What is Japanification?

Economists fears challenges posed by coronavirus pandemic may push Europe into Japan-like crash

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Fears are growing that the economic downturn and record deflation triggered by the coronavirus outbreak may trigger the so-called “Japanification” of the eurozone.

The term is used as shorthand for the economic problems that crippled Japan around the turn of the millennium.

What happened in Japan and could Europe go the same way?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Around 20 years ago, Japan was hit by “weak rates of growth and persistently low rates of inflation despite huge amounts of policy support, particularly from central banks”, explains Neil Shearing of London-based research consultancy Capital Economics.

The Telegraph reports that “economists have long feared that the eurozone is heading into a state of Japanification where it cannot escape a period of stagnation, defined by weak growth, ultra-loose monetary policy and deflationary pressures”.

Deflation can cause people to stop spending, in the expectation that prices will fall lower in future, and can also hurt employers if wages do not fall with prices.

This increases the pressure on the economy and “can cause a vicious cycle”, the newspaper says.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

How great is the risk facing the eurozone?

Experts say the coronavirus outbreak is resulting in economic damage that poses the greatest risk faced by the eurozone since the 2008 financial crash.

From a “big-picture perspective”, the pandemic “has once again brought the structural issues of debt, demographics and disinflation to the fore”, Morgan Stanley economists warned in mid-March, as the Los Angeles Times reported at the time.

Days later, the European Central Bank (ECB) launched an emergency €750bn (£660bn) package to ease the impact of the coronavirus pandemic. ECB boss Christine Lagarde tweeted that there were “no limits” to the bank’s commitment to the euro.

Europe is not alone in taking extraordinary measures to try to mitigate risk. The US Federal Reserve last month announced that it was cutting interest rates to near zero and buying at least $700bn (£570bn) of Treasury and mortgage-backed securities in a bid to boost the economy.

“We’re essentially at the Japanese place,” former treasury secretary Larry Summers said during an interview with Bloomberg Television. “That’s a place that’s very hard to get out of.”

David Mann, chief economist for Standard Chartered Plc in Singapore, told the network to “think of things like helicopter drops” - central banks printing cash and delivering it straight to the public - “think of things like fiscal deficits that could be partially directly monetised by central banks”. This new toolkit will be needed “not just during this shock, but during the 2020s”, Mann warned.

–––––––––––––––––––––––––––––––For a round-up of the most important stories from around the world - and a concise, refreshing and balanced take on the week’s news agenda - try The Week magazine. Start your trial subscription today–––––––––––––––––––––––––––––––

How is Japan’s economy doing now?

“Not all that bad,” says Capital Economics’ Shearing. Japan’s GDP has risen by an average of 1.3% a year over the last decade, while overall employment has never been higher.

“Predictions of an impending fiscal catastrophe caused by a large and rising government debt burden have (so far) proved to be unfounded,” Shearing adds.

However, the high employment rate in the East Asian nation has led to wage growth stagnating, and putting more people to work without creating more work to go around has seen productivity fall.

And inflation remains stuck at very low levels, despite “super-loose” monetary policies from Bank of Japan.

-

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

The Japanese salarymen with a side hustle as cheerleaders

The Japanese salarymen with a side hustle as cheerleadersUnder The Radar 'Suited and booted' Cheer Re-Man's cheer squad are 'injecting high-flying excitement' into Japan's business world

-

What went wrong at Nissan?

What went wrong at Nissan?In the Spotlight And will a merger with Honda make the difference?

-

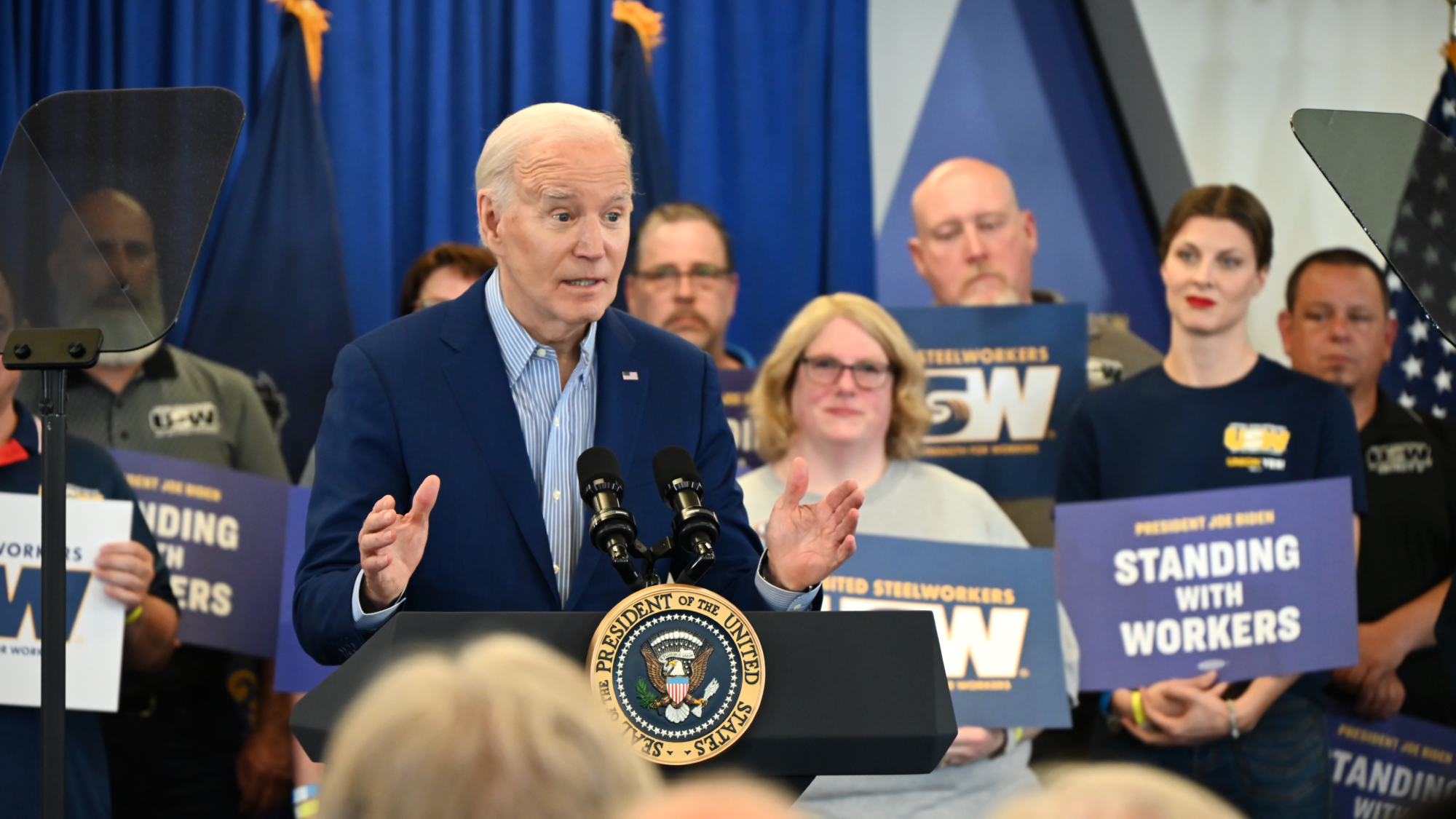

Biden expected to block Japanese bid for US Steel

Biden expected to block Japanese bid for US SteelSpeed Read The president is blocking the $14 billion acquisition of U.S. Steel by Japan's Nippon Steel, citing national security concerns

-

'Super Mario' to the rescue: can Draghi fix Europe's economy?

'Super Mario' to the rescue: can Draghi fix Europe's economy?Today's Big Question Former central bank boss calls for more innovation and investment – but faces 'too many moving parts for a straightforward fix'

-

The government's growing concern over a potential US Steel takeover

The government's growing concern over a potential US Steel takeoverIn the Spotlight Japan's largest steelmaker, Nippon Steel, is attempting to buy the company

-

Canadian takeover bid for Japan's 7-Eleven could change how the Asian country does business

Canadian takeover bid for Japan's 7-Eleven could change how the Asian country does businessIn the Spotlight Would a foreign company upend konbini culture?