The national debt, explained

The U.S. debt is $20.5 trillion and rising. Should Americans be worried?

The U.S. debt is $20.5 trillion and rising. Should Americans be worried? Here's everything you need to know:

Why does the U.S. owe so much?

Apart from a four-year stretch during the economic boom of the late 1990s, the federal government has run a budget deficit every year since 1970. In 2017, the shortfall was $666 billion. The national debt is now slightly larger than the size of the entire U.S. economy, equal to 106 percent of the country's gross domestic product. Overall, the Congressional Budget Office (CBO) expects the national debt to surpass $30 trillion by 2028, as Medicare and Social Security costs soar to cover aging baby boomers. Outgoing Federal Reserve Chair Janet Yellen has warned that the country's growing debt load could eventually become unsustainable. "It's the type of thing that should keep people awake at night," she told Congress in November.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why is it a problem?

Like any credit card user, the government must pay interest on its debt. For much of the past decade that hasn't been a major problem, because of historically low interest rates. Net interest payments on the debt represented 6.8 percent of the federal budget in 2017, or $276.2 billion, compared with more than 15 percent in the mid-1990s. But with the Fed unwinding its post-recession stimulus campaign, interest rates are expected to rise steadily in the coming years. As a result, the CBO estimates, the cost of servicing the national debt is expected to nearly triple by 2027 — leaving the government paying more on interest payments than on national defense.

Is everyone worried?

No. Economists point out that debt can be used to fund important investments, such as stimulating the economy during a recession or fighting unavoidable wars. The nation's debt is also wildly different from a household's budget, because the government can print its own money and has a theoretically infinite life span to pay off its obligations. Some theorists even argue that deficits and the debt are mostly irrelevant. One emerging school of thought, known as Modern Monetary Theory, argues that inflation is the only obstacle standing in the way of the government creating and spending as much money as it wants. "The national debt is not a national crisis," says economist Stephanie Kelton, a former adviser to Sen. Bernie Sanders. "The fact that 21 percent of all children in the United States live in poverty — that's a crisis."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Who owns the debt?

About three-quarters is held by investors in the form of Treasury securities sold by the government to raise money. The rest is intragovernmental debt that comes from Washington borrowing against government trust funds, such as Social Security and Medicare. Americans own most of the public debt, which means they benefit from the interest paid on it. That includes corporations, state and local governments, and individual investors, many of whom hold Treasury bonds in their retirement funds. Foreign investors own about 30 percent of the nation's total debt, or about $6.3 trillion. America's biggest foreign creditor is China, which holds about 5 percent of the total debt, followed closely by Japan. This could become a problem if the U.S. ever damaged its credit rating, but for now American debt is still considered one of the world's safest assets.

Has the U.S. always been in debt?

President Andrew Jackson briefly paid off the national debt in 1835, partly with proceeds from lands seized from Native American tribes. Otherwise, the U.S. has been in hock for nearly every year of its existence, beginning with the bill for the Revolutionary War. The debt peaked after World War II, ballooning to 119 percent the size of the GDP in 1946, but it swiftly shrank during the postwar economic boom. The debt load bottomed out at about 24 percent of GDP in 1974, and has been rising ever since. But it was after the Great Recession in 2007 that the debt really began to explode. Tax revenues cratered while the government spent heavily trying to stave off economic collapse, including George W. Bush's $700 billion bank bailout, known as TARP, and Barack Obama's $787 billion economic stimulus package.

What can be done to pay it off?

Theoretically, paying down the debt is simply a matter of spending less and collecting more in taxes. But voters don't like spending cuts or tax increases, so politicians who want to be re-elected avoid them. Depending on whether they're in power or out, both Democrats and Republicans are conveniently inconsistent in their views on the debt. During the 2008 presidential campaign, Obama chided Bush for "unpatriotic" deficit spending on the Iraq War and tax cuts, which helped increase the total debt by 101 percent during the Bush years. But Obama increased the debt by 68 percent during his own presidency, arguing that deficit spending was necessary to rescue the economy. Likewise, Republicans who warned that Obama was spending away the country's future have now embraced deficits, arguing that their $1.5 trillion tax plan will pay for itself by generating economic growth — a contention that most economists say is unrealistic. Rep. Mark Walker (R-N.C.) says his party sees the dangers of debt as "a great talking point when you have an administration that's Democrat-led. It's a little different now that Republicans have both houses and the administration."

Other countries' debt

In sheer dollars, the U.S. is the most indebted country in the world, followed by Japan ($11 trillion) and China ($5 trillion). But in relation to the size of its economy, Japan's debt is the biggest in the world by far. Japan's debt is more than 240 percent the size of its economy, with Greece carrying the world's second-largest debt load at 180 percent. By that same measure, the U.S. sits at 12th in the world. Japan's debt-to-GDP ratio is so large because its economic growth has largely stagnated over the past 20 years, beginning with the bursting of a real estate and stock market bubble in 1991. Japan has run deficits since then in hopes of stimulating the economy back into growth. But its economy remains stagnant. Japan spends nearly half its tax revenue on servicing its debt, but so far, the Bank of Japan and Japanese investors have happily continued to buy government bonds. In fact, Japanese traders call betting against these bonds "the widow maker."

-

Which way will Trump go on Iran?

Which way will Trump go on Iran?Today’s Big Question Diplomatic talks set to be held in Turkey on Friday, but failure to reach an agreement could have ‘terrible’ global ramifications

-

High Court action over Cape Verde tourist deaths

High Court action over Cape Verde tourist deathsThe Explainer Holidaymakers sue TUI after gastric illness outbreaks linked to six British deaths

-

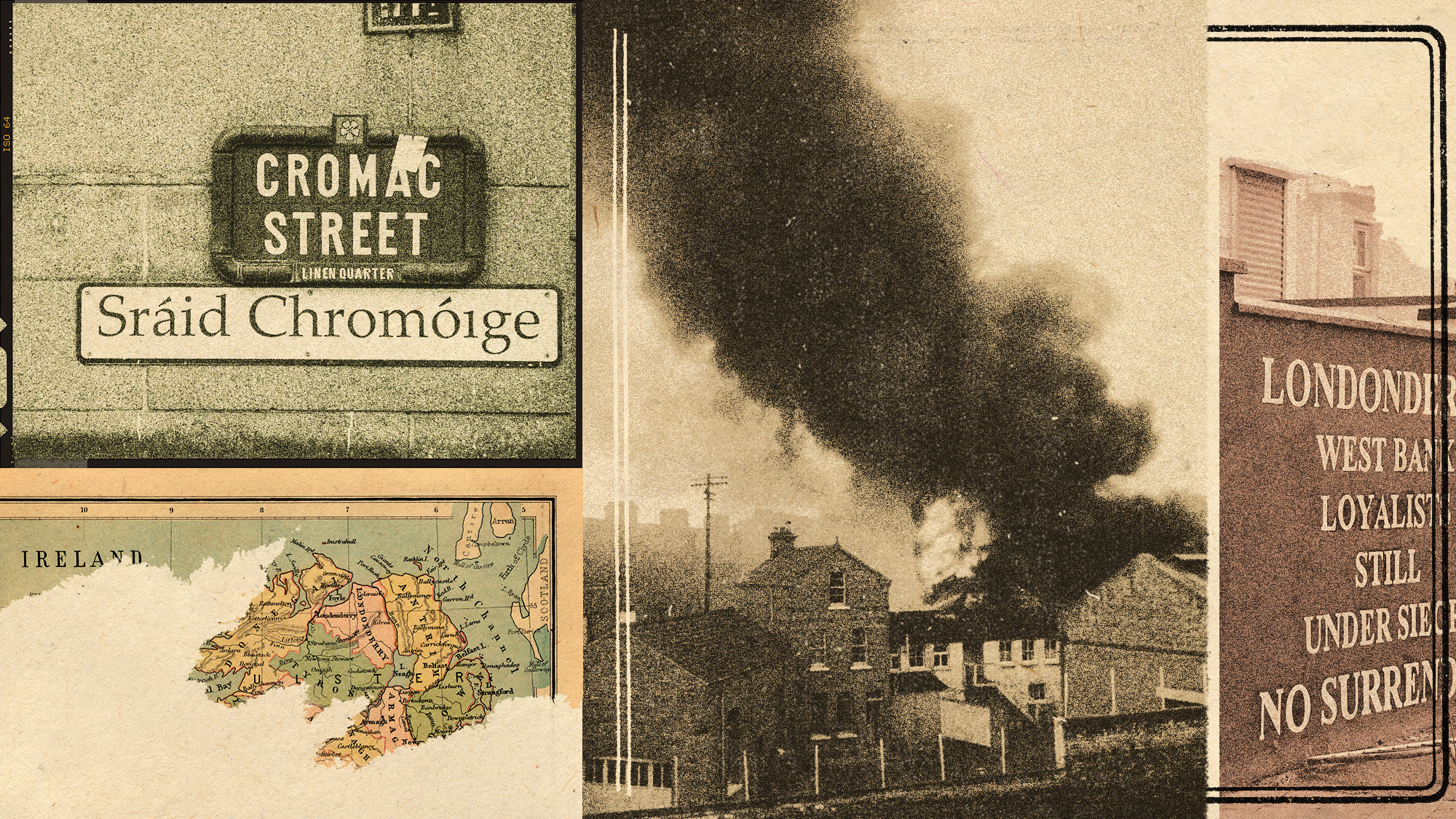

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred