4 ideas in the GOP tax plan that Democrats should support

From encouraging corporate investment to blowing up the deficit ...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

"If you can't say anything nice, don't say anything at all" is some homespun wisdom that doesn't really apply to politics. If someone puts forward a policy that would make America worse off, voters need to know about it. This is eminently true of the new tax reform scheme just released by President Trump and the Republicans.

But perhaps you could amend the wisdom: Once you've said all the mean things, find a few nice things to say, too. Democrats can't just snipe from the sidelines: They need to offer an alternative. And as difficult as bipartisan cooperation is these days, it would still behoove the Democrats to identify which Republican tax ideas might improve the economy and negotiate from there.

So here are four things Trump's new tax proposal actually gets at least sort of right.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

1. Encourage businesses to invest more.

Business investment in the American economy has collapsed over the last few decades. This translates into less economic growth, lower productivity, fewer jobs, and lower wages.

Similar to how you can deduct job expenses from your individual income taxes, a corporation can deduct spending on new capital investments from the federal tax on their profits. But those deductions are complex: The rules change from industry to industry, and the deductions often have to come in pieces over several years.

So the GOP is proposing something called "full expensing." Basically, all companies get to write off an investment as soon as it happens, and keep writing it off for the next five years. The idea is to make the tax benefit more certain, simpler, and immediate, thus incentivizing more investment.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Obviously, you can quibble over details. (For example, should it be five years?) And full expensing could definitely benefit some types of businesses more than others. But the overall idea would still pump money into more jobs and growth.

2. Stop encouraging corporate debt.

Another thing corporations can expense from their taxes is the interest they pay on their debt. Unfortunately, this also makes it more attractive for businesses to finance themselves by borrowing rather than by raising new equity. Companies have piled on debt, especially in recent years. And as we learned from the Great Recession, debt in the private sector can spiral out of control.

Republicans aren't proposing to eliminate the expense for interest entirely, just "partially limit" it. But this would at least lower the incentive to borrow.

Some conservatives would prefer to fix this problem by just cutting the tax on corporate profits or eliminating it entirely. That's not a completely crazy option. But if you did get rid of the corporate income tax, you'd need to compensate by jacking taxes on capital gains way up.

Come to think of it, that's also something Democrats would be more likely to do.

3. Improve the child tax credit.

Let's be blunt: Children are wonderful, but they come with lots of expenses, and they don't contribute any income to the family budget. There's a very strong correlation between the ratio of earning parents to non-earning dependents and how likely a family is to be in poverty. Most modern Western nations address this problem by giving all families with children lots of cash aid to help with those expenses. The United States is one of the few that doesn't.

All we have is the child tax credit (CTC). Unfortunately, it's only worth $1,000 per child, and it phases in as income rises so the poorest families get left out.

Trump and the GOP want to increase the CTC, and they want to lengthen the phaseout so families higher up the income ladder can get it. All well and good.

There are a few problems though: First, the CTC eligibility already extends to pretty high earners. Second, the plan doesn't specify how much they want to raise the credit to. Meanwhile, they do specify that only the first $1,000 will still be refundable, which isn't great, because refundability is a key feature in the credit's ability to help the poorest.

Ideally, the CTC should be increased to something like $4,000 per child, and the whole thing should be fully refundable. The phase-in should be eliminated entirely, so all families, no matter how poor, get the full benefit of the credit on their very first dollar. A universal child allowance would be ideal, but Democrats should at least go this far. Still, what Republicans are offering would be an improvement on the status quo.

4. Add to the deficit.

It seems clear at this point that Republican concerns about the deficit are entirely a matter of opportunism and hypocrisy. This new plan, for instance, could lose the Treasury $2.2 trillion in tax revenue over the next decade.

But Democrats shouldn't simply scold Republicans for blowing up the deficit over tax cuts or anything else. Yet they do it: "We're about to add billions to the deficit to rebuild parts of our country, something we absolutely should do because it's an emergency," Senate Minority Leader Chuck Schumer (D-N.Y.) said earlier this month. "But that makes it even more important that tax reform be fiscally responsible and deficit-neutral."

As I've argued before, since the federal government controls the supply of the U.S. currency, it doesn't actually need to bring in revenue through taxes. It can just create new money supplies. The true purpose of taxes is to prevent the economy from overheating and to control inflation. And despite the seemingly low unemployment rate, the economy is still quite far from reaching that threshold.

Of course, tax policy is also a pretty good tool for adjusting the distribution of incomes, and thus for making sure everyone has a decent living standard. Since Democrats are ostensibly in the business of lifting up the lowest earners, they ought to leap at the opportunity afforded by the federal government's unique fiscal and monetary powers. They can and should disagree with Republicans when they focus on the wealthy at the expense of the poor, but they needn't engage in right-wing talking points to do it.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

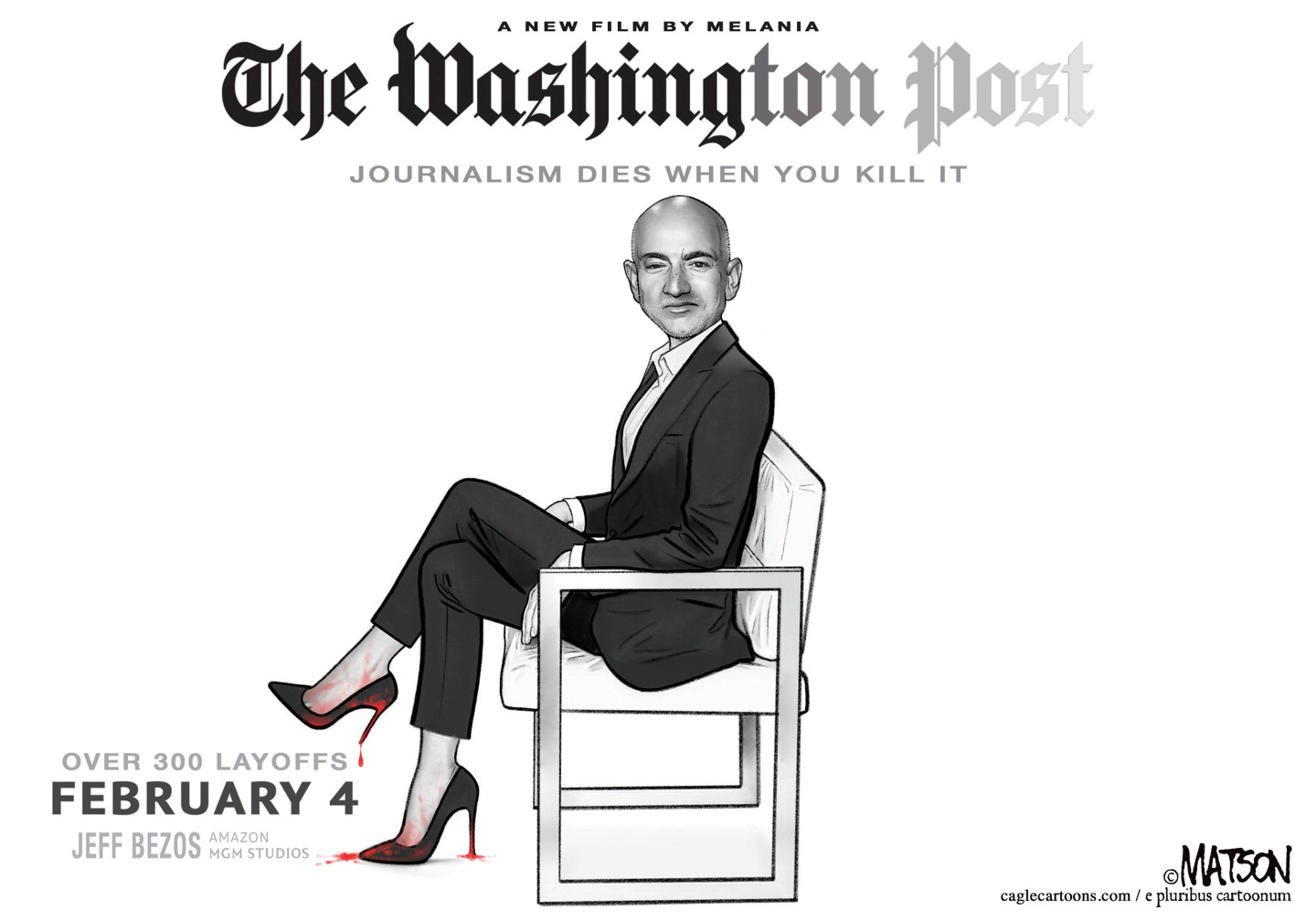

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred