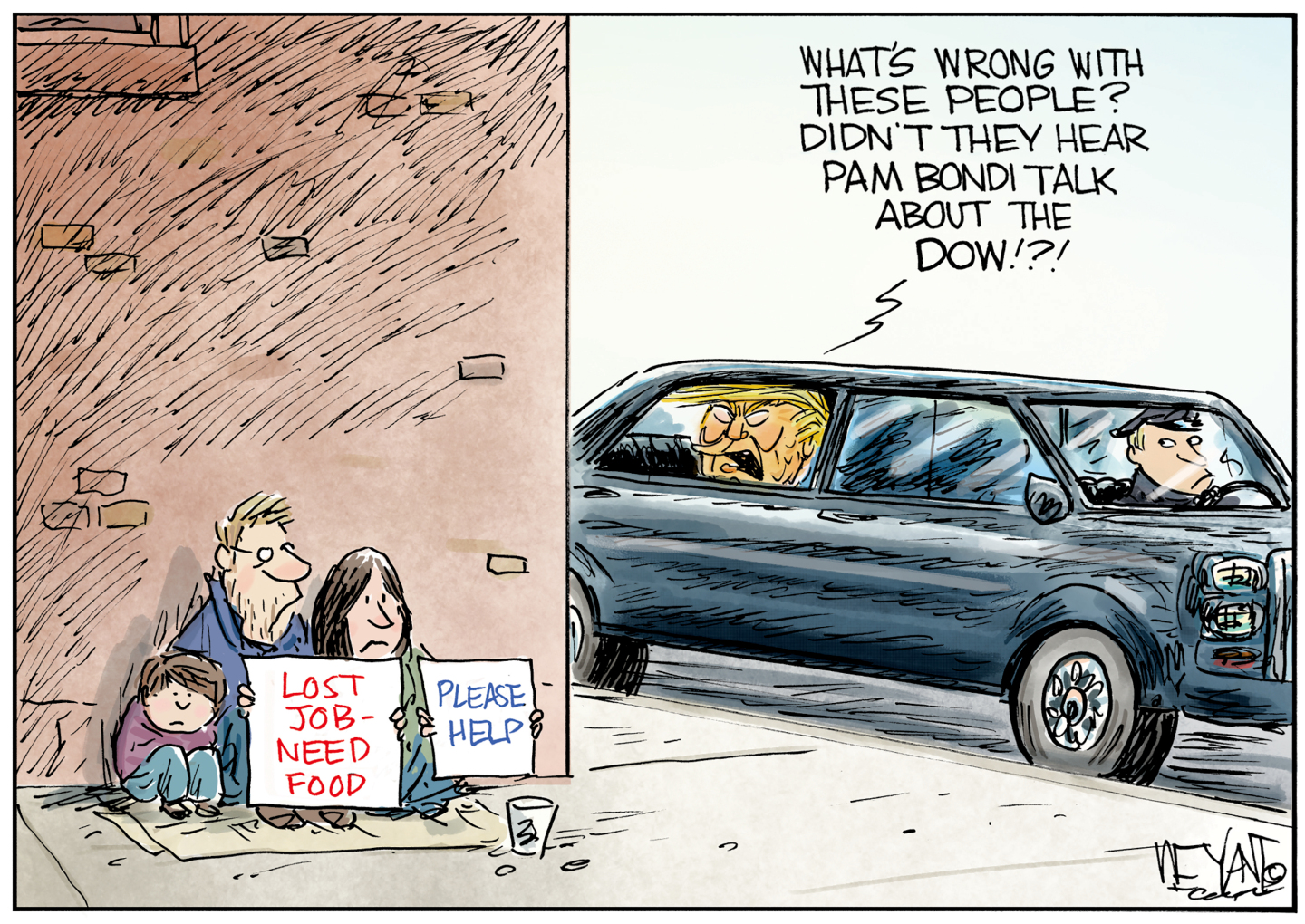

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ read

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ readIn the Spotlight A Hymn to Life is a ‘riveting’ account of Pelicot’s ordeal and a ‘rousing feminist manifesto’

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money

-

Saving for a down payment on a house? Here is how and where to save.

Saving for a down payment on a house? Here is how and where to save.the explainer The first step of the homebuying process can be one of the hardest