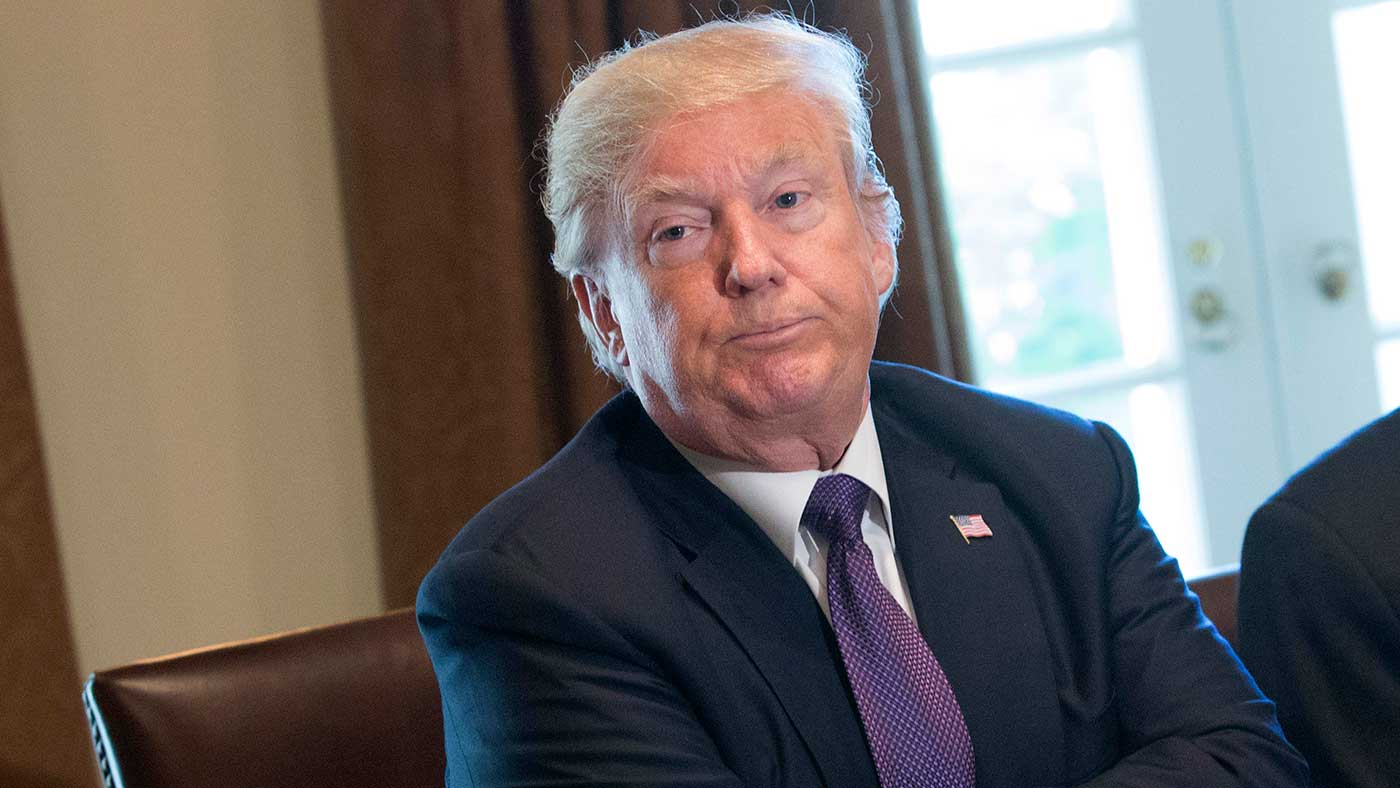

Donald Trump blocks $117bn sale of Qualcomm

Move is designed to stop China from overtaking the US in critical 5G technology

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Donald Trump has prohibited Broadcom, the Singapore-based chipmaker, from completing a takeover of its rival firm Qualcomm, citing security concerns.

The US President revealed in a statement that he has “credible evidence” that suggests the proposed deal, believed to be worth over $117bn (£84bn), “threatens to impair the national security” of the country.

Last week, the Committee on Foreign Investment in the United States (CFIUS) expressed concerns over Broadcom’s relationship with third-party foreign entities, CNN Money reports.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But The Guardian argues the move appears to target the tech industry in China, rather than Broadcom itself.

The Trump administration’s primary concern involves cutting-edge 5G wireless technology, the newspaper says. Allowing a “US semiconductor company” to be bought out by a foreign firm could weaken the country’s influence on the tech industry while strengthening China’s.

Stacy Rasgon, a chip analyst at Bernstein Research, told CNBC: “Given Broadcom’s business practices, the worry is that they will cut investment significantly, particularly in the 5G roadmap”.

This would weaken Qualcomm and the US’s position in the industry, he said, allowing the Chinese tech giant Huawei to “take the lead”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ultimately, the president’s decision to block the takeover indicates the extreme lengths he’s willing to go to “shelter American companies from foreign competition”, the New York Times says.

Had the deal been agreed, it would have been “the biggest technology sector takeover on record”, says BBC News. The planned merger would have also promoted Broadcom from the fourth largest chipmaker in the world to the third, placing it behind Intel and Samsung.