Our Brand Is Crisis, and the West's catastrophic global austerity experiment

Sitting behind America's failure to care for its own citizens is a massively bungled project of exploitation and austerity imposed on the impoverished citizens of the rest of the globe

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

There was a time in the early 2000s when liberals looked at the International Monetary Fund (IMF) and saw a symbol of everything terrible about free-market ideology and Western exploitation of the developing world. The IMF has mostly fallen off the cultural radar since — but a new movie might serve up a reminder of the institution's old infamy.

Our Brand Is Crisis is a sharp political comedy ostensibly based on Bolivia's 2002 presidential election. Now, the film is so heavily fictionalized that it's much more an emotive or thematic pastiche than a historical account. For instance, the possibility that the election will allow the IMF to take over Bolivia's finances looms large in the film's plot, but in reality, the bulk of the institution's involvement in Bolivia occurred before 2002.

Nonetheless, there's an important story worth revisiting here. Not only did craven Western economics impose a heavy toll on poor countries — it came back to bite U.S. workers as well.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

First, a basic macroeconomic refresher: Trade between countries involves manufactured goods and commodities, along with capital income and investments. They don't always all flow in the same direction, but add them all up and you get a country's current account balance.

When it comes to the relationship between rich, developed countries and poor, developing ones, the rich countries should have a positive current account balance and the poor countries should have a negative one. "Capital is supposed to flow from where it's plentiful to where it's scarce," Dean Baker, an economist and director of the Center for Economic and Policy Research, explained to The Week. Rich countries have lots of capital relative to the demand for it, so returns on investment are low. Poor countries don't have a lot of capital relative to demand, so investors "take advantage of high returns on investment."

Poor countries are usually buying consumable goods from rich countries too, since they need to feed and clothe and provide for their populations while developing, but they have very little wealth per person to devote to split between both tasks. Rich countries have wealth in abundance, so they help the poor ones: "They're getting all this stuff to build up their infrastructure, build up their capital stock, while at the same time meeting the consumption needs of their population," Baker continued. "So rich countries would have a trade surplus, and poor countries would have a trade deficit."

This is what happened for much of the 20th century. Then everything reversed.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

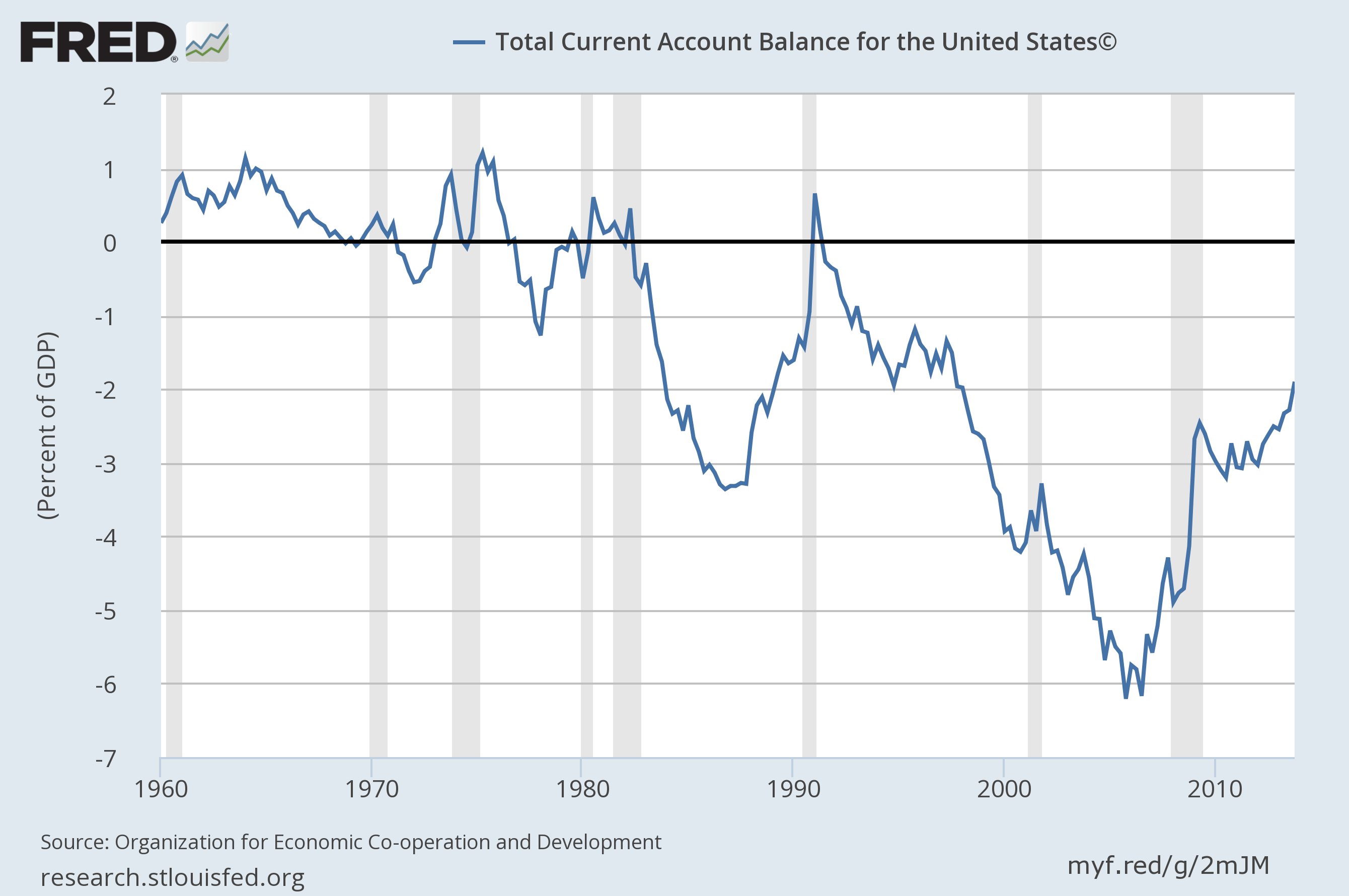

In the 1980s, America's current account balance went negative. Then it went deep negative in the 1990s. It has stayed there ever since.

Even more amazingly, flows of capital specifically reversed. Across Latin America, South and East Asia, and Sub-Saharan Africa, capital started flowing out of developing countries and into the developed West. "The idea of developing countries being net lenders of capital to rich countries goes completely against what the theory's supposed to be," Baker said.

What happened? Well, development is tricky. You can have bubbles in international development — same as any other investment — and then you can get panics. The global elite got overly excited pumping money into poor countries, and then they got way overly excited pulling money out. That kicked off crises and recessions, which were exacerbated by the choice many of these countries made to peg their currencies to the U.S. dollar, effectively preventing their own monetary policy from helping. (It's not that dissimilar from what's happened in Greece or Puerto Rico.) Then, when rich Western investors worried they'd lose their shirts, they called in the IMF.

"In Latin America, you had a lot of debt crises in the 1980s," Baker explained. "That's what gave the IMF its enormous power to set the agenda there."

That IMF agenda was bailouts, but in exchange, countries had to impose austerity, rework their economies, and often pay back most if not all of their debt. In Bolivia specifically, mines, oil and gas reserves, rail, electricity, and even water supplies were all privatized. The water network for Cochabamba, Bolivia's third-largest city, was handed over to a private consortium, including many locally run water co-ops that served the city's poorer outlying districts. In response, violent unrest swept across the country, right up through the 2002 election.

Developing countries reacted to this IMF-fueled disaster by buying up massive amounts of U.S. dollars. They did this, first and foremost, because they needed the currency to pay back their debts, which were denominated in U.S. dollars. But they were also building up massive reserves of U.S. dollars, just to have on hand in case their economies were ever pilfered again. "The amount of reserves they were accumulating just soared," Baker said.

As a result, their currencies plummeted, and the relative value of the U.S. dollar shot up. This process began in Latin America in the 1980s and into the 1990s, then slowly moved east until it culminated in the East Asian crisis in the late 1990s. That helped blow the U.S. trade deficit wide open, as we started importing way more cheap goods.

That shift, in turn, helped decimate U.S. manufacturing, and drive those formerly middle-class American jobs overseas. On top of that, a trade deficit means demand is effectively leaving the economy. So unless the government is willing to run a big enough budget deficit to counteract the effect — and the U.S. government has most certainly not been willing — the result will just be a perpetual lack of sufficient jobs to employ everyone in the country.

And so you end up with our modern American economy. Sitting behind America's loss of middle-class jobs, and its failure to care for its own citizens in the age of globalization, is a massively bungled project of exploitation and austerity imposed on the impoverished citizens of the rest of the globe.

Some things have changed in recent years, but not all that much. Bolivia reversed many of the IMF-imposed policies, and has largely recovered. Opposition to austerity is now much more mainstream in elite economic circles, and even the IMF itself made a modest mea culpa. Nonetheless, the economic slump in Europe and the crisis in Greece are still being handled with the same old economic playbook.

So the people and institutions that caused all the destruction of the 1980s and 1990s remain in power, and they're still making a hash of things. It's the people of Bolivia — and the developing world, and Greece, and working Americans — who paid the price.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy