Greece finally reaches deal to release €12bn bailout funds

ECB stress tests show country's banks needs €14bn to fill a capital shortfall

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Greece crisis: IMF shocks Europe by calling for debt relief

15 July

The International Monetary Fund has condemned the terms of the Greek bailout deal negotiated by the eurozone and called for some of Greece's enormous debt to be written off.

In a leaked memo to eurozone leaders, it warned that Greece's public debt was highly unsustainable and the scale of debt relief needed went "well beyond" what has so far been considered.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"The findings are explosive," says the Daily Telegraph. The document amounts to a warning that the IMF will not take part in the bailout unless Germany and other European creditors offer Greece substantial debt relief – something they have strongly resisted throughout months of fraught negotiations.

Greece owes roughly 10 per cent of its debt to the IMF, and Germany has insisted it remain part of the bailout plan. If the organisation were to walk away, it could cause "significant political and financial problems for Berlin and other eurozone creditors," according to the Financial Times."[The report's] conclusions validate what Greece's Syriza government has been saying all along," says the Telegraph's Ambrose Evans-Pritchard. "The debt cannot be repaid. Any formula that fails to recognise this merely stores up an even bigger crisis down the road." News of the report news comes just hours before Greek MPs are due to vote on introducing a number of harsh economic reforms in exchange for the bailout funds. The BBC's economics editor Robert Peston warns that the report will makes it even harder for Tsipras to persuade parliament to back the measures in today's vote.

"Why on earth should Greek MPs vote for a painful economic reform package which the IMF – the supposed global arbiter of these things – does not believe will put the country back on the path to prosperity?" he says.

Despite the rebellion within his own party, Tsipras says he will not step down as leader. "The worst thing a captain could do while he is steering a ship during a storm, as difficult as it is, would be to abandon the helm."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In a televised address to the nation ahead of today's vote, he said he took full responsibility for signing a deal he did "not believe in, but which I signed to avoid disaster for the country".

Greece crisis: what's standing in the way of the rescue package?

14 July

Greek Prime Minister Alexis Tsipras has returned to Athens after striking a bailout deal which averted the immediate risk of Greece's ejection from the eurozone. He now faces a number of new challenges, including convincing the Greek parliament to accept further austerity measures in exchange for the new €86bn rescue package. Athens needs to implement punishing economic reforms, including spending cuts, tax hikes and pension reforms by Wednesday in order to begin formal negotiations this week on a financing package that would save the country from complete economic collapse. Here's what else is standing in the way:

Greek parliament

A growing number of MPs within the ruling Syriza party – which was elected on a promise of ending austerity – have vowed to oppose the reforms, with the party's extremist Left Platform calling the deal a "humiliation of Greece". Tsipras also faces a revolt from his right-wing coalition partners, the Independent Greeks, who have dismissed the deal as a "coup" by Germany. Despite this, experts predict the deal will pass with the help of wide support from the opposition. "But the insurrection called into question how long Mr Tsipras could survive as prime minister once the legislation was passed," warns the Financial Times.

Eurozone parliaments

It is not just Greek politicians who will be voting on the new bailout deal. Six other European parliaments, including Germany's, will need to pass legislation to pave the way for the rescue package, with voting expected to go ahead later this week. German Chancellor Angela Merkel said that once Greece had pushed through the required reforms, she would "recommend with full conviction" that the Bundestag approve the deal.

Strikes and protests

Tsipras will have difficulty convincing his fellow politicians, but selling the unfavourable terms to the Greek public – who have borne the brunt of years of austerity – will be nearly impossible. Anti-austerity marches have taken place across Athens following news of the deal, and the country's civil service has called for a 24-hour strike to be held on Wednesday.

While the deal might have avoided short-term economic disaster, it won't translate into immediate, or even medium-term relief for the long-suffering population, says Bloomberg. "Unemployment and poverty will continue to spread, and the genuine sense that Greeks have lost control of their destiny will intensify."

Britain backs away

Britain could face a £1bn bill from Greece's emergency bailout, according to Sky News. European institutions are considering the use of a contentious emergency fund, entailing the use of UK funds, to support Greece's economy over the coming weeks. However, the British government remains strongly opposed and Chancellor George Osborne will attempt to block the use of these British-backed funds, The Guardian reports. “The idea that British taxpayers' money is going to be on the line in this latest Greek deal is a non-starter," said a Treasury source.

"The last thing European leaders will want to acknowledge after this weekend’s marathon discussions is that the hardest part still lies ahead," says Bloomberg. "Yet that is the complex reality of this very messy situation."

No Grexit: unanimous deal finally reached after all-night talks

13 July

Greece has reached a deal with the rest of the eurozone to gain access to new bailout loans after marathon talks in Brussels."Euro Summit has unanimously reached agreement," tweeted European Council president Donald Tusk. "All ready to go for ECM programme for Greece with serious reforms and financial support."After more than 16 hours of negotiations between eurozone finance ministers, an agreement was struck which will pave the way for Greece to receive new bailout funds over the next three years. However, the deal still requires the approval the Greek parliament. Prime Minister Alexis Tsipras had been under pressure to agree to tough new economic reforms to avoid complete economic collapse and an exit from the single currency.European Commission head Jean-Claude Juncker this morning confirmed: "There will not be a Grexit." He described the deal as a compromise, saying "there are no winners and losers."Defending the deal, Tsipras said: "We averted the plan of a financial choking and banking system collapse. We sent a message of dignity to all of Europe."

The deal: reaction to this morning's agreement

[[{"type":"media","view_mode":"content_original","fid":"83110","attributes":{"class":"media-image"}}]]

While the exact details are not yet clear, the reforms are thought to include serious changes to Greece's tax system, cuts to its pensions, large-scale privatisation and reforms to its labour market.The Greek parliament will now be expected to pass the reforms demanded by the eurozone by Wednesday, reports the BBC. Six other European parliaments will also need to approve the new bailout.Talks on bridge financing for Greece will also begin immediately to help the country cover its debt repayments over the next few months. The European Central Bank will now be under pressure to renew its funding for Greece's banks, which are on the verge of collapse.

The Greek population will be extremely relieved that a deal has finally been struck, the BBC's Tanya Beckett reports from Athens. "But the Greeks also feel a very strong sense of humiliation. They are angry that […] Alexis Tsipras has turned their back on them by accepting precisely what they didn't want – more austerity."

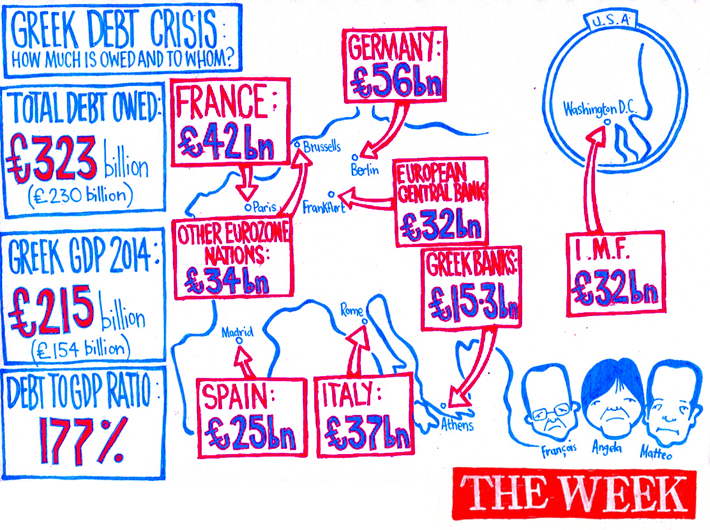

Greek debt: who is due money from Greece?

Graphic by Simon Coxall

Greece crisis: what exactly is Tsipras offering the eurozone?

10 July

The Greek Prime Minister, Alexis Tsipras, has promised to implement fresh austerity measures in a desperate bid to prevent his country from going bankrupt and leaving the single currency.

The new 13-page proposal has been submitted to Greece's international creditors and promises spending cuts totalling €13bn in exchange for a three-year loan worth €53.5bn.

"With this proposal, the Greek people and the Greek government confirm their commitment to fulfilling reforms that will ensure Greece remains a member of the eurozone and ending the economic crisis," he said, according to the Financial Times.

The proposals include radical changes to the country's tax system, cuts to military spending and the privatisation of state-owned assets.

The measures include:

- Defence spending cuts worth €300m (£216m)

- Privatisation of ports and sale of state shares in telecoms giant OTE

- Scrapping solidarity grants for poorest pensioners by 2019

- Getting rid of tax breaks for wealthiest islands

- Unifying VAT rates at 23 per cent

French president Francois Hollande has praised the proposals, calling them "serious and credible" and offer evidence that Greece is serious about avoiding an exit from the eurozone.

European markets have also reacted positively to the news, with the Stoxx Europe 600 Index rising by 1.5 per cent, the FTSE 100 up 0.93 per cent, and the euro jumping 1.1 per cent, reports the Daily Telegraph.

But commentators have pointed out that the new proposal contains many elements rejected in the country's referendum last Sunday. "There will be factions within the Greek parliament that simply won't know what Tsipras is playing at," economist Chris Weston from IG told The Guardian.

Greek MPs will vote on the proposals later today, and the prime minister is likely to face strong opposition from the far-left. But a Syriza spokesperson told the BBC the party was confident it would get the backing it needs.

Two obvious questions remain, says The Guardian's Graeme Wearden. "Will this … be enough for creditors, or will they push for even tougher 'conditionality' now we're talking about a new bailout programme?

"And how will Alexis Tsipras persuade his party, including the hardline Radical Left, to support it?"

Grexit: banks stay shut as Tsipras promises 'credible reforms'

9 July

Alexis Tsipras, the Greek prime minister, has promised to submit new reform proposals to Greece's international creditors by midnight tonight in a last-minute effort to save his country from economic collapse.

Greece will "file new concrete proposals, credible reforms, for a fair and viable solution," he said during a heated debate in the European Parliament yesterday.

The left-wing leader was greeted with a mixture of cheers and boos as he began his speech, blaming previous bailouts for turning Greece into an "austerity laboratory," the BBC reports.

The European Central Bank, the International Monetary Fund and the European commission will then have 48 hours to analyse the proposals before leaders from all 28 EU countries meet for final crisis talks.

Athens has tabled a request to the European Stability Mechanism for a three-year loan programme in exchange for tax and pensions reforms as negotiations enter their critical stage and Greece's exit from the single currency looms.

"This is really and truly the final wake-up call for Greece but also for us, our last chance," said Donald Tusk, the president of the European council.

But the breakdown in trust between Tsipras and his eurozone partners "is so severe that it is difficult to see how it can be rebuilt in time to salvage the situation by Sunday," says The Guardian.

Greek banks and the Athens Stock Exchange remain closed and will stay shut until at least Monday, the day after the creditor's final deadline. Capital controls also remain in place, limiting cash withdrawals to just €60 per day. The European Central Bank has taken the decision not to increase support for the banks until the crisis is resolved.

As money runs out, the Greek government insists there is no immediate threat to fuel or food supplies. The economics and tourism ministry issued a statement to "reassure both the Greek citizens and the visitors (tourists) that there are adequate food supplies in the market and that their prices remain stable".

In a poll conducted by Reuters, the majority of economists now believe – for the first time – that Greece will become the first country to be forced out of the single currency. Christel Aranda-Hassel, senior European economist at Credit Suisse said: "Ultimately, I think the Greeks have overplayed their hand."