Standard Chartered scandal: what is UK bank accused of?

Bank faces Wall Street exit after US regulator accuses it of breaching sanctions in 'rogue' dealings with Iran

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

SHARES in Standard Chartered have plummeted in Hong Kong and London after a US regulator accused the British-based bank of conspiring with the Iranian government to launder at least $250bn in breach of American sanctions over almost a decade.

Labelling Standard Chartered a "rogue institution", the New York State Department of Financial Services (DFS) said the bank might have had dealings with Burma, Libya and Sudan, which were also under sanctions.

Standard Chartered, which stands to lose its US banking licence if the charges are proven, has strongly rejected the allegations.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The DFS alleges that Standard Chartered "designed and implemented an elaborate scheme by which to use its New York branch as a front for prohibited dealings with Iran - dealings that indisputably helped sustain a global threat to peace and stability".

Standard Chartered is accused of engaging in 'wire stripping' - removing data from payments made under the SWIFT international banking scheme, thus preventing US authorities from identifying payments involving Iranian institutions.

The bank even allegedly produced a manual describing how best to process Iranian payments and titled it: 'Quality Operating Procedure Iranian Bank Processing'.

According to the DFS, by 2006 the CEO at Standard Chartered's New York branch was so concerned about the situation that he emailed head office in London saying: "Firstly, we believe [the Iranian business] needs urgent reviewing at the Group level to evaluate if its returns and strategic benefits are... still commensurate with the potential to cause very serious or even catastrophic reputational damage to the Group.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"[S]econdly, there is equally importantly potential of risk of subjecting management in US and London (eg you and I) and elsewhere to personal reputational damages and/or serious criminal liability."

The DFS says Standard Chartered's "obvious contempt" for US banking regulations was illustrated "succinctly and unambiguously" when the group executive director allegedly emailed in response: "You f***ing Americans. Who are you to tell us, the rest of the world, that we're not going to deal with Iranians."

In a statement, Standard Chartered says it does not "believe the order issued by the DFS presents a full and accurate picture of the facts".

It says it "acted to comply, and overwhelmingly did comply, with US sanctions".

The bank adds that "well over 99.9 per cent of the transactions relating to Iran" complied with regulations.

Reflecting the seriousness of the potential penalty facing Standard Chartered - being booted out of Wall Street - shares in the bank fell six per cent in late trading in London yesterday. In Hong Kong this morning, shares in the bank fell 7.5 per cent in early trading.

The Times observes that the accusations will be "extremely embarrassing" for Standard Chartered, which has avoided the allegations of mis-selling, rate-rigging and money-laundering that have dogged its competitors.

Peter Sands, Standard Chartered's chief executive, "is among the most respected of London-based lenders" and has been suggested recently as a candidate for vacancies at the top of Barclays and the Bank of England.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

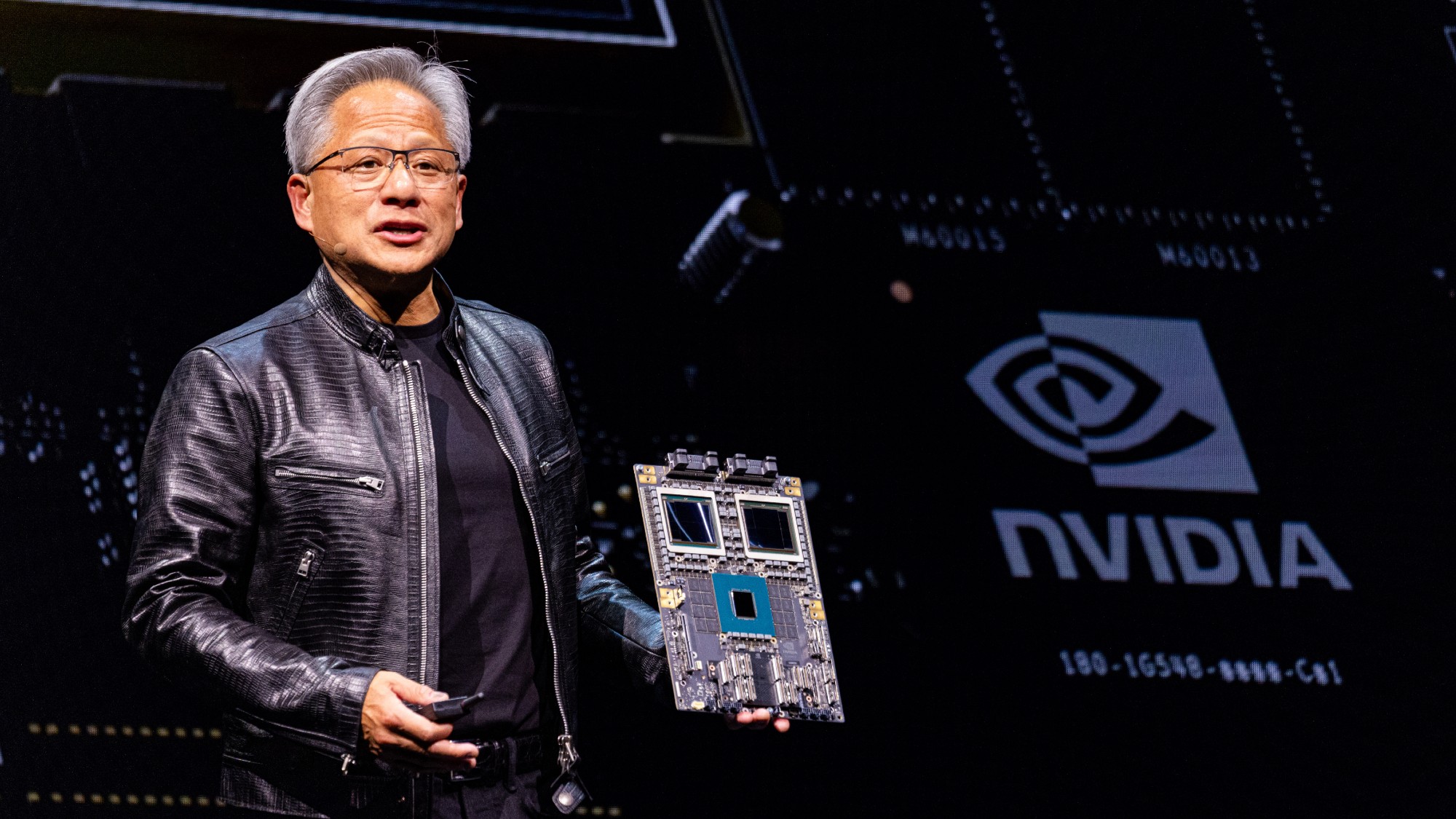

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room