Cost of living squeeze may be 'overblown'

Bills index compiled by Money Saving Expert suggests core costs are rising in line with wages

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

UK inflation leaps as post-Brexit vote pound slump bites

18 January

Inflation jumped to its highest level since July 2014 last month, as the slump in the pound following the vote for Brexit finally hit.

Consumer prices rose on average by 1.6 per cent year-on-year, says the Office for National Statistics, up from 1.2 per cent in November and above a consensus forecast for a 1.4 per cent increase.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The figures show that the "fall in the pound since the Brexit vote was starting to feed into the economy", said the BBC.

Increasing food prices were a major contributor to the headline rate, an "ominous" sign that "years of falling food prices appear to be coming to an end", added the broadcaster, while the Daily Telegraph said a larger rise in air fares for December than last year and a smaller decline in petrol prices due to a recent oil price recovery were also key factors.

Experts do not believe this to be the end of the inflation story. Manufacturing costs rose by 16 per cent over the year to December, their fastest rise since September 2011.

"Separate producer price inflation figures showed that the price of goods bought from factories rose 2.7 per cent in December compared with a year ago, as manufacturers started to pass on the higher input costs," says the BBC.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It is thought that consumer prices will surge this year, perhaps to as high as three per cent, squeezing real incomes.

In a sign of how higher costs are filtering through to consumers, the Financial Times reports that Apple is hiking prices in its online app store by 25 per cent.

The tech giant said: "Price tiers on the app store are set internationally on the basis of several factors, including currency exchange rates, business practices, taxes and the cost of doing business."

Inflation hits two-year high - and this is 'just the start'

13 December

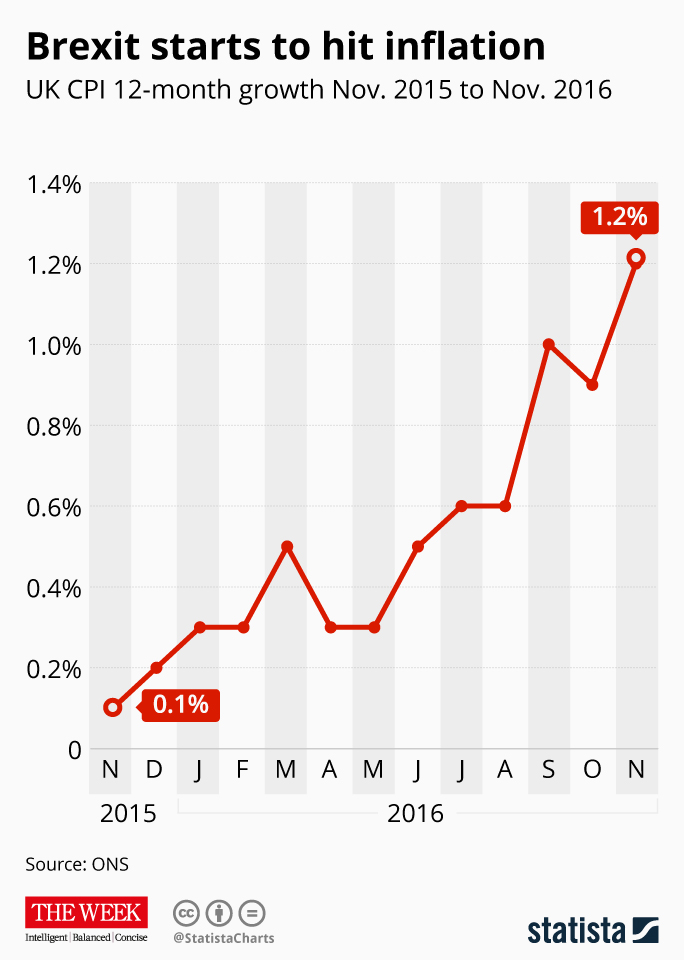

Inflation rose to a more than two-year high in November, an increase one commentator says is "the start of things to come" following the vote for Brexit.

Figures published this morning by the Office for National Statistics show consumer prices increased 1.2 per cent compared to the same month last year. That's the fastest acceleration since October 2014 and ahead of the 1.1 per cent that had been widely expected.

The rise in the headline rate was driven by "higher petrol and diesel costs, and a fall in food price deflation", says The Guardian.

However, adds the paper, it's the underlying data that has caught the eye of some observers, particularly the "core" rate of consumer price inflation, which strips out volatile items such as food and energy prices. It rose to 1.4 per cent, suggesting "underlying price pressures are building".

Further evidence of this is provided by the figures for "output costs" charged by factories, which rose to 2.2 per cent, the fastest rate in four years.

"That may drive inflation higher, once those goods hit the shops," says the Guardian.

Economists have long predicted a rise in inflation as the pound's slump of more than 15 per cent against the dollar since the referendum increases import costs.

The Bank of England's latest forecast is for inflation to peak at 2.8 per cent next year, but some believe it could go as high as three or even four per cent.

With average wage rises currently running at a little above two per cent and rate-setters expected to hold interest rates for fear of upsetting the economy, this implies a squeeze on household finances in the year ahead.

Hannah Maundrell of money.co.uk says: "Household finances have been protected against the backlash of Brexit so far but today's higher than expected figures show it's finally starting to bite.

"This is the start of things to come and next year, we'll be battling rising prices head on.

"This is an important wake-up call and one we should all bear in mind as we head towards the most expensive time of the year. Blow your budget on Christmas now and you could be setting yourself up for a very difficult year ahead."

Infographic by www.statista.com for TheWeek.co.uk.

Mothercare warns prices could rise by up to 5%

November 25

Mothercare has become the latest UK firm to issue warnings of Brexit-related price rises after announcing that costs to consumers could go up by as much as five per cent in six months' time.

The mother and baby retailer says its input costs have risen as a result of the near-one fifth fall in the value of the pound against the dollar, which has driven up the wholesale cost of imported goods.

The store's boss, Mark Newton-Jones, said that Mothercare had been able to avoid price rises up until now because it had hedged against currency movements, but that from May of next year it may have to pass on shop price increases of between three and five per cent, according to the Telegraph.

"After the vote to leave the European Union, the dollar was up by around 18pc," he said. "We came to an agreement with our suppliers and managed to mitigate against around a third of that increase. We'll take some of the rest through costs, but the bulk of the difference will go to customers."

Brexit-related price rises have been in the headlines recently following attempts by Unilever to add around 10 per cent to the cost of goods such as Marmite.

The move proved controversial because Marmite is produced in the UK. The Dutch company was accused of trying to protect its euro-denominated profits.

The same accusation has been levelled at other companies taking similar action, like Nomad Foods (which owns Birdseye) and Pepsi Co (which owns Walkers Crisps). Both firms are based in the US and report in dollars.

Experts are warning that overall inflation in the UK could surge to three per cent or more next year.

Other companies have kept prices unchanged but responded to their rising costs by shrinking the size of their products, as is the case with Toblerone's owner Mondelez.

Mothercare's admission comes on the day the British retailer reported half-year losses of £800,000, compared to a profit of £5.8m for the same period last year. Despite this, the store says its turnaround remains on track.

"Group revenue in the six months to October 8 was flat at £347.7m, compared to £349.9m a year ago." Losses were attributed mostly to restructuring costs of £10.7m.

Like-for-like sales in the UK at stores open for more than one year fell 0.7 per cent. Newton-Jones told the BBC this was the result of "unseasonal weather during spring and summer leading to bigger price cuts in order to shift stock".

Tesco warns suppliers over 'Marmite-gate' price rises

18 November

Tesco has fired a warning shot to suppliers seeking to raise prices in the wake of the pound's tumble since the Brexit vote.

Sterling is down by the best part of a fifth against the dollar, 14 per cent against the euro and even more against some other currencies since the shock EU referendum result in June, a drop in value that reflects concerns over the likely hit to the UK economy.

The devaluation makes it more expensive to import goods, which the Office for National Statistics says is driving up wholesale prices at the fastest rate for four years.

Tesco boss Dave Lewis is not convinced that some of the consumer brands are "justified" in raising their prices, says the BBC. He suggests that in some cases this simply reflects overseas firms trying to protect local currency profit margins.

One consequence of the falling pound is that profits reported by the UK arms of companies based overseas are lower when converted back into their "home" currency, even if the actual money being made from UK customers hasn't changed.

All the companies that have hit the headlines so far in relation to post-Brexit pricing, including Unilever, Birds Eye-owner Nomad Foods, PepsiCo and Toblerone-maker Mondelez, are based outside the UK.

But Lewis, who was previously an executive at Unilever, says that all multi-national businesses present results in both current and "constant" exchange rates.

Constant exchange rates ignore currency movements between periods being compared in order to give a truer reflection of underlying trading and look past volatile currency fluctuations.

Investors "don't devalue the stock because of that," said Lewis, according to the Financial Times.

Tesco recently had a public spat with Unilever over its demand for 10 per cent price rises across its range, including on products like Marmite that are made in the UK. A compromise deal was struck, the details of which have not been disclosed.

Morrisons seemed to swallow the price rises and pass them on, upping the price of Marmite by 12.5 per cent. PepsiCo and Nomad this month increased charges to retailers on Walkers crisps and Birds Eye frozen products by as much as 12 per cent.

Mondelez instead engaged in "shrinkflation", reducing the size of its Toblerone bars by increasing the gaps between the chocolate peaks but keeping the price the same.

Walkers and Birds Eye next to increase prices

7 November

After last month's attempt by Unilever to charge more for Marmite, the spectre of rising costs has spread to crisp lovers and fish-finger fanatics.

Both Walkers and Birds Eye have announced wholesale price rises of as much as 12 per cent, says the BBC.

Walkers has confirmed it is increasing the cost of a 32g bag of crisps from 50p to 55p, while a larger "grab bag" will go up from 75p to 80p. It will be up to retailers to decide whether to pass the cost on to shoppers.

A spokesperson said: "Since we do not set the retail price of our products, it will be for individual retailers to determine the impact on the price at which they sell our products."

It's not clear which Birds Eye products will see the heftiest rises, although The Guardian says the company has threatened to reduce packet sizes without dropping costs if retailers do not agree to the increases.

"Birds Eye is said to be threatening to shrink pack sizes on some products… cutting the number of fish fingers in a packet, for example, from 12 to 10 or from 20 to 18," adds the paper.

Both companies, like Unilever, blame the move on the slump in the value of the pound.

Sterling has dropped by nearly a fifth against the dollar and 15 per cent against the euro since the vote for Brexit on 23 June.

However, also like Unilever, Walkers and Birds Eye are being accused of using this as an opportunity to increase prices, as most production takes place in the UK.

Walkers rejected the criticism and told the BBC that while it makes its crisps in the UK using British potatoes, it imports "seasonings, oil for frying and key raw materials used in its packaging film" and has seen costs surge.

Bird Eye similarly said many of its raw materials were priced in dollars "and the fall in the value of the pound since the EU referendum has meant that our costs in sterling have risen".

Nevertheless, they could be looking to protect profits at parent companies.

Birds Eye's owner Nomad Foods reports its revenues and earnings in euros, while Walkers parent company, PepsiCo, does so in dollars. Consequently, even if profit in the UK arms remained unchanged, it would be worth less on the bottom line.

-

Can Europe regain its digital sovereignty?

Can Europe regain its digital sovereignty?Today’s Big Question EU is trying to reduce reliance on US Big Tech and cloud computing in face of hostile Donald Trump, but lack of comparable alternatives remains a worry

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Magazine printables - February 13, 2026

Magazine printables - February 13, 2026Puzzle and Quizzes Magazine printables - February 13, 2026

-

How your household budget could look in 2026

How your household budget could look in 2026The Explainer The government is trying to balance the nation’s books but energy bills and the cost of food could impact your finances

-

With economic uncertainty, 2025 looks to be a 'No Buy' year

With economic uncertainty, 2025 looks to be a 'No Buy' yearIn the spotlight Consumers are cutting back on splurges to combat overconsumption

-

3 tips to lower your household bills

3 tips to lower your household billsThe Explainer Prices on everything from eggs to auto insurance to rent have increased — but there are ways to make your bills more manageable

-

What's next for US interest rates?

What's next for US interest rates?The Explainer A pause after a series of cuts

-

Where will inflation go next?

Where will inflation go next?The Explainer Believe it or not, inflation is easing up

-

What is shrinkflation and why is it happening?

What is shrinkflation and why is it happening?The Explainer The practice reduces the size of a product without lowering the price — and it's perfectly legal

-

Prices are going down. Here's where you can see the difference.

Prices are going down. Here's where you can see the difference.The Explainer 'An era of price hikes is fading,' but that doesn't mean prices will all come down

-

5 tips when retiring amid market volatility

5 tips when retiring amid market volatilityfeature In a turbulent market, diversification becomes especially important