Unemployment isn't a good 'fix' for inflation

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Is it time to panic about inflation? The personal consumption expenditures (PCE) deflator showed a 3.9 percent annual increase in the last quarter, while the consumer price index (CPI) registered 4.3 percent. Both of those figures are at their highest point since 2008, though still far short of the inflationary highs of the early 1980s.

Bipartisan economic orthodoxy in such a situation holds that the Federal Reserve needs to throw people out of work and decrease American incomes by hiking interest rates. If the Fed makes credit harder to get, then businesses, home owners, and car buyers will spend less, economic activity will slow, and people will be laid off. ("The standard of living of the average American has to decline," then-Fed chair Paul Volcker said to justify his rate hikes in 1979.)

Economist Larry Summers, the final treasury secretary of the Clinton administration, has been advocating this for months. In March, he argued that the American Rescue Plan was too big; in July, he urged the Fed to hike interest rates more quickly; and just a few days ago he argued that because unemployment is getting too low, we are "taking a big risk on the inflation side."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Summers and that economic orthodoxy are wrong. The only way out of America's peculiar inflation troubles is persistence in our current course of easy credit, high spending, and large-scale federal investment in the American people via the Biden administration's Build Back Better plan. Killing jobs won't help.

A recent publication from the Roosevelt Institute by J.W. Mason and Lauren Melodia elegantly shows why. As they argue, the first thing to remember about inflation is that all prices are individual. The PCE and CPI indexes are made up of hundreds of prices given different weights to try to make them representative of average consumer spending. These conglomerate metrics can be useful tools, but they're only so good as the subjective decisions about what to include in the indexes.

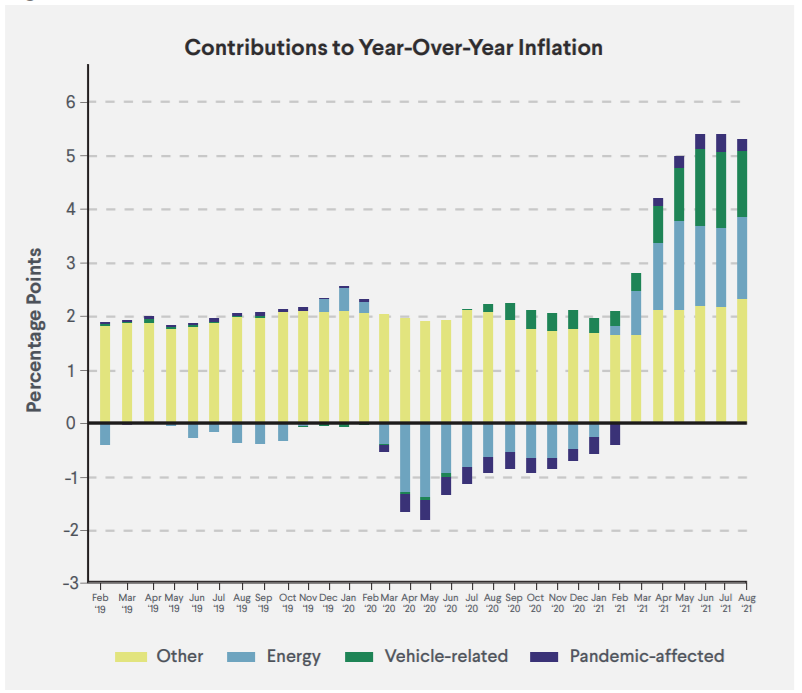

The composition of inflation especially matters today, because price increases are not happening across the board — they are heavily concentrated in a few sectors hardest hit by the pandemic, above all energy and cars. (Another important thing to remember is that this year's inflation numbers look artificially high because of the unusually low prices last year. The yearly increase isn't so dramatic on a several-year scale.) This chart breaks down the contributions to inflation by sector. Increases in energy, vehicle, and directly pandemic-affected industries account for virtually all the inflation showing up in the general indexes:

(Courtesy Roosevelt Institute)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This concentration of inflation in a few sectors is the result of chronic underinvestment in economic capacity over the last several decades. Take for instance this New York Times story about the overburdened cargo port in Savannah, Georgia. (Shipping is another area where prices have increased considerably.) There are so many ships and cargo containers coming through the port that it simply can't move them fast enough. Ships are being forced to wait for days or weeks offshore, while the port has no choice but to store thousands of containers in huge piles. Struggling under the crush of tires, electronics, furniture, toys, cars, and God knows what else, the port's owner has bought up some of the surrounding vacant land to be used for extra storage.

Presumably, at some point, the snarled global cargo system will be straightened out, and that storage space won't be strictly necessary all the time. But that's exactly the kind of redundancy that makes a supply system more robust — and the lack of it helped cause the supply chain crisis in the first place.

During the neoliberal decades from about 1980-2020, the conventional wisdom in the business class was that you should cut your supply capacity to the bone. Extra storage space at a port would be a wasteful drain on profits. Wall Street was a big architect of this thinking, thanks to financial raiders buying up companies, slashing their payroll and capital investment, and pocketing a quick fortune.

This behavior was heavily reinforced by the pitifully weak post-2008 recovery, when sales of almost everything were chronically sluggish. For a business, the primary reason to have some excess capacity on hand is to be able to respond to unexpectedly strong demand — if you get a burst of orders but have no spare capacity in the factory, or backup inventory, you are losing money. But after 2008, no one could afford to maintain spare capacity anymore. Aside from some super-profitable tech and financial firms, in many industries investing in capacity meant risking insolvency.

When the pandemic struck, many companies anticipated a repeat of post-2008. They cut their investment down as far as possible. The car industry pulled in its horns especially far, which accounts for most of its current problems (production delays, low stock, and high prices). That anticipation proved incorrect. Instead there were several spectacularly generous economic rescue packages, at least by American standards. Incomes increased and poverty actually fell, so spending has recovered quite quickly (though unfortunately the quick economic boom many were hoping for seems unlikely at this point, thanks to the Delta variant suppressing economic activity).

Combined with rampant business concentration centralizing production in a handful of huge firms, this makes for a brittle supply system. A globalized, "just in time" production model is a low-cost operation when times are good, but it produces exceptionally costly delays and tangles when times are bad. One good whack delivered by, say, a pandemic, and the whole thing seizes up.

It follows that Summers' preferred solution of increasing unemployment and decreasing American incomes will actually preserve these supply bottlenecks. He would "solve" inflation by returning us to the low-growth post-2008 economic model where sales are weak, businesses don't bother to invest, and supply chains retain their present diaphanous vulnerability. As Mason and Melodia write, "Rather than restore production to its pre-pandemic levels, it would be a decision to keep society poor enough that we can only afford what businesses are currently able to produce."

President Biden's agenda, by contrast, would help push through some of these bottlenecks. It would incentivize new investments in housing and semiconductors, which are needed for car production. The plan's infrastructure elements will help ease the supply bottlenecks in shipping, and its general spending will keep incomes higher, thus incentivizing businesses to keep investing in new capacity.

These supply issues and cost hikes are painful now, and the Biden agenda could expand to include relief for Americans struggling to meet such new expenses. Mason and Melodia have a lot of smart suggestions for dealing with prices increases that disproportionately affect the poor and working class. For instance, pharmaceutical prices could stand direct government controls, as I have previously argued.

But their central message — that it would be foolhardy to throw people out of work because of a temporary shortage of gasoline and cars — is undoubtedly correct. This inflation is a bill coming due for decades of cheaping out on investment, not least through financial deregulation and stingy stimulus spending Summers himself helped enact. Let's not make that mistake again.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

‘They’re nervous about playing the game’

‘They’re nervous about playing the game’Instant Opinion Opinion, comment and editorials of the day

-

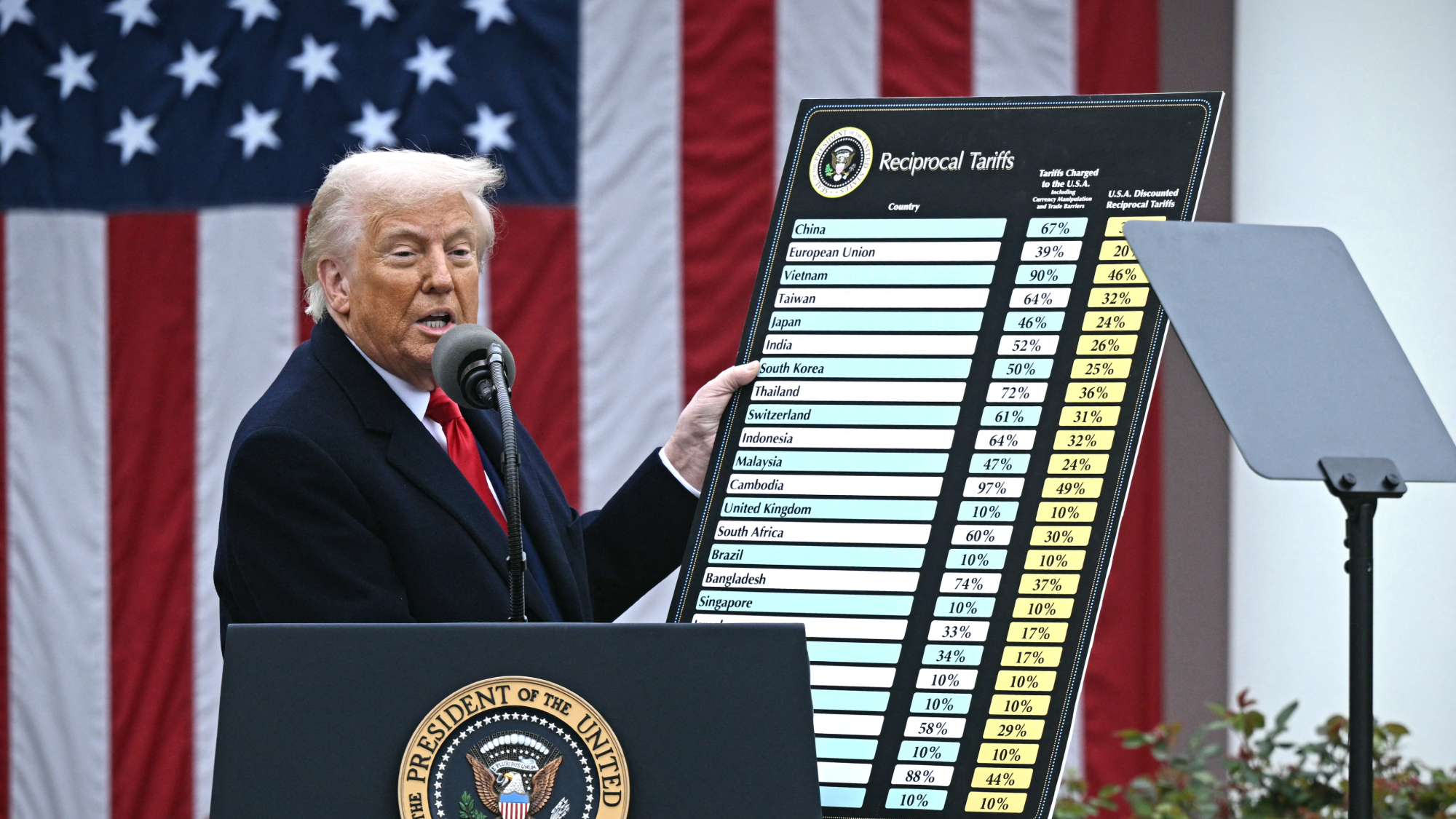

Tariffs: Will Trump’s reversal lower prices?

Tariffs: Will Trump’s reversal lower prices?Feature Retailers may not pass on the savings from tariff reductions to consumers

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

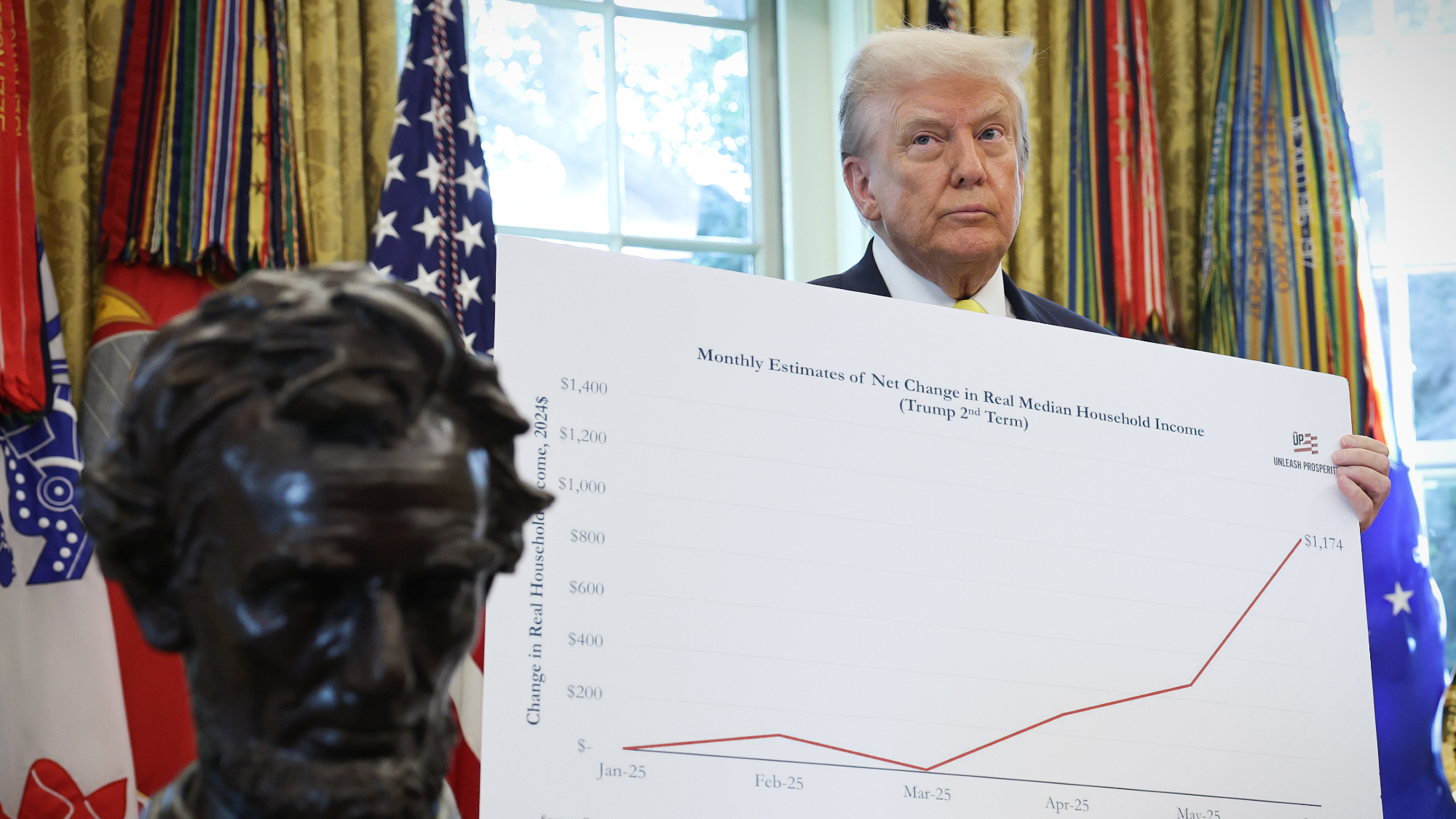

Inflation derailed Biden. Is Trump next?

Inflation derailed Biden. Is Trump next?Today's Big Question 'Financial anxiety' rises among voters

-

Trump picks conservative BLS critic to lead BLS

Trump picks conservative BLS critic to lead BLSspeed read He has nominated the Heritage Foundation's E.J. Antoni to lead the Bureau of Labor Statistics