What's next for US interest rates?

A pause after a series of cuts

At its first meeting of the year in January, the Federal Reserve opted to hold interest rates steady at a range of 3.50% to 3.75%. The move came despite continued pressure from President Donald Trump for the central bank to lower borrowing costs. It also marks the first time since July that the Fed has left rates unchanged, after cutting rates three times at the end of 2025.

The decision was not unanimous. Two Fed governors dissented, voting to lower rates by a quarter-point instead. However, "at a press conference to discuss the decision, Fed Chair Jerome Powell noted that some risks appear to have eased, such as pressures in the labor market, while economic activity is picking up," said CBS News.

What will the Fed do next?

What is up ahead for interest rates will depend largely on where the economy goes. In a press conference following January's meeting, Powell said that the "committee would continue to make their interest rate cut decisions 'meeting by meeting' based on incoming data," said CNBC.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Either another rate cut or even a hike could technically be possible, or the Fed may opt to continue holding rates steady. "If the labor market were to weaken considerably, they would consider cutting," whereas "if inflation picked up without labor market deterioration, rates could increase," said The New York Times. However, Powell "noted that 'it isn’t anybody's base case' that 'the next move will be a rate hike.'"

Meanwhile, "investors are betting that the Fed will cut interest rates twice in 2026, starting in June, according to CME Group’s FedWatch tool," said Bankrate. Fed policymakers, on the other hand, "see just one cut this year."

Powell did reiterate at the January meeting that the Fed will maintain its independence going forward. His term ends in May; Trump will soon name Powell's successor.

When is the next interest rate decision?

The Federal Reserve will next meet March 17-18. Powell indicated after the January meeting that "officials were not taking any moves off the table," with either a rate hike or a cut possible depending on where the labor market and inflation head, said the Times.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

How do interest rates affect the economy?

The Fed uses interest rates to either stimulate or rein in economic activity. Generally, the theory is that "cutting rates decreases borrowing costs, prompting businesses to take out loans to hire more people and expand production," which "in turn, stimulates economic activity and growth," said Investopedia. "Conversely, when the economy is overheating, the Fed may raise rates to cool things down and prevent inflation from spiraling out of control."

What do rate changes mean for your wallet?

Beyond broader economic implications, the Federal Reserve's decisions also hold significance for your finances.

When rates are cut, that provides "some welcome relief for consumers who are in the market for a home or auto purchase, as well as for those carrying pricey credit card debt," said CBS News, by lowering interest rates on those products. On the other hand, rate cuts "could also have a downside of shaving the relatively high returns recently enjoyed by savers," said the outlet.

Meanwhile, when the Fed decides to raise rates, it usually has the inverse effect, in that it will typically lead interest rates on credit cards, auto loans and variable rate mortgages to go up. The good news with rate hikes, though, is that "savings accounts tend to earn more interest," said LendingTree.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

