FTSE hits nine-month high as Trump and Xi agree to talks

London index joins global rally - but will the market optimism last?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The FTSE 100 has reached its highest level this year after the US and China agreed to restart trade talks over the weekend. It climbed to 7530 during Monday's session, its peak since the end of September.

Thawing relations between Donald Trump and his Chinese counterpart Xi Jinping have eased fears over the escalation of a damaging dispute between the world's two leading economies.

Amid a global stock market rally, Wall Street indexes were also significantly higher, with the S&P 500 hitting an all-time high as it surpassed a previous record set in June.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Dow Jones Industrial Average rose 0.97%, or 258.15 points higher, to 26,858.11. The Nasdaq jumped 1.67%, or 133.39 points, to 8,139.63 and the S&P 500 gained 0.58% to 2,941.76 - the new intraday record.

“Investors are relieved that Donald Trump and Xi Jinping backed away from a deeper trade war, agreeing to restart negotiations during their meeting at the G20 last week,” says The Guardian.

Scott Brown, chief economist at Raymond James, said: “Any step towards a trade resolution, and it doesn't have to be a lot of progress - just a step, is viewed very positively by markets.

“And investors at this point are trying to focus on the positive in hopes that there will be some trade resolution down the line.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, Fawad Razaqzada, Market Analyst at Forex.com, has sounded a note of caution. “If this latest trade optimism fades completely, the focus will turn very quickly to the ailing global economy,” he said.

“As such, the S&P’s latest breakout to a new all-time high could be brief, especially as some of the positivity regarding trade talks was already priced in.”

CNN is also at pains to try and temper the optimism. “The fragile truce does little to alleviate pressure on a global economy wounded by earlier exchanges of fire that hit manufacturing and trade,” writes Charles Riley.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

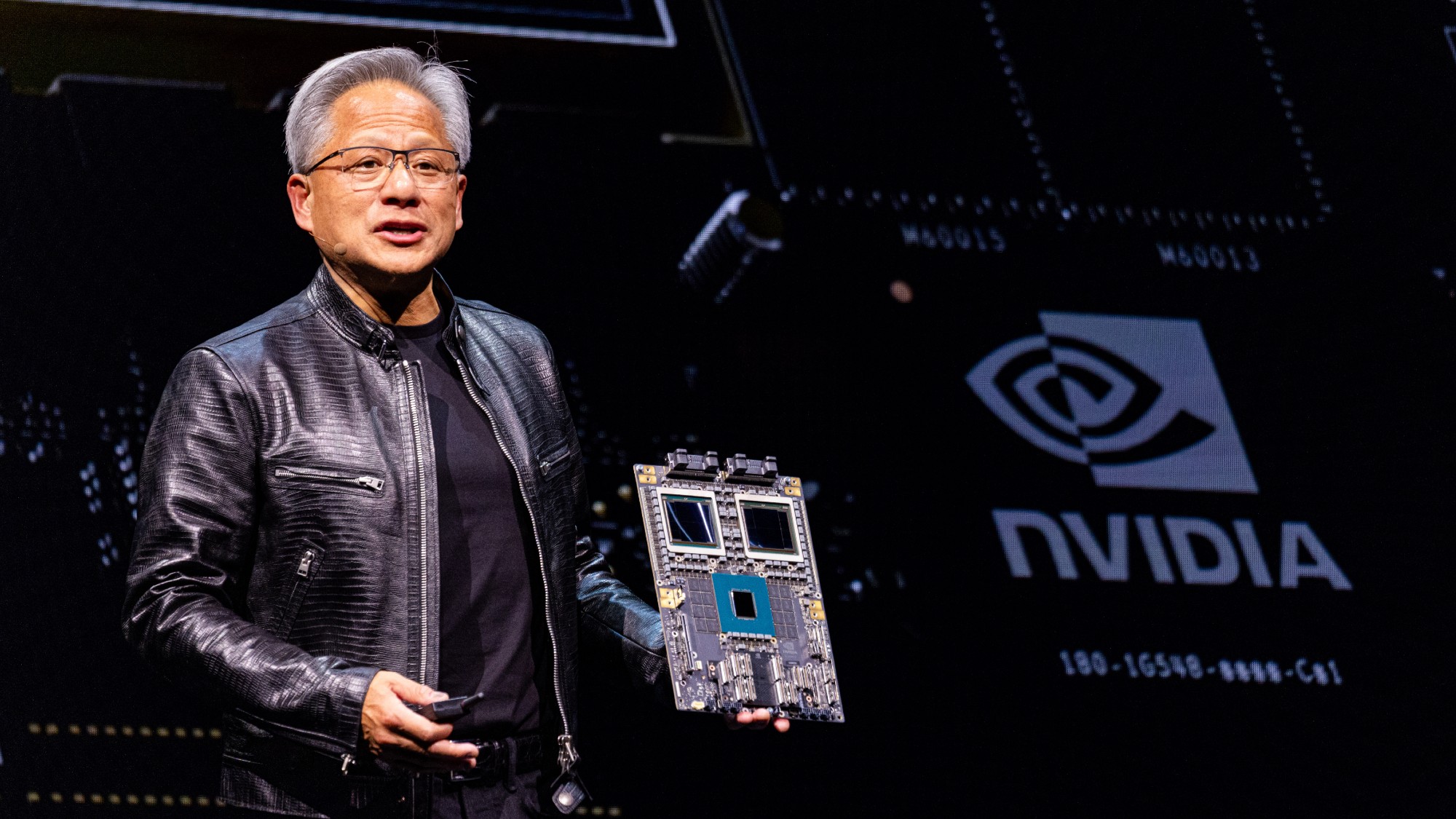

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

Trump's threats to fire Jerome Powell are unsettling the markets

Trump's threats to fire Jerome Powell are unsettling the marketsTalking Points Expect a 'period of volatility' if he follows through