Peloton borrows money from Wall Street after sales drop 15 percent

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Peloton is running out of cash and its turnaround plan "can't happen fast enough," CNN Business reports. The company lost $757 million over the last quarter.

Its sales have continued to decline, CNN says, citing Tuesday's new quarterly financial report, and have dropped 15 percent from last year.

Peloton CEO Barry McCarthy said the company was left "thinly capitalized" at the end of the quarter, with $879 million in cash. "That forced the company to borrow a significant amount of money from Wall Street," a whopping $750 million, "to keep its operations running," writes CNN. This all comes after Peloton laid off 2,800 employees in February.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A lot of people took a hiatus from their local gyms at the start of the COVID-19 pandemic, but have since returned. However, that means Peloton is now struggling to sell bikes and subscriptions compared to last year. The company added just 195,000 new subscribers in the last quarter, less than half of what it added a year ago. To attempt to boost sales once again, the company is cutting the prices of its treadmills and bikes.

Peloton's downturn is "astonishingly bad," according to GlobalData managing director Neil Saunders. Even with further action, he predicted to investors, "Peloton would still be, at best, a low-profit company that delivers a poor return." Read more at CNN.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kelsee Majette has worked as a social media editor at The Week since 2022. In 2019, she got her start in local television as a digital producer and fill-in weather reporter at NTV News. Kelsee also co-produced a lifestyle talk show while working in Nebraska and later transitioned to 13News Now as a digital content producer.

-

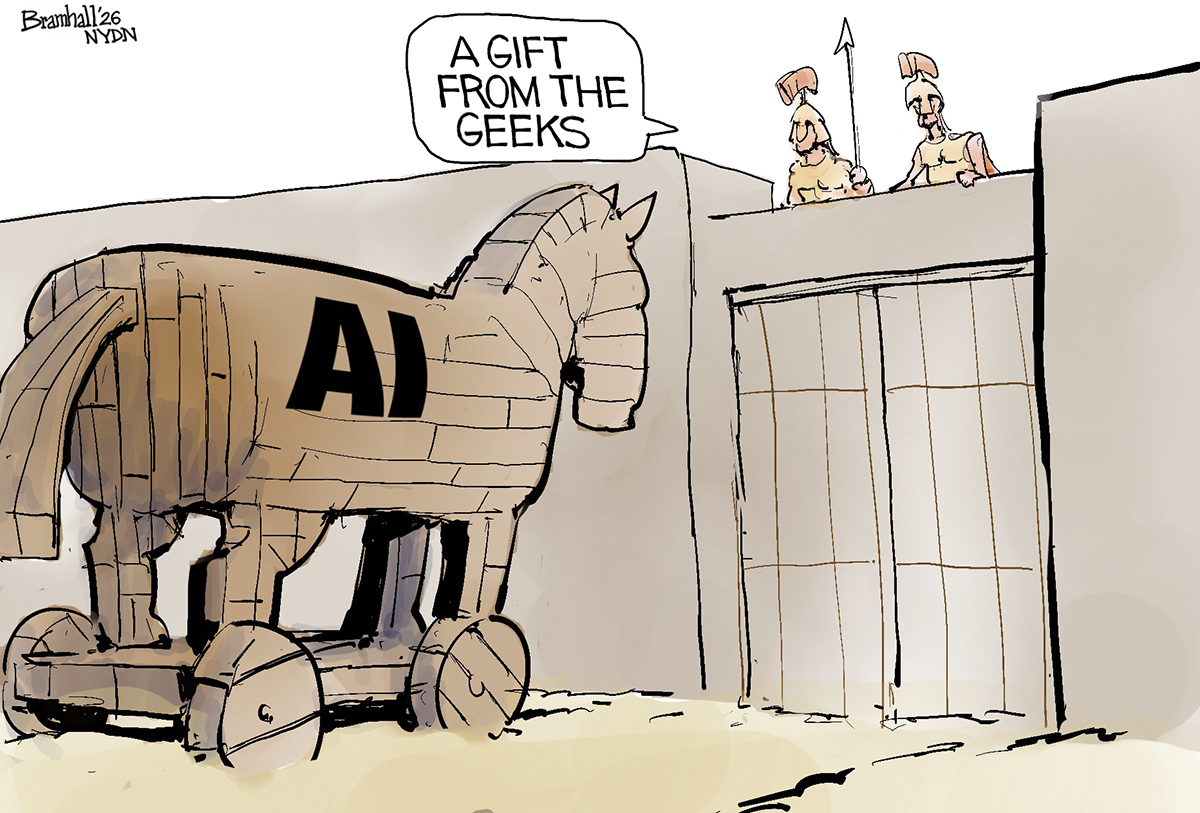

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting