Rich people have nowhere to put their money. This is a serious problem.

This is more than a justice problem

So here's a mystery: According to the latest numbers from the International Monetary Fund (IMF), the world economy grew 3.1 percent in 2015 and is projected to grow 3.4 percent in 2016. On the world stage, that's a pretty modest rate, but it is growth. And yet at the same time, financial markets started 2016 by panicking as if they expect Armageddon any day now: The S&P 500 has dropped 9 percent this year already, and stock indexes in poorer developing countries have fallen further.

Neil Irwin tried to puzzle through this contradiction in The New York Times, and put forward a few ideas. But he admitted that "what makes these falling prices unnerving is that it's hard to tell a simple story about what is driving them."

Allow me to try.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The first thing to know, as Irwin points out, is that there is just an unprecedentedly huge amount of money sloshing around the upper echelons of the American economy these days. This is not simply a matter of rising income inequality, but it's certainly related.

Every business in the country is its own hub of distribution: It doesn't just decide how much of its revenue to pay to workers versus top management, but how much to pay to all of them versus how much to pay out to shareholders. (And, of course, top management and shareholders overlap enormously these days.) Over the last 30 years there's been a massive shift in favor of paying out to shareholders, rather than investing in new jobs or capacity. There is now far more money churning endlessly in financial markets than there is going into real-world investment in any given year. Wealth inequality — largely driven by ownership of stocks and other assets — is just insanely skewed towards the top.

This is more than a justice problem. This sort of imbalance comes with real practical consequences.

The rich cannot possibly spend all this money on consumption. So they need to park it somewhere. And the basic idea behind an investment — be it in stock or bonds or whatever — is that it's a bet. Someone in the economy has an idea for a new business or other project, and is either borrowing money or trying to raise equity to give it a try. If you buy a stock or a bond, you're basically saying you think that looks like a good bet: If the project is successful, you'll get dividends form the stock or service payments from the debt, and the value of those instrument will go up on the financial markets.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When the rich have excess money, this is how Econ 101 says they store it: in new projects that lead to new growth and new jobs.

Yet that isn't happening. All the buying and selling in the financial markets isn't going into new investments. It's just endlessly trading instruments that already exist back and and forth. Meanwhile, corporations are sitting on roughly $1.9 trillion in unused cash. As Adam Davidson noted, also in the Times, this is equally weird: Investing money in new projects is supposed to be more beneficial, in purely self-interested terms, than holding onto it.

These facts are being treated as grand mysteries by most commentators. But may I invoke Occam's Razor and suggest the simplest explanation is the right one: There's not enough stuff going on in the economy that's worth investing in.

