How mobile payments can help grow your business

The rise of mobile payments is changing the way we do business. Here's how to take advantage of a growing trend

In February this year, worldwide smartphone sales reached a billion, and alongside the spread of the technology, a new form of commerce has emerged: mobile payments.

Mobile payments are growing rapidly around the world, with more innovative ways to pay introduced every year. Some analysts say the recent changes to financial transactions are nothing short of revolutionary, so how can your business take advantage of the rise of mobile commerce? And what new methods of payment lie just beyond the horizon?

The growth of mobile

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

According to predictions from Juniper Research, the number of mobile payment users will almost double within the next three years, up to 450 million mobile payment consumers by 2017. Gartner anticipates that total mobile payment transactions are expected to top $507 billion by the end of this year.

So where is the major development happening? Today, companies from a broad range of industries – from retail outlets to mobile manufacturers, and from financial services to social media companies – are all trying to capitalise on this explosive growth.

Recently, Apple introduced a "mobile wallet" to its new iPhone 6 allowing users to scan and add their card details to their iPhone and make payments using near field communication (NFC). This technology will be familiar to many people as it features in most modern bank cards, allowing users to make purchases by tapping on contactless payment tills at supermarkets, coffee shops and service stations around the UK.

Swift innovation

Social media companies such as Facebook and Twitter are also rolling-out new mobile-focussed payment options by launching "buy" buttons which will appear on their apps in coming months.

Retail and online stores and fast food outlets such as Domino's Pizza, Tesco and Ocado are also developing different forms of mobile payment, either by rolling out in-store payment readers or by allowing users to pay for their goods via mobile apps.

"The ability to accept contactless payments has enabled the use of contactless cards in a variety of places," says Eimear O'Connor, Head of Corporate Mobile Payments, Corporate Banking, Barclays. "Quick service merchants have been early pioneers – Starbucks, Pret-a-Manger, McDonald's, for example – and for fast-service businesses it's proving an invaluable development."

How can businesses take advantage of the growth of mobile payments?

The short answer is that it depends on what your business does. For retailers, the focus may be on introducing contactless payment systems, while online stores might wish to consider how to make it easier for customers to make purchases using their mobiles. This can be by either building an app or simply by redesigning an existing website so that it works better on mobile devices. Many businesses may also want to take advantage of new innovations as they emerge such as Barclays Pingit and other similar services to make and receive payments.

As O'Connor explains: "The evolution of Pingit enables consumers pay for goods, products and services in different environments". For example, the app's 'buy it' feature allows consumers to make purchases just by scanning an advert or poster. "From a business point of view, [Pingit is] creating a new sales channel," O'Connor says. "It takes traditional printed media and incorporates QR codes so that customers can buy straight from the poster. This didn't exist before, and that's what our clients are getting really excited about."

Enabling mobile payments can also help improve sales and, according to some experts, can increase customer loyalty. Sandwich franchise Subway became one of the first businesses to introduce a mobile version of its loyalty programme in the UK when it launched its Subcard app in 2009. EIPC, the company that manages Subcard, said that customers who access the app spend 22p more per visit than regular loyalty card users and visit outlets 3.5 times more frequently.

What comes next?

New wearable devices such as Google Glass and the new Apple Watch point the way to how mobile payment systems will continue to develop in the future. A third-party developer for Google Glass recently developed a 'nod payment' system that allows users to make purchases with a quick nod of the head, for example.

One of the most innovative developments in recent years is a new device launched by Barclays to help UK businesses combat identity fraud. The Barclays Biometric Reader uses finger vein technology and is a first by a UK bank. By scanning a finger, users will be able to access online bank accounts and authorise payments, without needing a PIN, passwords or other means of authentication. The small device reads and verifies the unique vein patterns in a user's finger. Unlike finger prints, vein patterns are considered to be extremely difficult to replicate. The bank anticipates that its biometric reader offers a new level of protection for people who continue to hold reservations about the security of digital payment systems.

The introduction of this technology by Barclays offers a glimpse of how business owners may keep payments secure in the years to come. Looking ahead, all eyes will be on Apple Pay, to see how the California-based tech company handles mobile payments.

The time is now

According to O'Connor, the opportunities for UK businesses to introduce new forms of mobile payment are currently enormous: "In the UK we've never had this much activity around alternative payments" she says. "On a global basis there have been lots of initiatives, but in the UK this innovation is really becoming a reality."

Whether by creating a mobile app, setting up a mobile loyalty scheme, or introducing contactless payment tills, many UK businesses will benefit from embracing the current rapid innovations in mobile payments. Mobile commerce is no longer the technology of tomorrow, it is very much the technology of today.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Trump’s jumbled doctrine of global force emerges

Trump’s jumbled doctrine of global force emergesTALKING POINTS A hastily launched war of vaguely articulated goalposts in Iran has thrust Trump’s vision of expanded empire into a spotlight for which it might not be ready

-

China could be co-opting ChatGPT to suppress dissidents

China could be co-opting ChatGPT to suppress dissidentsIn the Spotlight A new report indicates China’s use of AI is significant

-

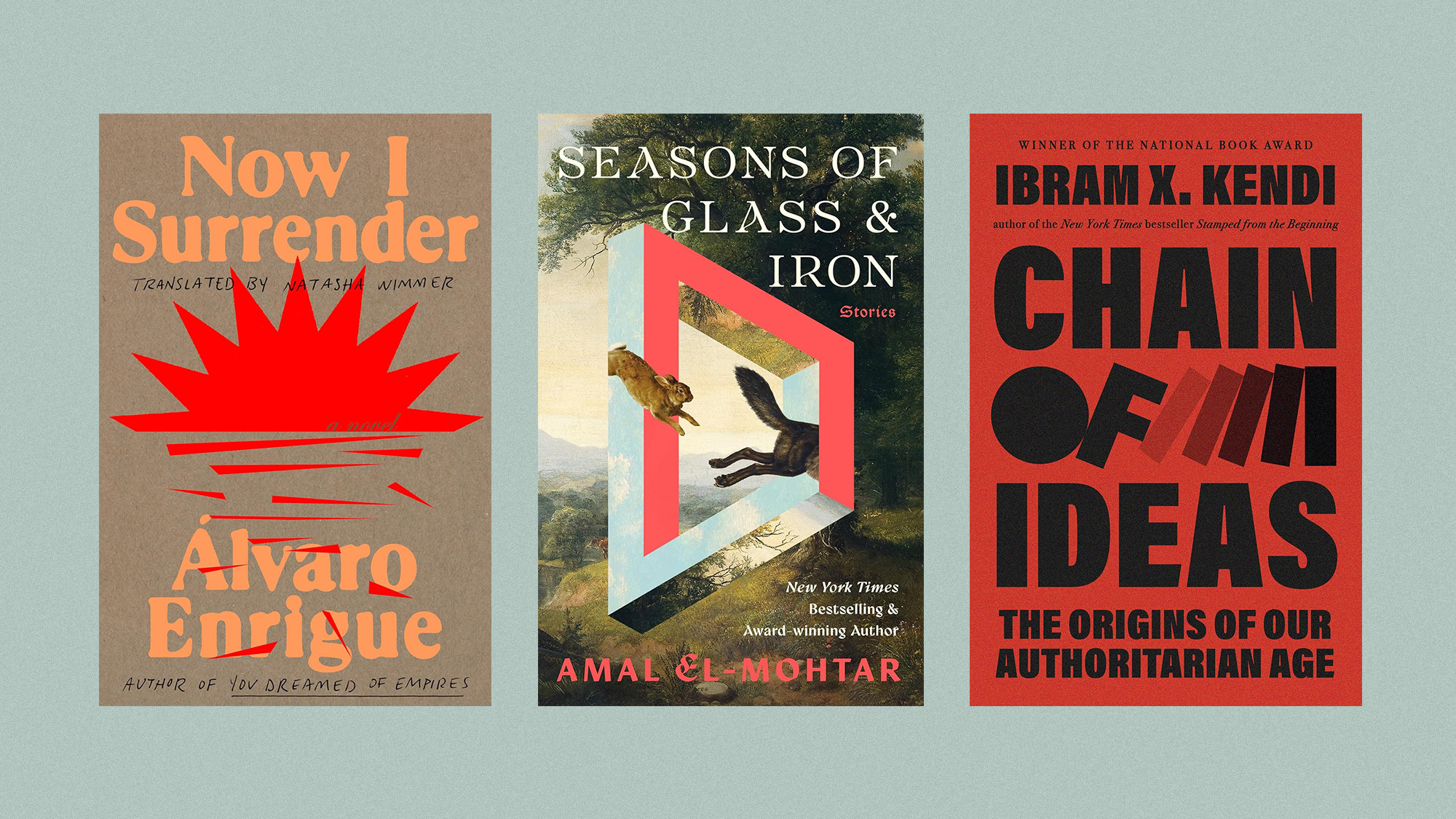

March’s books feature a sci-fi collection, an epic alt-western, and an examination of the ‘replacement theory’

March’s books feature a sci-fi collection, an epic alt-western, and an examination of the ‘replacement theory’The Week Recommends This month’s new releases include ‘Seasons of Glass & Iron: Stories’ by Amal El-Mohtar, ‘Now I Surrender’ by Álvaro Enrigue and ‘Chain of Ideas’ by Ibram X. Kendi

-

China could be co-opting ChatGPT to suppress dissidents

China could be co-opting ChatGPT to suppress dissidentsIn the Spotlight A new report indicates China’s use of AI is significant

-

South Africans are angry as Johannesburg faces a growing water crisis

South Africans are angry as Johannesburg faces a growing water crisisUnder the Radar This comes despite Johannesburg being Africa’s wealthiest city by GDP

-

Fugu Day: why Ghana’s traditional garment is having a renaissance

Fugu Day: why Ghana’s traditional garment is having a renaissanceUnder the Radar A centuries-old outfit is being rewoven into a statement of cultural pride – and defiance

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer