Here's Microsoft's oddly prescient 'smart home,' from 1999

Microsoft/YouTube

Back in 1999, the future belonged to Microsoft. It was so dominant in the computer/IT market — Windows, Office, Internet Explorer, Windows Media Player — that a few years later the European Union would slap it with a hefty antitrust judgment and fine. Now, Microsoft is merely a tech giant competing against everyone from Apple and Google to Nintendo and Facebook. Those companies, it turns out, have helped make a reality out of much of this 1999 Microsoft concept video of the "smart home" of the future. The Jetsons, today, if you will. One quibble: Rosie is the Jetsons' robotic housekeeper — isn't Astro their dog? --Peter Weber

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Will California tax its billionaires?

Will California tax its billionaires?Talking Points Proposed one-time levy would shore up education, Medicaid

-

Blue Origin launches Mars probes in NASA debut

Blue Origin launches Mars probes in NASA debutSpeed Read The New Glenn rocket is carrying small twin spacecraft toward Mars as part of NASA’s Escapade mission

-

Trump DOJ sues to block California redistricting

Trump DOJ sues to block California redistrictingSpeed Read California’s new congressional map was drawn by Democrats to flip Republican-held House seats

-

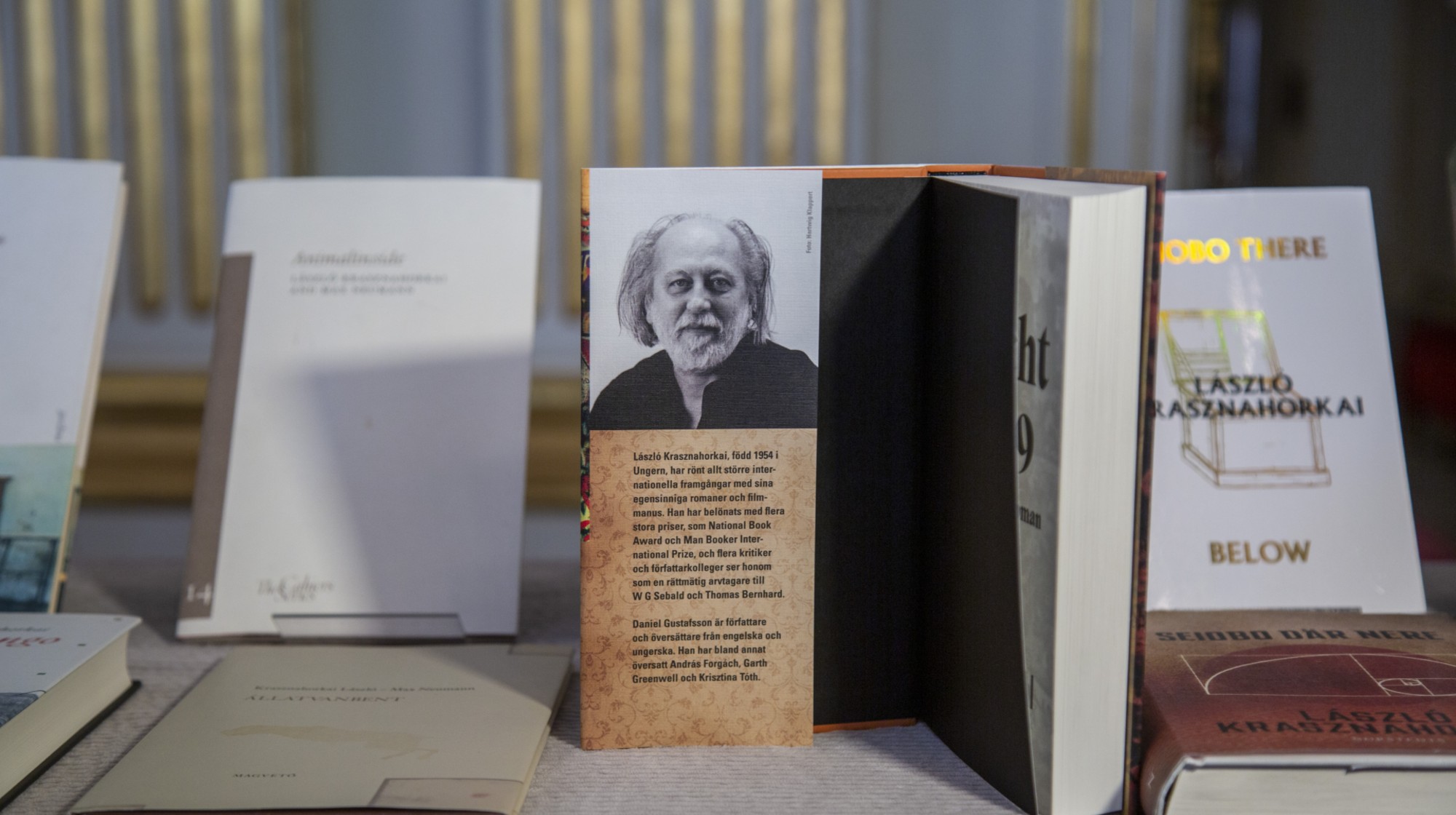

Hungary’s Krasznahorkai wins Nobel for literature

Hungary’s Krasznahorkai wins Nobel for literatureSpeed Read László Krasznahorkai is the author of acclaimed novels like ‘The Melancholy of Resistance’ and ‘Satantango’

-

Primatologist Jane Goodall dies at 91

Primatologist Jane Goodall dies at 91Speed Read She rose to fame following her groundbreaking field research with chimpanzees

-

Florida erases rainbow crosswalk at Pulse nightclub

Florida erases rainbow crosswalk at Pulse nightclubSpeed Read The colorful crosswalk was outside the former LGBTQ nightclub where 49 people were killed in a 2016 shooting

-

Trump says Smithsonian too focused on slavery's ills

Trump says Smithsonian too focused on slavery's illsSpeed Read The president would prefer the museum to highlight 'success,' 'brightness' and 'the future'

-

Trump to host Kennedy Honors for Kiss, Stallone

Trump to host Kennedy Honors for Kiss, StalloneSpeed Read Actor Sylvester Stallone and the glam-rock band Kiss were among those named as this year's inductees

-

White House seeks to bend Smithsonian to Trump's view

White House seeks to bend Smithsonian to Trump's viewSpeed Read The Smithsonian Institution's 21 museums are under review to ensure their content aligns with the president's interpretation of American history

-

Charlamagne Tha God irks Trump with Epstein talk

Charlamagne Tha God irks Trump with Epstein talkSpeed Read The radio host said the Jeffrey Epstein scandal could help 'traditional conservatives' take back the Republican Party

-

CBS cancels Colbert's 'Late Show'

CBS cancels Colbert's 'Late Show'Speed Read 'The Late Show with Stephen Colbert' is ending next year