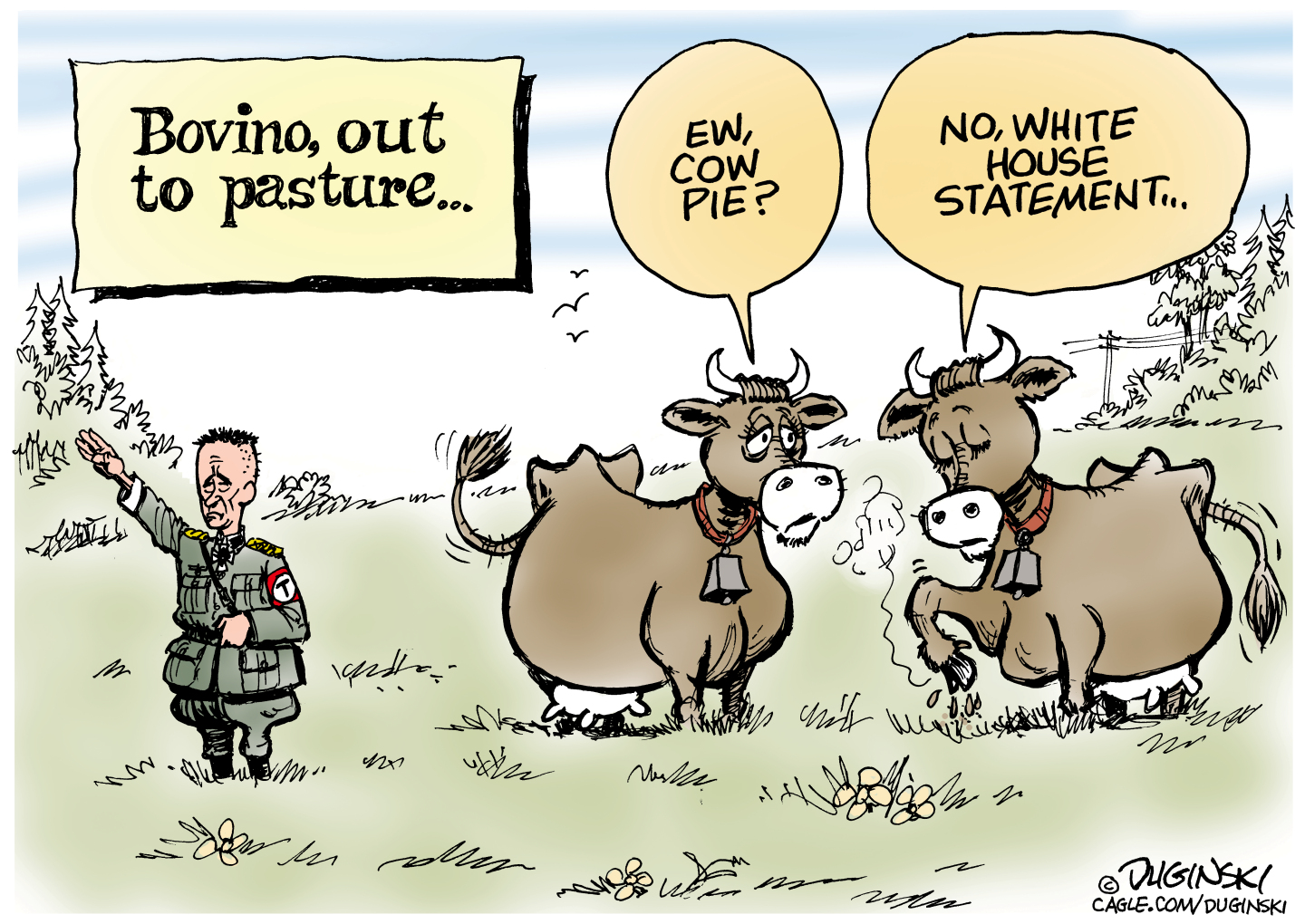

5 redundant cartoons about Greg Bovino's walking papers

5 redundant cartoons about Greg Bovino's walking papersCartoons Artists take on Bovino versus bovine, a new job description, and more

-

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

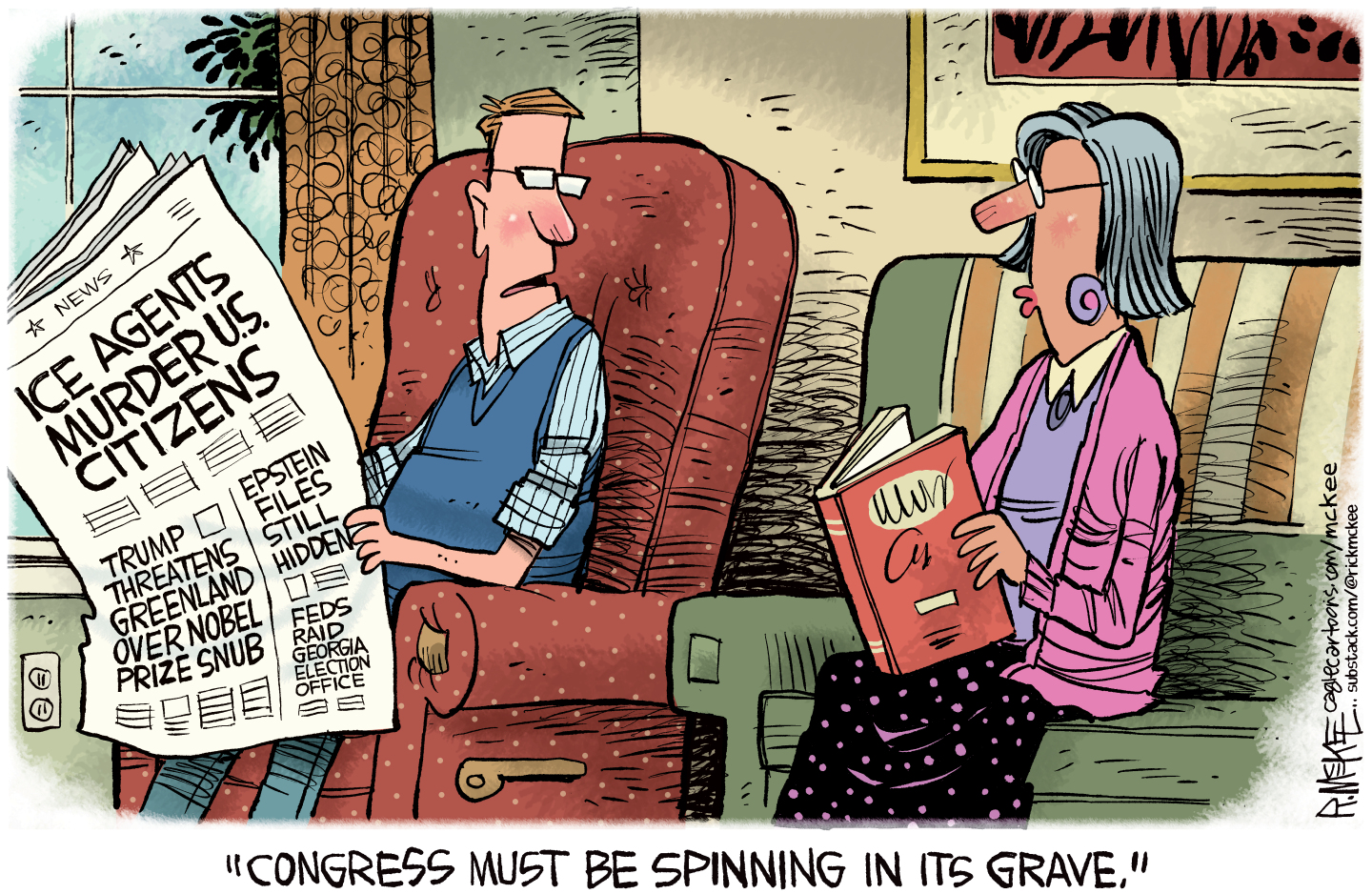

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Saving for a down payment on a house? Here is how and where to save.

Saving for a down payment on a house? Here is how and where to save.the explainer The first step of the homebuying process can be one of the hardest

-

What would a credit card rate cap mean for you?

What would a credit card rate cap mean for you?the explainer President Donald Trump has floated the possibility of a one-year rate cap

-

What to look for in a reliable budgeting app

What to look for in a reliable budgeting appThe Explainer Choose an app that will earn its place in your financial toolkit

-

Do you have to pay taxes on student loan forgiveness?

Do you have to pay taxes on student loan forgiveness?The Explainer As of 2026, some loan borrowers may face a sizable tax bill

-

Planning a move? Here are the steps to take next.

Planning a move? Here are the steps to take next.the explainer Stay organized and on budget

-

What should you look out for when buying a house?

What should you look out for when buying a house?The Explainer Avoid a case of buyer’s remorse

-

3 smart financial habits to incorporate in 2026

3 smart financial habits to incorporate in 2026the explainer Make your money work for you, instead of the other way around

-

What to know about the rampant Medicare scams

What to know about the rampant Medicare scamsthe explainer Older Americans are being targeted