The personal check is on the way out. Here's what to use instead.

A growing list of retailers, including Target and Whole Foods, no longer accept personal checks as payment

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Policy changes by major retailers may have put another nail in the coffin of what used to be a financial mainstay: the personal check. In July, said CNBC, "Target joined a growing list of retailers, including the Aldi supermarket chain, Whole Foods, Old Navy, and Lululemon, that no longer accept personal checks as payment."

If it's hard to even remember the last time you wrote a check, this may not come as a big surprise. "Only 15% of adults said they wrote a few checks a month in 2023," while a whopping "46% of the more than 1,000 respondents said they hadn't written a single check in 2023," said CNBC, citing a report by GoBankingRates.

If you are one of the holdouts when it comes to using personal checks, here is why you may want to consider finally moving on — and what you can use to transfer money instead.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why should you reconsider using a paper check?

A major reason to stop relying on paper checks: "Check fraud tied to mail theft is up nationwide," said NerdWallet, and "letter carrier robberies are also on the rise." When checks are lost or stolen, they "can be used to steal money from your checking account," said Experian.

And that is far from the only downside of a paper check. Other drawbacks include the fact that nowadays, "banks typically charge extra for paper checks," and "paper checks may take two days or more to clear," said Experian. Your recipient may also have a harder time actually getting the money, as those "without bank accounts may have to pay fees to cash a check."

Finally, while writing a check is not all that difficult, it is certainly a bit more tedious and can take longer than some of the alternatives now available. The responsibility also falls on you to keep records, rather than automatically having an electronic paper trail.

What are ways to send or exchange money instead of writing a check?

If you have long relied on paper checks, whether to gift money at the holidays, pay a contractor or cover costs for your kid's extracurricular activities, you may not have considered how else to transfer those funds. Turns out, there are a number of other options, including:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Wire transfers: Available through your banking account, wire transfers are a great way to deliver "large amounts ($10,000 or more) from one bank to another within hours or minutes," said NerdWallet. Just note that you may face a fee for transfers — "the median domestic wire cost for sending is $25, and $15 for receiving." A wire transfer can often be a good option for things like "house closing, car purchases [and] sending money to friends and family overseas," said Investopedia.

Peer-to-peer payment (P2P) apps: This category includes options like "PayPal, Venmo and Zelle," all of which "allow you to pay businesses and individuals from a linked bank account or credit card," said Experian. It is possible to send and receive payments "instantly," though "transferring funds from the app to your linked account may take a few days unless you pay a fee."

Money orders: If you would still rather work on paper, a "safe and secure" alternative to explore is a money order, said Investopedia. These "can be cashed just like checks and used to send money overseas or when you don't have a checking account but need to pay with a check." Just note there is often a limit of around $1,000, and you'll pay a fee.

Cashier's checks: While still technically a check, cashier's checks are a much safer bet than the standard personal check. Cashier's checks are "issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the face value of the check," said Bankrate. But "because the check is backed by the bank's funds, there is no risk of the check bouncing." Usually "used for major transactions," a cashier's check typically "clears by the following business day and may involve a small fee," said Experian.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

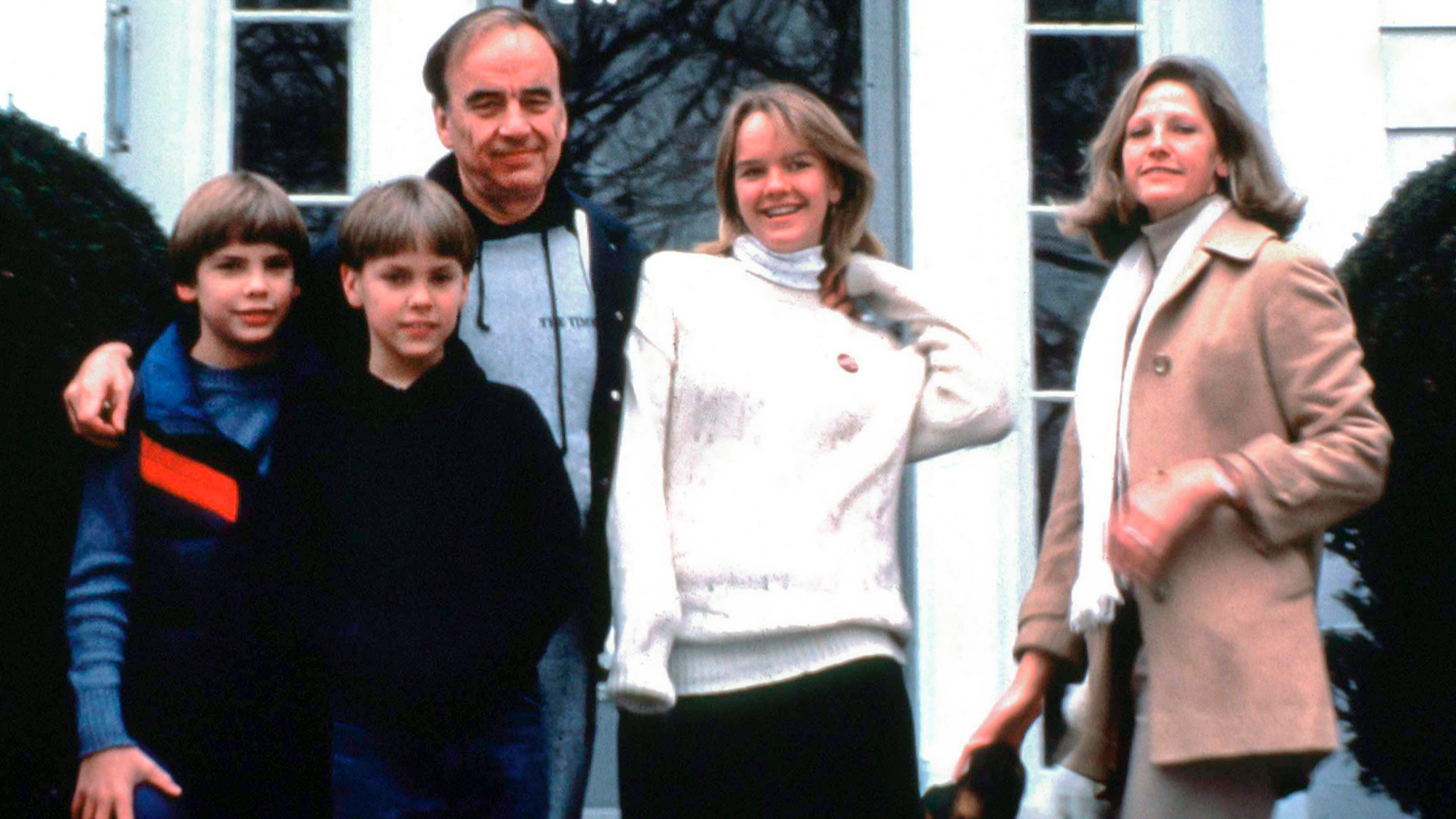

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

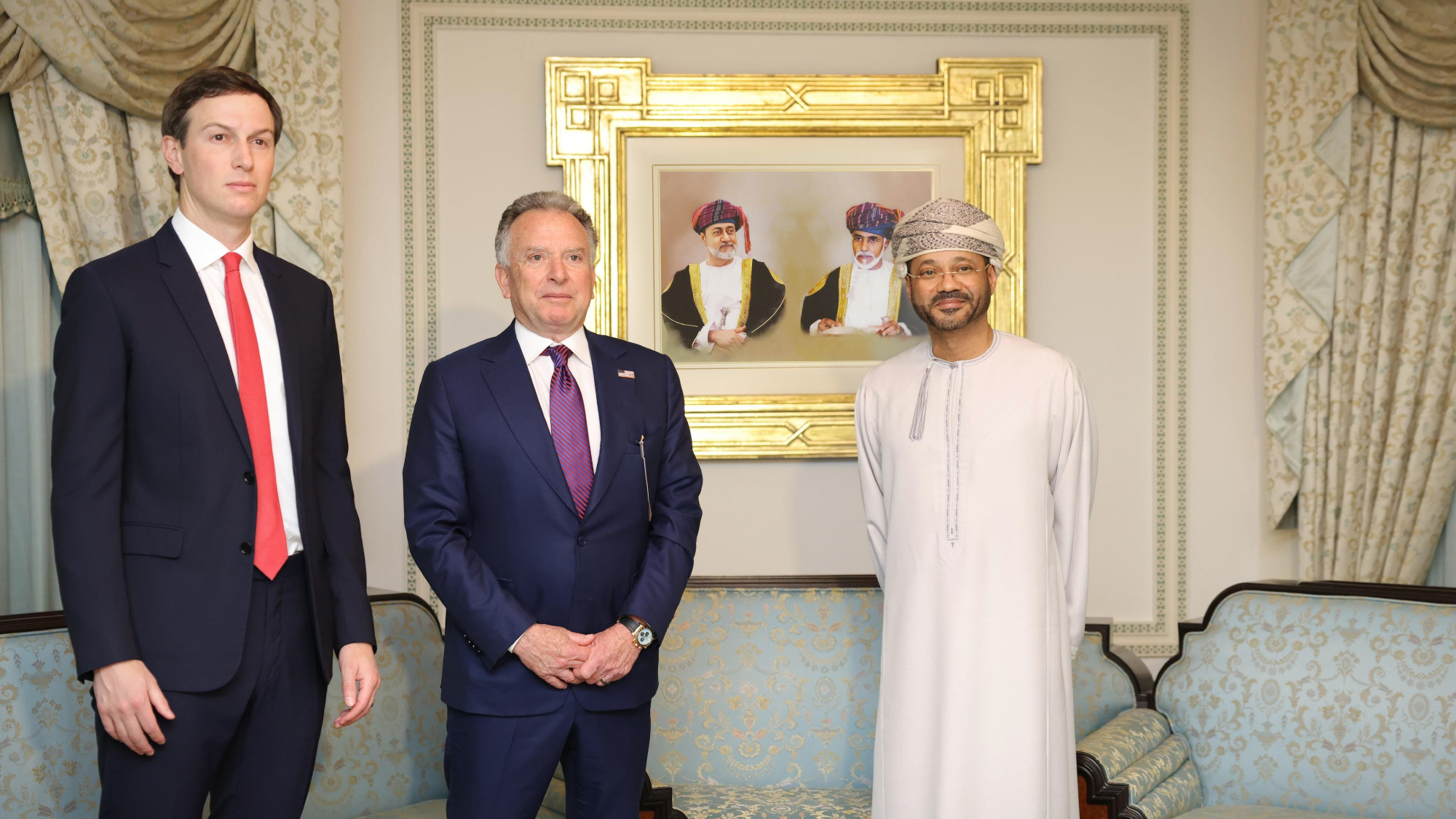

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money