Trump's budget math is probably off by several trillion dollars

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

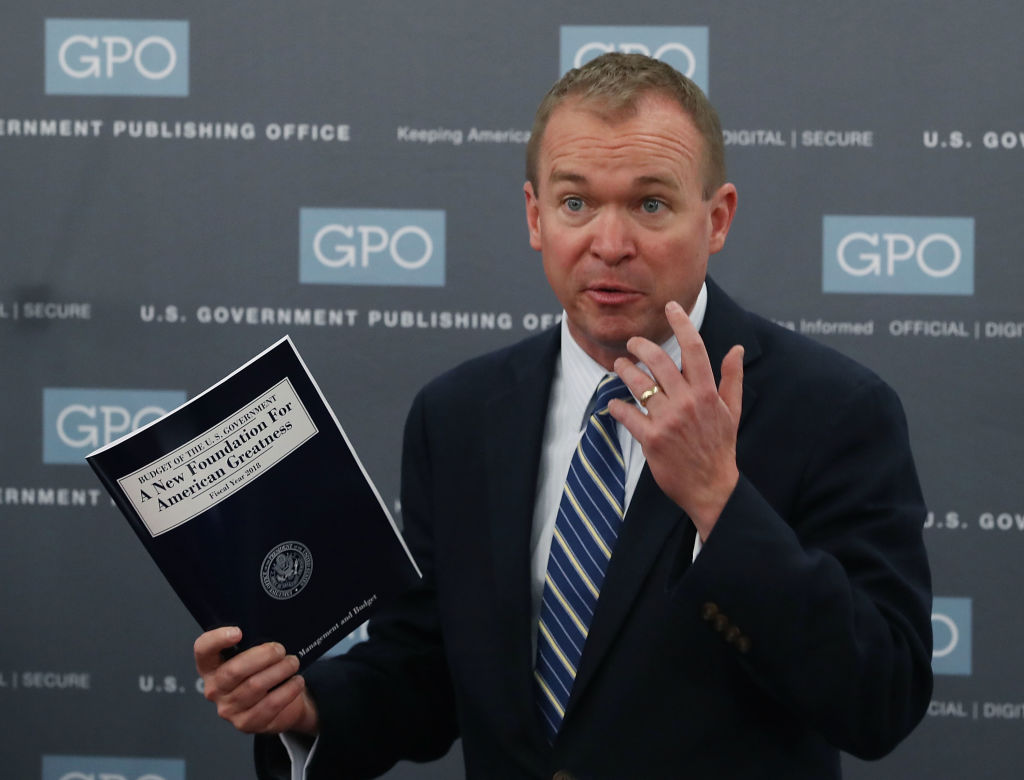

All White House budgets rely on somewhat rosy economic assumptions and some guesswork, but President Trump's fiscal 2018 $4.1 trillion budget plan "is unusually brazen in its defiance of basic math, and in its accounting discrepancies amounting to trillions-with-a-t rather than mere millions or billions," says Politico's Michael Grunwald. The blueprint purports to balance the federal budget within 10 years, but to get there the White House used some pretty creative math, economists say.

The first red flag is that it assumes average 3 percent growth over the next decade, rather than the 2 percent projected by the Congressional Budget Office and other forecasters. "If growth instead remained at 2 percent with no uptick in unemployment, projected deficits would widen by $3.1 trillion over the coming decade, according to Mr. Trump's budget," The Wall Street Journal says. The White House dismisses the 2 percent number as defeatist, saying Trump's proposed tax cuts and regulation-slashing will lead to at least 3 percent growth.

That's "fair enough if you believe in tooth fairies and ludicrous supply-side economics," says former Treasury Secretary Lawrence Summers in The Washington Post. But it also appears that Trump is counting $2.1 trillion in revenue twice — once from growth sparked by the projected tax cuts, and once to make those tax cuts revenue-neutral — which Summers says "appears to be the most egregious accounting error in a presidential budget in the nearly 40 years I have been tracking them." Maya MacGuineas at the Committee for a Responsible Federal Budget agrees: "The same money cannot be used twice."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

White House budget officials pushed back on the double-counting charge, saying the $2.1 trillion isn't assumed to come from the tax cuts, because the tax overhaul — when the plan is finalized — will be deficit-neutral on its own, thanks to to-be-determined loophole-closing and deduction-limiting. Trump "is counting on unspecified tax increases to convert a plan that independent analysts believe will cost about $5.5 trillion in its current form into a plan that will cost nothing at all, and would somehow end up producing $2 trillion worth of deficit reduction through growth," translates Grunwald, skeptically.

There are some other accounting oddities, too; Binyamin Appelbaum at The New York Times points to the projected $300 billion in revenue from the estate tax, which Trump has promised to eliminate. The Wall Street Journal's Nick Timiraos notes that Trump proposes $200 billion in infrastructure spending while also cutting $95 billion from the Highway Trust Fund, which maintain's the nation's roads and bridges. You can get a brief overview of Trump's budget from CNNMoney below. Peter Weber

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting