HSBC shares rise after £1.5bn buyback pledge

Plan takes total returned to investors in past three years to more than $25bn

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Has HSBC hinted it will keep UK head office?

18 September

"HSBC's chairman has suggested the bank could retain its domicile in the UK," claims the Daily Telegraph.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The high street lender is conducting a review into where it should site its head office, after concerns about a strict UK regulatory environment and high taxation led it to talk of moving abroad. A well-publicised "pivot" to Asia and the recent move of the boss of its funds arm to Hong Kong (see below) added to speculation that it HQ would move east.

But recent whispers have suggested that the bank is unlikely to take such a move after all, not least after the chancellor George Osborne announced he was removing the levy on bank assets in favour of a surcharge on UK-based profits. This will cut hundreds of millions from HSBC's tax bill.

The Telegraph now cites a speech at Cass Business School in London, during which Douglas Flint talked up the UK as one of a few markets – he notably did not mention China-controlled Hong Kong – where regulators are geared up to oversee international institutions.

"Regulatory regimes reflect their constituents, and most markets outside the UK, US and EU are essentially regional as the banks there are domestic or are subsidiaries of international banks," he said. "There is a common platform of rules under Basel, but the application is domestic."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Reuters notes he specifically "declined to comment" when asked about the head office review.

Writing for The Motley Fool, Rupert Hargreaves gives another reason the bank might be cooling towards Asia. He cites a recent slump in the share price, which has fallen 24 per cent from a high earlier this year, and says it is suffering from a concentration on the region as it closes underperforming units elsewhere to cut costs, which is weakening prospects for the bank at time when Chinese growth is said to be slowing.

The stock was down 2.7 per cent at lunchtime on Friday at 489p.[[{"type":"media","view_mode":"content_original","fid":"84645","attributes":{"class":"media-image"}}]]

HSBC rejects radical rebrand options

3 September

HSBC has backed away from a radical rebranding of its British retail banking network, choosing to differentiate high-street branches from global operations simply by adding "UK" to their name.

The new 'HSBC UK' name will be used across the bank's 1000 UK branches from the beginning of 2018, a year before laws requiring lenders to ringfence their retail operations come into effect.

There had been speculation that the bank might choose to resurrect the Midland Bank name it acquired in 1992 and dropped 16 years ago, but last month the bank said it had found that customers had no affinity with the brand. Expanding the use of its online banking brand First Direct was also touted as an option.

Sky News says that HSBC's decision to retain its branding on the high street will "dampen suggestions that it will seek to sell the UK business as a consequence of industry reforms being introduced by the Government".

UK banking operations will be headquartered in Birmingham, while a review is ongoing into whether the company's global head office remains in London or moves outside the UK, probably to Asia.

In a memo to staff the bank said of the change: "It soon became obvious that everyone preferred a name that maintains a strong connection to HSBC, and a clear commitment to the UK."

HSBC pledges to refund losses caused by system fault

1 September

HSBC has said it will compensate customers, including those with rival banks, who may have incurred charges as a result of a major system error that left hundreds of thousands of business payments, primarily salaries, stranded before the bank holiday weekend.

On Friday morning it emerged that a technical glitch had prevented businesses that bank with HSBC from transferring funds electronically using the BACS system, which is used across the sector. It meant 275,000 payments were not made, leaving people without wages ahead of the long bank holiday weekend and, the Guardian notes, causing direct debits for outgoings such as mortgage and rent payments to bounce, leaving some "facing steep charges".

HSBC said it is "committed to ensuring that no one loses out" as a result of what it termed "unacceptable problems" – and said it will "work with our customers and the other banks, including providing compensation where appropriate".

Sky News reports that all payments were thought to have been processed by Saturday morning, with customers still without their funds advised to call 03457 404 404. It adds that the financial regulator, the Financial Conduct Authority, "said it would ensure HSBC did not leave people out of pocket". Customers reported the day-long delay in payments had also caused getaways planned for the bank holiday weekend to be cancelled.

HSBC was not the only bank affected by technical problems. Royal Bank of Scotland – which was fined £56m for a major system meltdown in 2011 that left customers without access to accounts for days and which saw 600,000 payments "go missing" last year – was hit again on Monday as 6.5 million customers across its RBS, Natwest and Ulster Bank brands were unable to access online banking for about an hour.

According to The Times in June the bank pledged to invest £3.5bn in IT infrastructure in order to improve its systems.

HSBC computer fault leaves 275,000 people unpaid

28 August

As many as 275,000 people are facing the prospect of going without their paycheques over the bank holiday weekend, as a major computer glitch prevents businesses with HSBC bank accounts from making payments.

HSBC confirmed that 275,000 electronic payments from business accounts have been affected, including salary transfers and payments to other banks via the Bacs payments system.

Bacs said the company was "aware of an isolated issue that has affected one of its member organisations", but that its service was not at fault. "The Bacs system is operating as normal and we are currently working with our partners to help them resolve this as quickly as possible," a spokesman said.

HSBC has this afternoon said on its customer service Twitter feed, through which it is disseminating updates on the issue, that it is "investigating alternative ways to ensure credits are received today". Without such a resolution, customers face being without end-of-the-month wages until after the long bank holiday weekend.

The bank's business customers have been vocal in their criticism to news outlets and on social media. Mark Eddy of Interlink Scaffolding told the BBC that salary payments had left the company's account, but not reached employees. "We now have 150 irate scaffolders," he said.

This is latest major IT problem to hit the banking sector, after 600,000 payments from Royal Bank of Scotland and NatWest bank accounts "went missing" in June. RBS was fined £56m in 2012 for a major system failure that left customers unable to access their accounts for a number of days in 2011.

HSBC: another sign of its 'pivot' to Asia?

27 August

HSBC may have revealed more evidence of its 'pivot' to Asia, after it emerged that the bank's fund management boss has been relocated from London to Hong Kong.

Sky News reports that Sridhar Chandrasekharan, chief executive of HSBC Global Asset Management, which manages funds that control around $500bn in assets, has already been moved as the bank focuses on "building its operations across Asia". The business operates in 30 locations around the world and employs 2,500 people.

It cites comments made by Stuart Gulliver in June, when he said in the group's view "there isn't an obviously dominant Asian asset manager" and that it will seek to grow into that role by relocating "the centre of the asset management business back to Hong Kong from London". This came in the wake of the announcement that it was to cut 25,000 jobs worldwide as part of an extensive efficiency drive, which will see a reduction of 8,000 staff in the UK.

Earlier this month, Gulliver was quoted in the Financial Times as saying that he had given "a wrongful interpretation" that it would redeploy all of the $290bn it is planning to cut from underperforming activities into Asia. This could mean that while the funds business is being moved, the bank is not necessarily seeking to shift the wider base of its investment banking operations.

Observers are watching HSBC closely for indication of which way it is leaning as it reconsiders the location of its head office. The bank launched a review earlier this year, with Hong Kong seen as the most likely alternative to its present London headquarters.

However, the BBC's business editor Kamal Ahmed has said sources believe this is now "unlikely" since moves by George Osborne to lessen the tax burden on big banks.

HSBC rebrand: First Direct or Midland Bank?

25 August

HSBC may not, after all, be bringing back the Midland Bank brand that disappeared from high streets 16 years ago.

Earlier this summer, the Financial Times quoted chairman Douglas Flint describing the name HSBC acquired in 1992 as "odds-on favourite" for its UK retail branch network once it is ringfenced from the rest of the bank. But Sky News reports that it does not resonate with consumers and may not get the nod, according to "insiders".

"Research undertaken among HSBC employees and customers has suggested that there is relatively little affinity for the Midland name," it says. An alternative option "under consideration" is using the First Direct brand it uses on its exclusively for its telephone and internet banking business, or going the way of Prince in the early 1990s and simply badging the brands with a wordless adapted version of "HSBC's recognisable hexagon-shaped logo".

Speculation had been rife that Midland would return to the high street after HSBC announced the rebranding exercise earlier this year. Writing in The Guardian, Ian Jack said it would have been "something to lift the heart of anyone who believes that institutions and businesses should have names that reflect their history and purpose".

However, many younger customers will have only vague associations with a moniker that, when it was dropped in 1999, had a 163-year history and once represented the most powerful banking brand in the world.

Midland opened its first branch in Birmingham in 1836 and grew by acquiring local and then national rivals, becoming the world's biggest bank by 1918. When it was acquired 23 years ago by HSBC it was still among the "big four" of UK retail banks.

HSBC tight-lipped on UK head office move

3 August

HSBC dropped no hint about the outcome of a consultation that will determine whether it moves its headquarters outside the UK, but this morning it confirmed plans to relocate its British retail banking base to Birmingham.

In its interim report for the first half of 2015, the bank revealed profits rose by a little more than 10 per cent to $13.6bn (£8.7bn) despite a hit of more than $1.4bn (£900m) for ongoing legal battles related to past wrong doing and mis-selling compensation. HSBC's revenues for the first half of the year were up six per cent to $32.9bn (£21bn).

On the head office move, it said only that "detailed work has commenced" on the review and that a final decision will be announced by the end of the year.

HSBC's threat to leave the UK had been prompted, The Guardian says, by its anger over a levy on bank assets, which resulted in a £700m bill last year. That is set to rise to £1bn. Last month George Osborne rowed back on an election pledge to firm up the levy, announcing that it would be phased out and replaced by an 8 per cent 'surcharge' on banks' UK profits, which could reduce HSBC's bill to £300m.

The BBC's business editor Kamal Ahmed says sources at the bank have confirmed that a move is now "very unlikely".

The bank is, though, going ahead with plans to move its UK retail headquarters to Birmingham. A "ringfence" must be imposed on retail banking operations by 2019, but HSBC said it would move 22,000 UK employees to the new structure by the end of this year, with the office in the UK's second city being ready by the end of 2018.

The Financial Times reported in June that the new bank would be rebranded in a move that would see the HSBC name disappear from UK high streets – and which leaves open the option for what would become a standalone entity to be sold at a later date. At the same time the bank confirmed 25,000 global jobs would go in a restructure that would see 8,000 UK job losses.

That restructure is also moving on apace, with the latest results revealing the bank has sold its loss-making Brazilian operations to local group Banco Bradesco for $5.2bn (£3.3bn).

HSBC to axe 8,000 UK jobs in tilt to Asia

9 June

Thousands of HSBC employees are set to lose their jobs after the bank announced deep cuts in an effort to simplify its business and address poor investor returns.

A total of 8,000 jobs will be cut in Britain and at least 25,000 worldwide over the next two years as Europe's largest bank refocuses on the faster-growing Asian markets, The Guardian reports.

"We recognise that the world has changed and we need to change with it," said chief executive Stuart Gulliver. "Asia [is] expected to show high growth and become the centre of global trade over the next decade."

The latest staff reductions will be made across both the retail and investment banking operations and form part of HSBC's plan to cut costs by up to $5bn (£3.25bn) while expanding business in China.

The plans include the closure of HSBC's business in Turkey and the bulk of its operations in Brazil, as well as global branch closures and a massive overhaul of the bank's IT systems, the Financial Times reports.

The bank is also considering whether to move its headquarters from London, with many speculating that it could relocate to Hong Kong. HSBC has said that factors such as the tax environment and government support for the growth of the banking growth will influence its decision.

HSBC has been involved in a number of scandals in recent years. Last week it was hit with a 40 million Swiss franc (£28 million) fine by Swiss prosecutors to settle an investigation into alleged aggravated money laundering.

British unions have reacted angrily to the news of further job cuts, arguing that employees are bearing the brunt of cutbacks. "After all the scandals of recent years, frontline staff have suffered time and time again as they are forced to pay for the mistakes of others with their jobs, their terms and conditions and their reputation," said Dominic Hook, Unite's national officer for finance.

Gulliver's latest plan is unlikely to restore investor confidence, James Antos, analyst at Mizuho Securities Asia told the BBC. "Slaughtering the staff is not necessarily the solution unless management makes the bank considerably less complex," he said.

-

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

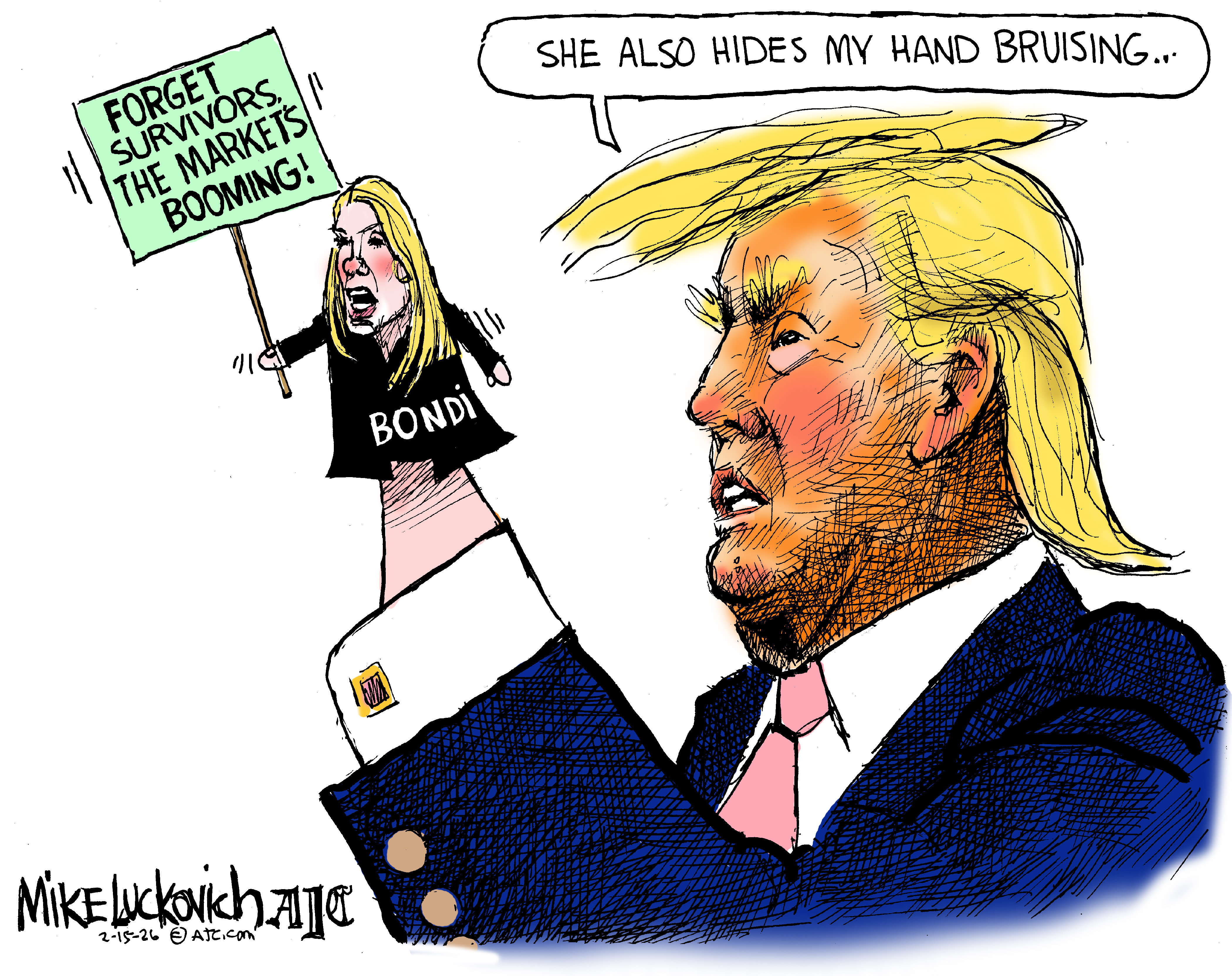

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

The Silicon Valley Bank collapse

The Silicon Valley Bank collapsefeature Sudden failure of tech sector’s go-to bank sparks fears of wider contagion

-

Minimum service levels and the right to strike

Minimum service levels and the right to strikeTalking Point Government’s proposed anti-strike laws will soon be debated by MPs

-

Unions of all kinds are flexing their muscles. Should we be celebrating?

Unions of all kinds are flexing their muscles. Should we be celebrating?feature New Unite union boss Sharon Graham has promised to make every UK workplace ‘action ready’ and vowed to take on Amazon

-

Unite: extend furlough scheme now or ‘redundancy floodgates will open’

Unite: extend furlough scheme now or ‘redundancy floodgates will open’Speed Read Union calls for immediate government action to save workers and business from ‘cliff edge’

-

HSBC to cut 35,000 jobs: why profits plunged

HSBC to cut 35,000 jobs: why profits plungedIn Depth British bank announces 33% drop in profits and plans to slash branches in US

-

Could ‘banking hubs’ solve problem of branch closures?

Could ‘banking hubs’ solve problem of branch closures?Speed Read MPs fear large sections of society could face ‘financial exclusion’

-

What is Britain’s worst bank?

What is Britain’s worst bank?Speed Read Royal Bank of Scotland comes joint-bottom in the new personal banking league table, and last for business banking

-

FBI warns cash machine global cyber-attack imminent

FBI warns cash machine global cyber-attack imminentSpeed Read British banks have been warned their ATMs could be mass-hacked by cyber criminals ‘in the coming days’