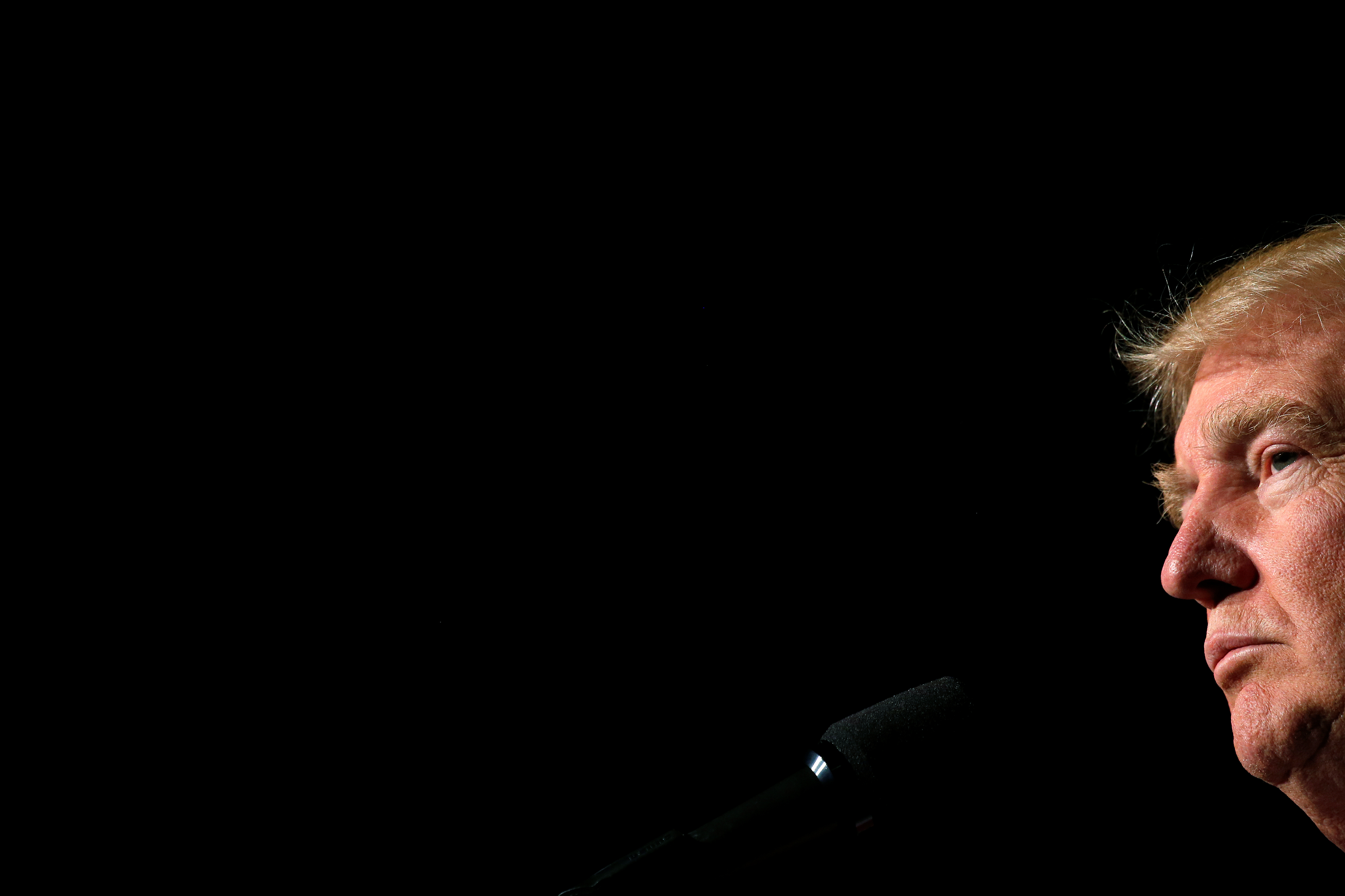

Donald Trump, black swan

I worked on Wall Street in 2008. I should have realized most assumptions about the election were built on sand.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

After voting on Tuesday, I gathered with some friends to watch the returns. To a person, we were expecting — and hoping for — a Hillary Clinton victory.

We came at the election from a variety of perspectives. Some were enthusiastic about Clinton; others were holding their noses to vote for her. Some opposed Donald Trump because he was a Republican; others because he was so different from a typical Republican; still others out of simple fear of such a volatile quantity in a position of power.

That very diversity bolstered our conviction that the night would end with Hillary Clinton elected as the 45th president of the United States. It didn't hurt that a vast army of data crunchers seemed to agree.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

I should have known better.

Before 2009, I worked on Wall Street, where I had a front-row seat for the financial crisis. I watched as a business I'd helped build — and that we thought we had approached with real concern for investor well-being — collapsed in the face of the financial equivalent of a 100-year storm.

It was what former risk analyst Nassim Taleb famously termed a black swan event, a highly improbable disaster that revealed everyone's faulty assumptions. But I can assure you: Everybody I worked with knew, on some level, that such a storm was possible, and more likely than anybody acknowledged. We knew the ways in which credit quality was deteriorating. We knew that the ratings agencies allowed themselves to be arbitraged. We knew that the financial entities that insured the bulk of various banks' portfolios were thinly capitalized, and that their assets were highly correlated with one another. We'd joke about extreme risks out on the tail of the distribution, risks that couldn't really be quantified but that didn't correspond to anything we'd actually observed, saying, "well, if that happens, we're all dead anyway."

We knew, but we didn't want to know. And so we did what we knew how to do — as well and as conscientiously as we knew how to do — and battened down the hatches when we saw the storm brewing. And then watched our business get swamped when the storm hit anyway.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The same is true of the possibility of Donald Trump becoming president. For the political class, the possibility was inadmissible because it meant that all their knowledge was worthless: Anything could happen. For the journalistic class, the possibility was inadmissible because it would mean that their efforts to inform and influence were worthless: They were less trusted than Donald Trump of all people.

Some knew even less than that, but their ignorance was also deliberately chosen. The hedge fund managers in the film The Big Short made a killing betting on the collapse of the mortgage derivative market. How did they decide to place that bet? They read the offering documents. And they went and visited some of the properties that were being mortgaged, and talked to the owners and the lenders. That was all it took. With just a little bit of research, they learned what reams of historical data couldn't tell them — that the market was built on sand.

How many of the pollsters and aggregators and political journalists attempted to measure, in advance, the likely voting propensity of the people who put Donald Trump over the top? Plenty of articles referenced the potential importance of non-college-educated white voters in the Midwest. Who seriously tried to answer the question of whether the various polls' assumptions about that propensity were right?

All of that ignorance, meanwhile, fed the growth of the very risk that ultimately undid the system as a whole. That's the difference between a black swan in zoology and a black swan in finance. Literal black swans exist or don't regardless of whether we look for them. But if you undervalue the risk in the tail of the distribution, you create an incentive to pile up risk there, which drives the probability of that extreme event up and up. And If you don't try to value it at all, then you are surely undervaluing it. And if you don't collect the information that might have told you that the risk out there was increasing, then you'd never know to value it. Similarly, if you don't ever try to turn qualitative pieces about potential Trump voters in western Pennsylvania into quantitative analysis, how will you know the likelihood that the polls will be wrong?

And what about people who just knew in their gut that something was up? How did they fare? Well, I was one of them.

I've spent some time looking back over my commentary on this election cycle. I started with my August 2015 column, "Why not Donald Trump?" that first explored why Trump was different from past flash-in-the-pan outsider GOP contenders. After Trump's primary victory, I explained how the GOP would adapt itself to Trump's leadership by adapting him to their policy priorities. Clearly, I knew GOP voters would mostly come home.

Turning my attention to Hillary Clinton, I wrote a series of columns on how she needed to redefine herself for the general election. More pointed was my warning to Clinton of the risks in focusing on adding unhappy Republicans to her coalition, and that she urgently needed to pitch more of her message at Trump's key constituency of non-college-educated whites if only so she could understand how they were receiving Trump's pitch.

Heck, my last column before the election had three maps of "weird" endings that were possible, and that I hoped didn't happen. Compare the second map — where Trump wins the Electoral College while Clinton wins the popular vote — to what actually happened. They aren't too far apart.

Reading my own stuff, it's clear I knew something like what happened could very plausibly happen, even if I wouldn't have said it was more likely than not.

I still missed it. I didn't want to believe what on some level I knew.

I'm one of those people who was motivated more than anything by simple fear of a quantity as volatile as Trump in a position of such power. In terms of experience and character, Trump is essentially unprecedented. He is a shot far deeper into the dark than we have ever taken as a nation in choosing our leaders.

I have to believe that fear of the unknown is one reason why, knowing all I knew, I went into the voting booth on Tuesday feeling serenely confident in something I didn't know at all.

Noah Millman is a screenwriter and filmmaker, a political columnist and a critic. From 2012 through 2017 he was a senior editor and featured blogger at The American Conservative. His work has also appeared in The New York Times Book Review, Politico, USA Today, The New Republic, The Weekly Standard, Foreign Policy, Modern Age, First Things, and the Jewish Review of Books, among other publications. Noah lives in Brooklyn with his wife and son.