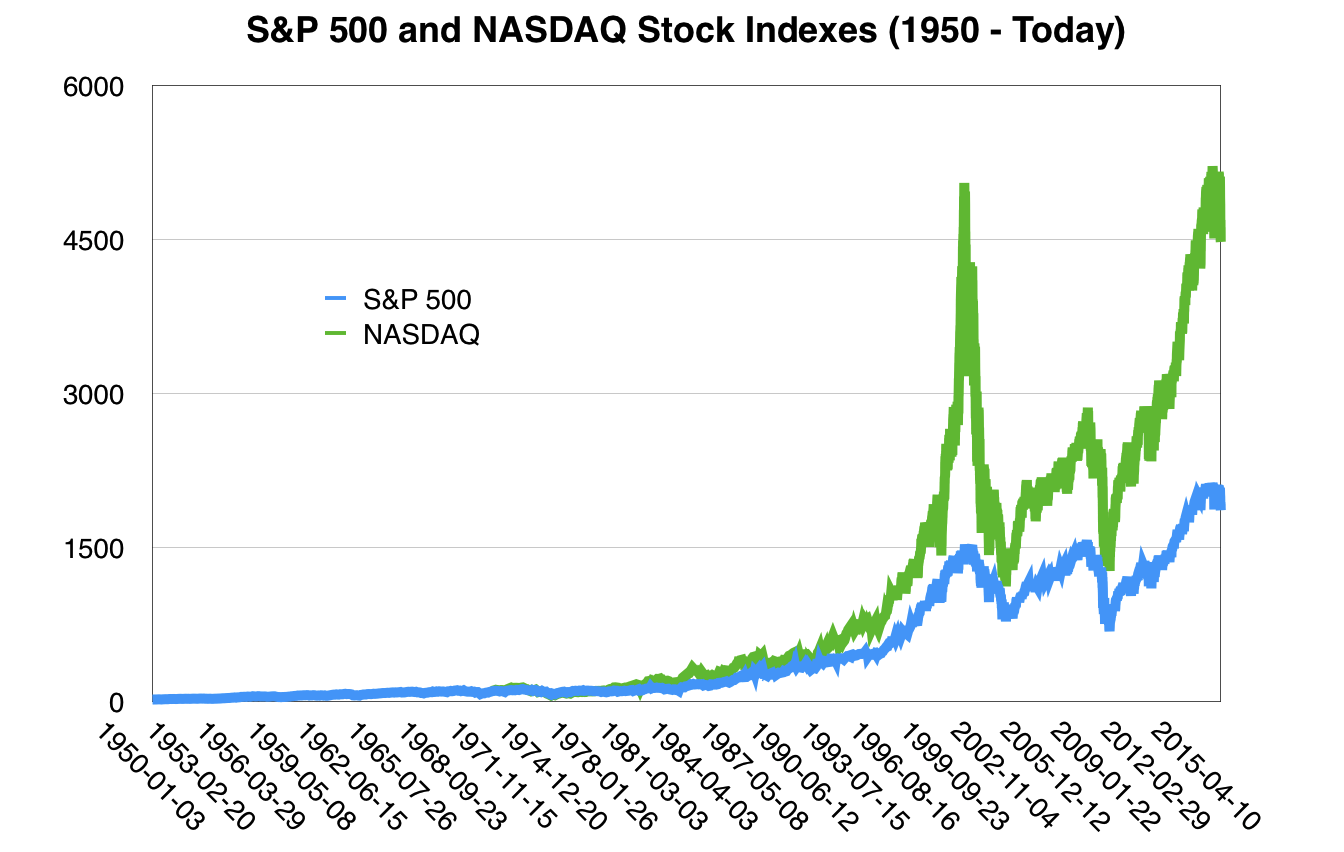

As the amount of money in the financial markets grows compared to the amount of worthwhile investments, it's like having more and more rich people standing on a shrinking platform. Of course financial markets become more volatile, and begin panicking in response to what would have seemed, in earlier decades, like no big deal. I don't think it's a coincidence that the era of rising inequality and massive shareholder payouts has also been the era of rapidly rising and wildly swinging stock markets:

Sure, the world is growing. But not that much. America's recovery has been mediocre: We're celebrating jobs reports that wouldn't have been anything to write home about in earlier eras. Europe as a whole is barely above recession, and some individual countries still are in recession. China is slowing down. In fact, some researchers recently poked through the IMF numbers and concluded the institution is actually off on its own analysis of 2015, and that the global economy actually spent that year contracting.

Things may not in fact be that bad, but it suggests the strong possibility the total amount of economic activity in the world — and thus potentials for investment — is even lower than we thought.

Another bit of evidence you can see of this is the massive demand growth for debt issued by the governments of advanced countries like America, Germany, France and so forth. Bonds from these governments are considered rock-solid safe assets: They're what everyone pours into when everything else looks too uncertain and risky to park your money in.

This is where inequality re-enters the mix. It's important to remember that economic activity — the real, concrete, human-to-human interactions — boils down to someone needing something useful done and someone wanting to do something useful. Money is just the medium of exchange our society uses to make those interactions happen. As more money goes to pay CEO salaries and shareholder payouts, and more money circulates through the high-end urban industries that support upper class jobs and cater to upper class consumers only, then there's less money circulating to make those other exchanges happen in the more modest reaches of society. As those exchanges happen less often, the experience, skills, relationships, and general social infrastructure you need to restart those interactions wither too.

Over this same 30-year period, we've also seen full employment virtually disappear. That means workers aren't getting enough of the jobs they need to get the money to make further economic activity happen. And it means they don't have the bargaining power to claim their share of business revenue. So it goes to shareholders instead.

As more money gets trapped at the top, it's almost a mechanical necessity that it will find fewer worthwhile projects to park itself in throughout the rest of the economy.

The new realities mean the stock markets panic in the bad and the good (or rather the not-as-good-as-they-used-to-be) times. "The stock market has predicted nine of the last five recessions," as Irwin dryly noted. So we could still be headed for an actual recession. But that's largely because, in recent years, we've never been too terribly far from the brink.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Ski town strikers fight rising cost of living

Ski town strikers fight rising cost of livingThe Explainer Telluride is the latest ski resort experiencing an instructor strike

-

‘Space is one of the few areas of bipartisan agreement in Washington’

‘Space is one of the few areas of bipartisan agreement in Washington’Instant Opinion Opinion, comment and editorials of the day

-

How robust is the rule of law in the US?

How robust is the rule of law in the US?In the Spotlight John Roberts says the Constitution is ‘unshaken,’ but tensions loom at the Supreme Court