Fed: Interest rate rises could come 'sooner than anticipated'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve could raise interest rates sooner than anticipated, according to minutes of the central bank's last policy-making meeting. Furthermore, members of the Federal Open Market Committee believe that the labor market is healing, that inflation is close to the right level, and that the Fed is on pace to end its quantitative easing stimulus in October.

This seems to be a shift away from the ultra-dovish tone that Fed Chair Janet Yellen has struck in recent months. Yellen previously insinuated that even with unemployment moving closer toward the Fed's target of between 5.2 percent and 5.5 percent, very elevated levels of part-time workers who want full-time jobs meant that there was slack in the economy. She also suggested that the Fed had room to continue with accommodative policy measures to raise employment.

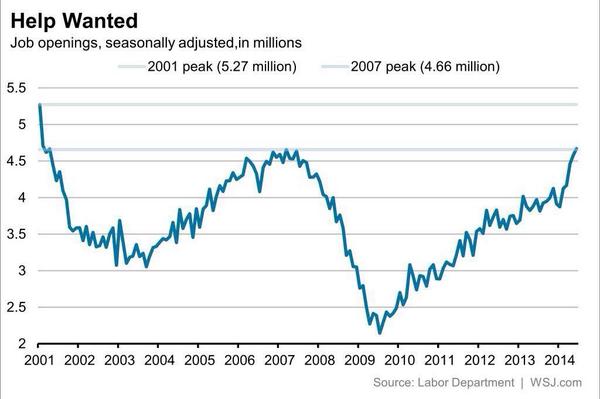

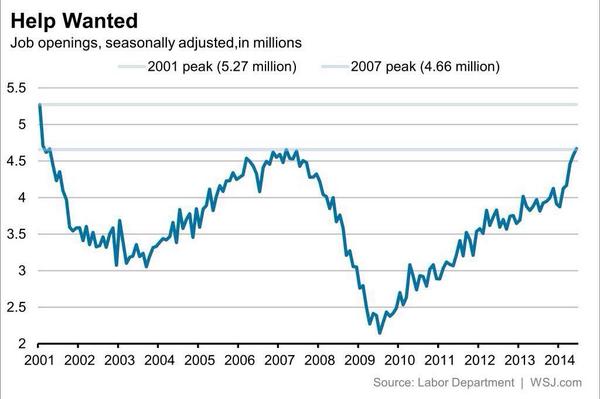

What moved the Fed to take a more cautious tone? Probably the surging level of job openings. Job openings have climbed back to 4.66 million — the level they were at before the recession, suggesting that the recovery may be stronger than previously supposed. --John Aziz

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

(Labor Department/Wall Street Journal)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.