Why small businesses are getting burned by the GOP tax bill

This is a huge problem for Republicans

House Republicans released their draft legislation for tax reform on Thursday. Then something remarkable happened: Groups representing small businesses all gave it a thumbs down.

Republicans (and Democrats, to be fair) tend to harp incessantly on the critical importance of small businesses. And these groups are usually reliable supporters of GOP efforts to cut taxes and regulations. Yet the National Federation of Independent Business (NFIB) declared it was "unable to support the House tax reform plan in its current form." The CEO of the National Small Business Association told CNBC he wasn't sure if his organization would back the reform plan. The Small Business & Entrepreneurship Council was also on the fence, supporting some aspects of the plan but not others.

The tax reform bill already faces an uncertain future. If small business groups abandon it en masse, they could well threaten its survival — along with Republicans' last meager hope of doing something big before the 2018 midterms.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why are small businesses unhappy?

It's a little complicated. But it starts with the fact that, as legal entities in the U.S. tax code, businesses can actually take various forms.

When we talk about corporations, what we usually mean are C-corporations. These are the companies that have to pay a federal tax on their profits. And the central item in the GOP's tax reform plan is to cut that tax rate from 35 percent to 20 percent.

But there are also S-corporations, partnerships, and sole proprietorships. These are called "pass through" businesses. And they're usually what we mean by small businesses: the self-employed plumber with one assistant, the local car repair garage, or the corner store owner who works the cash register along with her employees. These are ostensibly small operations of just a few people, not big bureaucratic behemoths with profits that have to be dolled out among hundreds or thousands of shareholders.

So for these smaller companies, their profits "pass through" to become regular income for the owners. So the money is taxed under the regular individual income tax.

But this also created a problem for Republican tax reformers. You don't want to cut taxes for big corporations, but not for smaller pass-through businesses. Yet by reducing the tax that C-corporations pay on their profits to 20 percent, the GOP plan would significantly lowball the four brackets it's proposing for the individual income tax: 12 percent, 25 percent, 35 percent, and 39.6 percent.

The Republicans tried to solve this problem by cutting off the top tax rate for pass-through businesses at 25 percent. Not exactly 20 percent, but much less of a gap.

Yet that still wasn't enough. "We are concerned that the pass-through provision does not help most small businesses," the NFIB said in a statement.

It turns out that inequality is a huge problem within the small business community.

Over 70 percent of pass-through businesses don't pay a tax rate higher than 15 percent. Under the current income tax, the cutoff for the 15 percent tax bracket is $37,950 for an individual and $75,900 for a married couple. Under the new individual income tax brackets in the GOP plan, both that individual and that couple would pay a max of 12 percent.

So for almost three-fourths of pass-through businesses, cutting off their tax rate at 25 percent doesn't provide any help at all. They're already paying much lower rates, because they don't make all that much money in the first place.

Meanwhile, the top 1 percent of pass-through businesses make at least $10 million a year, and account for a whopping 69 percent of all the income earned by pass-through businesses across the country. That's the tiny, rarified slice of people who would really benefit from the House GOP's proposed 25 percent rate for pass-through taxation.

It's a slice that includes hedge fund managers, investment bankers, and even real estate investors. In fact, President Trump's own family business files as a pass-through, which is why Hillary Clinton understandably called this proposed change the "Trump loophole."

It gets better.

Another challenge created by the GOP's proposal is that wealthy Americans, who would normally pay a top individual tax rate of 35 percent or 39.6 percent, might rejigger their tax filings and claim to be pass-through businesses — and thus cut their taxes to a max of 25 percent. To prevent this, the GOP introduced some complicated new rules for who can qualify for the 25 percent pass-through rate. The gist is that, if you actively work in the company you're claiming as a pass-through business, 70 percent of your income will still be taxed under the normal income tax brackets. You could argue with the IRS for a different proportion, but that requires time and the resources to hire accountants and lawyers.

Only passive investors in pass-through businesses will definitely enjoy the full benefits of the 25 percent rate. That means people who have enough excess money lying around that they can invest it in a business that someone else does the day-to-day work of running. Which will usually mean wealthy people.

Again, if we're thinking of car mechanics, plumbers, store owners, and so on, these are all people who actively work in the businesses they own. So they'd likely see little-to-no change in their taxes at all.

Now, Republicans could certainly help out the vast majority of pass-through businesses if they really wanted to. All they would need to do is significantly lower the individual income tax rates for people making $37,950 or less, and for couples making $75,900 or less.

But that would lose a lot of revenue, and leave the Republicans with two options.

They could pass the bill as a bipartisan compromise with Democrats, and thus clear the 60-vote threshold imposed by the Senate's filibuster. But the Democrats would certainly insist on no tax cuts for rich people. The other option is what the GOP is actually doing: Using the procedural tool of reconciliation to avoid the filibuster, and pass tax reform with just Republican votes. But bills passed by reconciliation face strict limits on how much they can increase the deficit. And once you've cut taxes so drastically for rich people, you've got to make up the lost revenue somewhere.

Basically, the Republicans are dead set on massive tax cuts for the top 1 percent and top 0.1 percent of Americans. So long as that's their first priority, they just don't have a lot of room to offer help to anyone else.

That's going to leave the vast majority of small businesses wondering why they should bother supporting this bill.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

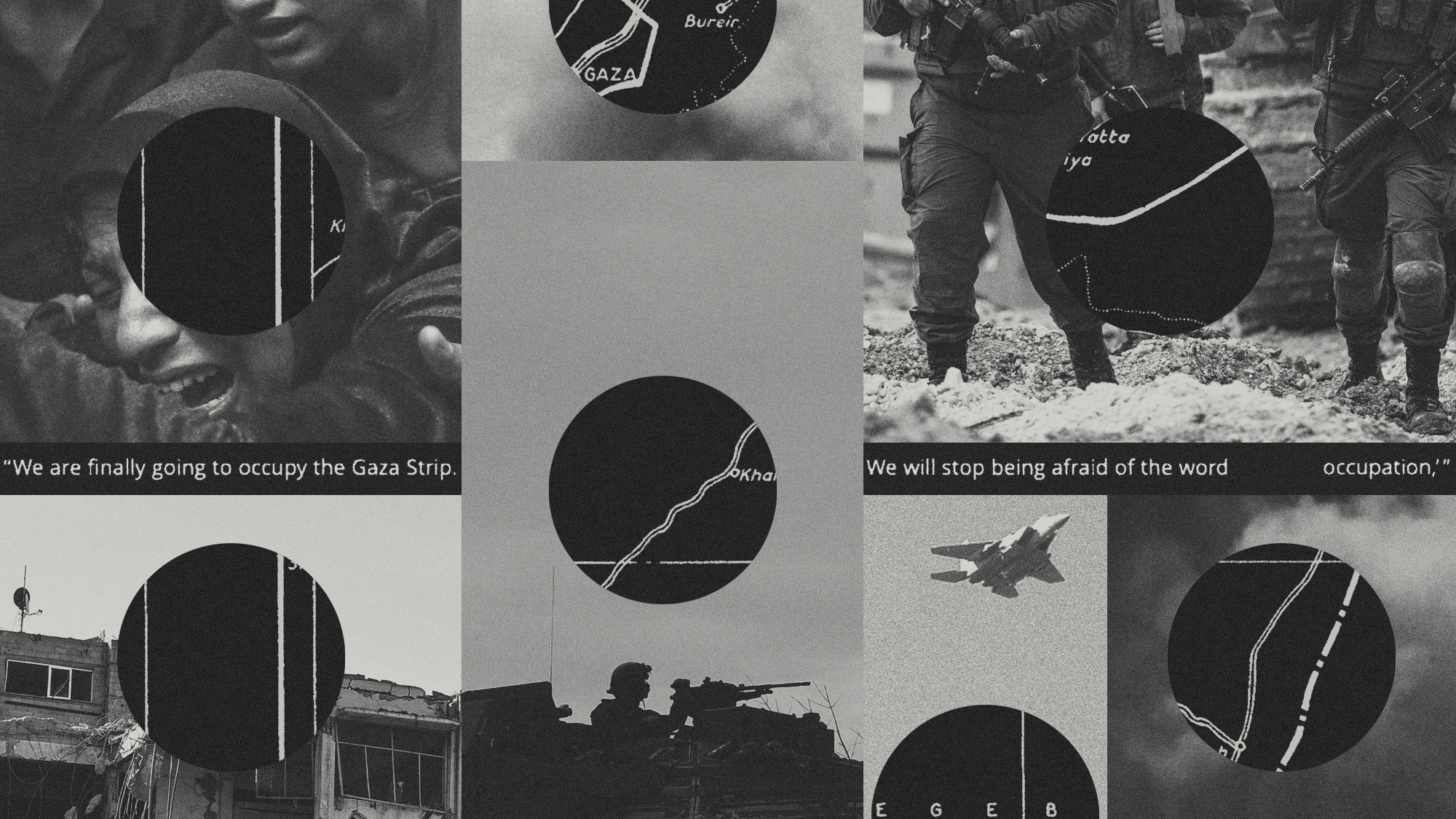

What does 'conquering' Gaza mean to Israel?

What does 'conquering' Gaza mean to Israel?Today's Big Question Benjamin Netanyahu's cabinet has approved a plan to displace much of the Palestinian population while seizing and occupying the territory on a long-term basis.

-

Casey Means: the controversial 'wellness influencer' nominated for surgeon general

Casey Means: the controversial 'wellness influencer' nominated for surgeon generalIn the Spotlight Means has drawn controversy for her closeness to RFK Jr.

-

Trump taps Fox News' Pirro for DC attorney post

Trump taps Fox News' Pirro for DC attorney postspeed read The president has named Fox News host Jeanine Pirro to be the top federal prosecutor for Washington, replacing acting US Attorney Ed Martin

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are the billionaires backing?

Democrats vs. Republicans: who are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?

-

Will 'weirdly civil' VP debate move dial in US election?

Will 'weirdly civil' VP debate move dial in US election?Today's Big Question 'Diametrically opposed' candidates showed 'a lot of commonality' on some issues, but offered competing visions for America's future and democracy