Canadian takeover bid for Japan's 7-Eleven could change how the Asian country does business

Would a foreign company upend konbini culture?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Convenience stores aren't just big business in Japan: They're a linchpin of the nation's culture — with reputations for tasty, well-prepared food and an astoundingly wide array of critical services — known as "konbini." Now a takeover bid could change everything.

7-Eleven stores are a "cornerstone of Japanese society," said The New York Times. Yes, the chain started in Texas, but it quickly became a huge success after opening its first Japanese store in 1974 — and has been a wholly-owned Japanese company since 2005. Now the Canadian firm Alimentation Couche-Tard (ACT) — which operates the Circle K chain — has offered an "unsolicited bid" to buy the company, raising alarms among the Japanese public: The sale would be the "equivalent to Toyota becoming a foreign company," said one analyst.

The proposal "marks a watershed even if it falls through," said The Economist. Japanese companies have traditionally had "hostile attitudes towards mergers and acquisitions," but in recent years government reforms have tried to make businesses "more shareholder-friendly" — with a particular focus on maximizing profit. ACT tried two decades ago to purchase 7-Eleven's American operations, but was rebuffed. That makes the new bid a test of the country's evolving business culture. "The fact that his latest offer is receiving serious consideration is a sign of how much has changed," said The Economist.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The 'indispensable' company?

Konbini stores like 7-Eleven "are the pinnacle of what Japan does best," Leo Lewis and David Keohane said in The Financial Times. They sell everything from food to "reasonably priced Cabernet Sauvignon" to funeral services and concert tickets. They have even served as critical aid stations during earthquakes and other disasters. That's why it's an "open question" whether Japanese officials — despite the new shareholder-friendly rules — would "countenance" ACT's takeover bid for such an "indispensable" company. Said a customer at a Tokyo 7-Eleven: "I do not believe a foreigner could run this particular company."

But other Japanese customers say 7-Eleven could use a fresh infusion of outside energy, said The Washington Post. The chain's quality has "already been declining," one person told the Post. Analysts see a different possibility: Not that ACT will bring North American ways of doing business to Japanese convenience stores, but rather that Japanese practices will filter back to North America. The chain that brings konbini to America, said one analyst, will "be king."

Coming to America

In fact, 7-Eleven is already "on a mission" to bring some of Japan's most-popular food items — fresh sandwiches, fruit and rice balls among them — to some of its American stores, Reuters said. In Virginia, for example, the company is selling chicken curry rice bowls. The konbini strategy has been "enthusiastically received by fans on social media and food-related websites" who are now carefully watching ACT's takeover proposal. "It makes me nervous that they will mess with what I deem perfection," said "food influencer" Jeremy Jacobowitz.

Japan is known for "multi-generation businesses," said Bloomberg. That's a factor in the takeover: The descendants of Masatoshi Ito are, together, the second-largest bloc in 7-11's ownership group. "They may be unwilling to part with their family legacy," said JapanConsuming's Michael Causton. Another factor? "Sampo-yoshi" — the belief that business dealers should benefit "the buyer, the seller and society overall," Gearoid Reidy said at The Japan Times. The future of 7-Eleven could determine whether those old ways still hold sway in Japan.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Companies are increasingly AI washing

Companies are increasingly AI washingThe explainer Imaginary technology is taking jobs

-

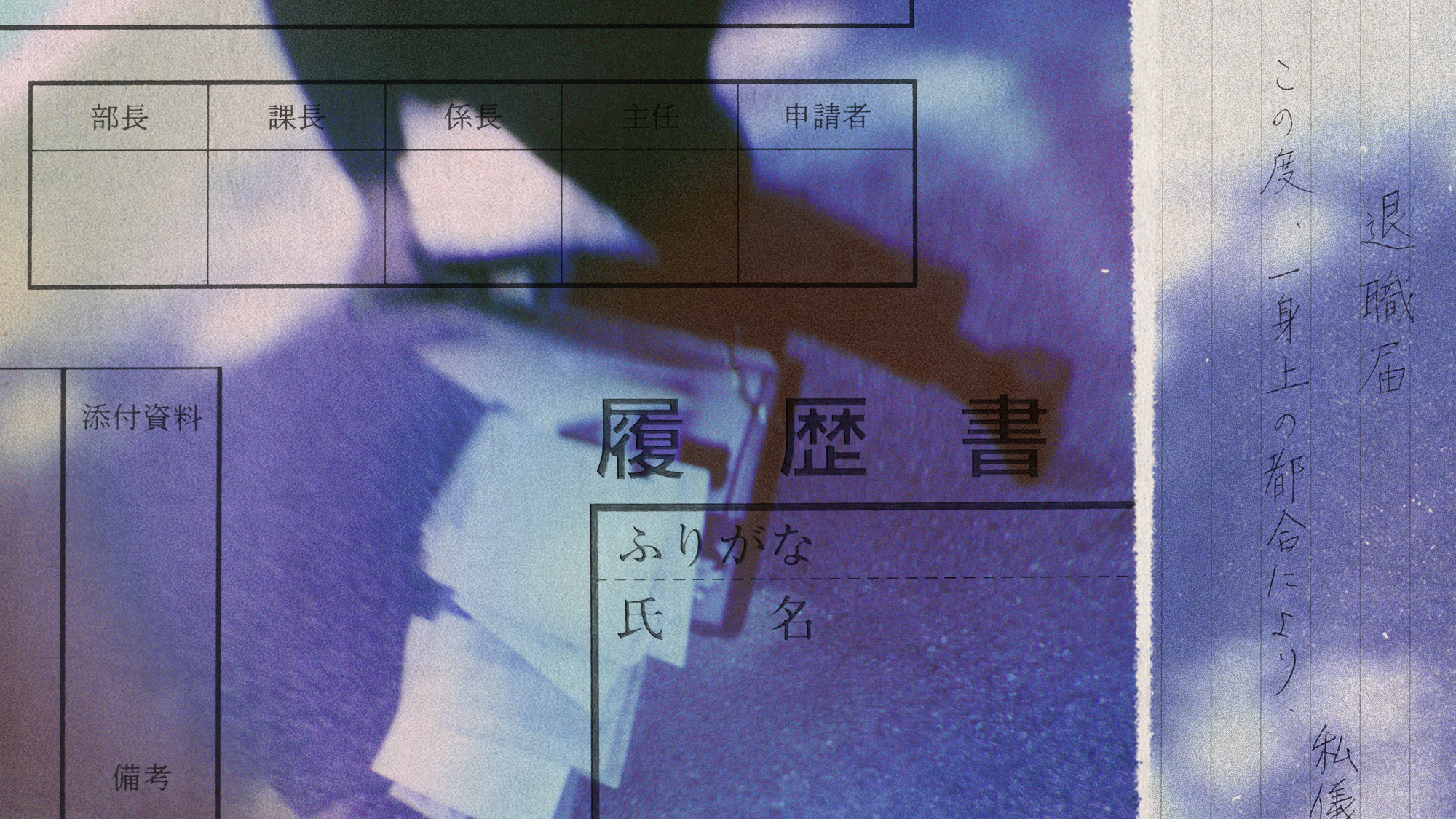

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler

-

How prediction markets have spread to politics

How prediction markets have spread to politicsThe explainer Everything’s a gamble

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will China’s $1 trillion trade surplus change the world economy?

How will China’s $1 trillion trade surplus change the world economy?Today’s Big Question Europe may impose its own tariffs

-

Job hugging: the growing trend of clinging to your job

Job hugging: the growing trend of clinging to your jobIn the Spotlight People are staying in their jobs longer than ever