What is national insurance and why are the Tories planning to increase it?

Government set to renege on manifesto pledge not to hike NICs

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Boris Johnson is preparing to announce a 1% increase in National Insurance (NI) for both employers and employees, according to reports.

The Times says the move will raise £10bn a year that will be used to fund “long-term reform” of social care while also reducing NHS waiting lists.

The prime minister and senior Tory officials have agreed that the one percentage point rise in national insurance contributions (NICs) - a penny in each £1 - will initially be used to address the “NHS backlog” following the Covid-19 pandemic, the paper adds.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Manifesto U-turn

Johnson and chancellor Rishi Sunak held “crunch talks” on Friday about how to fill a £7bn funding shortfall, The Sun reports.

However, plans to announce the resulting package this week were “plunged into chaos after the pair were forced into isolation” when Health Secretary Sajid Javid tested positive for Covid, the paper continues.

Regardless on when the announcement is made, the move to increase contributions would “smash the Conservatives manifesto commitment not to raise NICs, VAT or income tax in this parliament”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Guardian reports that former health secretary Jeremy Hunt backed an income tax rise, which he called a “health and care premium”. But Whitehall sources suggested that ministers were “leaning towards” an NI rise, says the paper, which notes that either option would “break the spirit” of the “triple tax lock” manifesto promise.

Who should pay for the rise in NI?

The plan to hike NI payments will “finally tackle the social care crisis” but has also been attacked as a “tax on the young”, The Independent says. Older people “would escape paying more” as ministers “appear to be backing away from a new tax on all over-40s, including pensioners”, in favour of increasing NI.

Torsten Bell, chief executive of the Resolution Foundation think tank, said that while tax rises will be needed to deliver decent social care, an NI rise was a “terrible way” to raise the funds.

“It’s a tax disproportionately loaded on to younger and lower-paid workers, compared to a fairer rise in income tax,” he said. “Why we would target a tax rise on the groups who have been hardest hit by the economic impact of this pandemic, while exempting older and wealthy individuals, is completely beyond me.”

Former government health adviser Andrew Dilnot, who is “the author of Johnson’s favoured plans”, believes pensioners should be made to pay NICs to help fund the social care reforms, The Telegraph reports.

Discussing proposals for funding the reforms, Sir Andrew told the Institute for Fiscal Studies that average income and the wealth of older people had “grown massively” over the past 50 years and that “it’s very important that charge should be paid by older people as well as younger people”.

What is national insurance?

NI is a tax paid by workers and employers that funds state-run public services. It is usually automatically deducted from workers’ pay packets via the pay as you earn (PAYE) tax code, and goes straight to HM Revenues and Customs (HMRC).

Under the current thresholds, workers pay mandatory NI if they are aged 16 or above and earn more than £9,568 (£184 a week), or if they are self-employed and making a profit of £6,515 or more a year.

The money raised is spent on the NHS, unemployment benefits, sickness and disability allowances, and the state pension.

Each worker’s NI payments determine which benefits they can receive, and what level of state pension they get when they retire.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

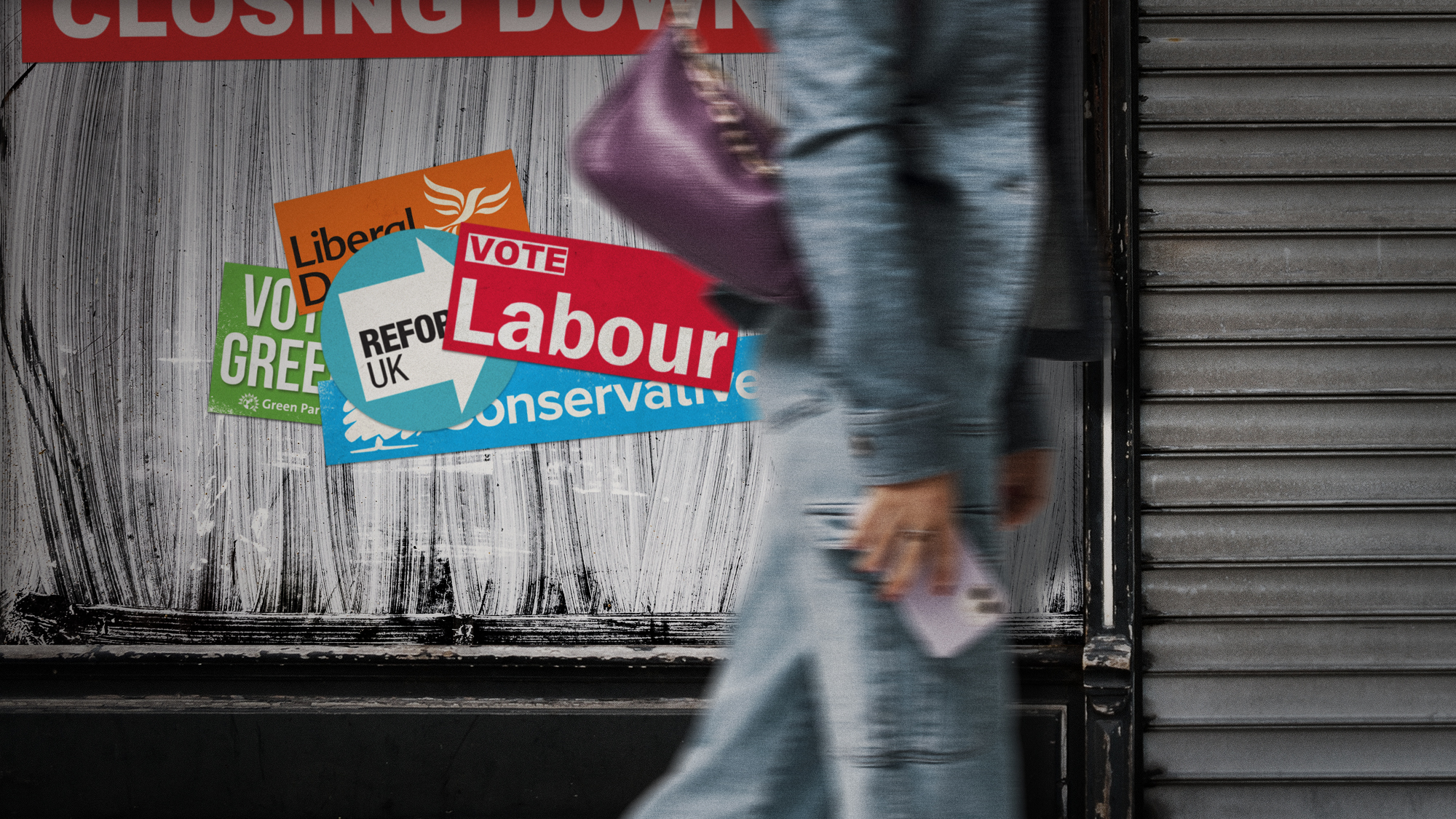

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

Asylum hotels: everything you need to know

Asylum hotels: everything you need to knowThe Explainer Using hotels to house asylum seekers has proved extremely unpopular. Why, and what can the government do about it?

-

Will Rachel Reeves’ tax U-turn be disastrous?

Will Rachel Reeves’ tax U-turn be disastrous?Today’s Big Question The chancellor scraps income tax rises for a ‘smorgasbord’ of smaller revenue-raising options

-

Taking the low road: why the SNP is still standing strong

Taking the low road: why the SNP is still standing strongTalking Point Party is on track for a fifth consecutive victory in May’s Holyrood election, despite controversies and plummeting support

-

Will billionaires kill France’s proposed wealth tax?

Will billionaires kill France’s proposed wealth tax?Today's Big Question In Paris, a preview of the debate over Zohran Mamdani’s NYC proposal

-

Behind the ‘Boriswave’: Farage plans to scrap indefinite leave to remain

Behind the ‘Boriswave’: Farage plans to scrap indefinite leave to remainThe Explainer The problem of the post-Brexit immigration surge – and Reform’s radical solution