Stocks hit new all-time highs this week

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The bull market in stocks isn't running out of steam, at least not yet — even with lots of geopolitical risks rearing their ugly heads and the Fed pressing forward with tapering its quantitative easing stimulus. Yesterday the S&P500 index soared to close at an all-time high of 2000.2, although it fell back a little today and is currently trading at 1999.6. The index is up 9.67 percent so far in 2014, and that's off the back of a monster 2013 when it rose 30 percent, the best annual gains since 1997.

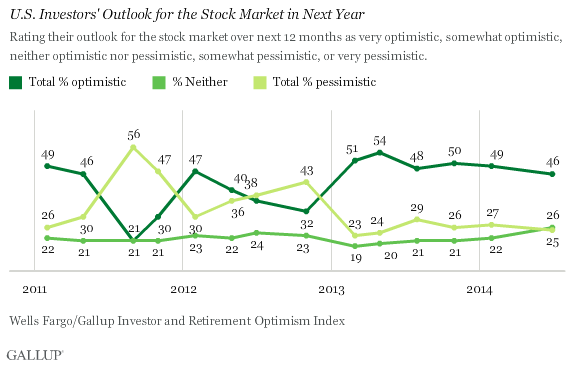

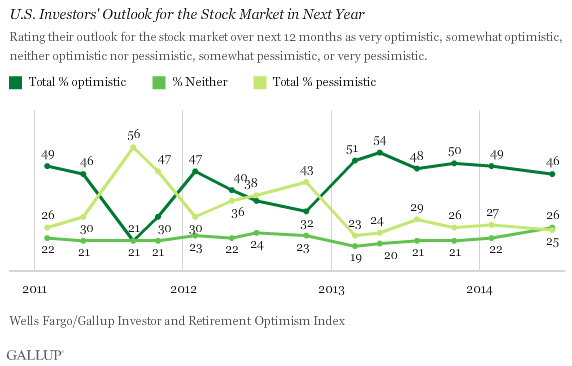

What's driving the continued growth? Ordinary investors — after a grim few years since the financial crisis — finally began to come back into the market in 2013, and money keeps flowing into stocks, albeit a little more slowly than last year. According to Gallup, the percentage of investors optimistic about the market soared to 54 percent last year, compared to 24 percent who were pessimistic. Today, the optimists still greatly outweigh the pessimists by 46 percent to 26 percent:

Forty-one percent of investors surveyed by Gallup last month said that the best place to put an extra $10,000 was in the market, compared to 36 percent who preferred to keep it in cash, and 20 percent who preferred a certificate of deposit.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.