Is a recession coming for Trump? You wish.

Democrats, don't court disaster

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A tumbling stock market is not a recession. A slowing economy is not a recession. And a recession is not a depression. These are all things Democrats and NeverEverTrumpers everywhere should keep in mind as they envision a nasty economic downturn driving President Trump from the White House.

Sure, a headline like "Stock market on pace for worst December since Great Depression" provides a wonderful opportunity for a bit of cathartic dunking on Trump. It was only last October when the president was still touting a higher Dow Jones Industrial Average and S&P 500 as proof Trumponomics was working beautifully. On Oct. 3, Trump tweeted: "The Stock Market just reached an All-Time High during my Administration for the 102nd Time, a presidential record, by far, for less than two years. So much potential as Trade and Military Deals are completed." Since then, the Dow has been down as much as 12 percent.

Of course Trump has a self-serving explanation for the decline. Several, actually. Just a refreshing "pause" after a big run. But maybe it's also pro-Trump investors repulsed by "presidential harassment" from Democrats who hate all the winning. And for sure, Trump argues, the Federal Reserve is badly screwing things up with its "crazy" interest rate hikes. Indeed, on Twitter, Trump has twice attacked the Jerome Powell-led Fed leading up to its December policy meeting, which is likely to result in an announcement today of another rate hike. Or, as Trump calls it, "yet another mistake."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Democrats see things differently. They are already blaming Trumponomics — the budget-busting tax cuts, the tariffs, the undermining of ObamaCare and other deregulation — for the recession or even depression that is surely on its way. Not that they don't make some good points. Tariff Man is generating lots of damaging uncertainty among businesses and investors. Plus hurting China is not the same thing as making America great, not when a bad economy there will hurt profits of U.S. companies here and the global economy more broadly.

Moreover, while the American economy definitely needed fundamental business tax reform — including a sharply lower corporate tax rate — it didn't need one that wasn't paid for. That Republican choice turned tax reform into steroidal fiscal stimulus. An economy running at its potential didn't need that. It only increased the odds of a Fed counteraction to prevent overheating. And whenever the Fed tightens, it risks tightening too much and causing a recession.

Now a recession might well result in a Trump defeat in 2020. A 1980 election-year downturn was the final nail in the Carter presidency. And some models suggest that a 2000 downshift — not even a full-fledged recession — may have been enough to deny Al Gore the Oval Office and Democrats a third straight term controlling the White House. Bad economies are bad news for incumbents.

But just how bad might the economy be, really? Maybe not that bad at all. And maybe in some ways better than it is right now. For starters, the stock market is just one data point. And while others look worrisome — such as initial jobless claims and housing permits — others looks good, including new manufacturing orders and consumer expectations. When Goldman Sachs plugs all of them into its model, the result isn't a recession, much less Great Depression 2.0. From the bank: "Despite signs of slowing, recent economic data has continued to indicate a growing economy with ever-diminishing slack."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

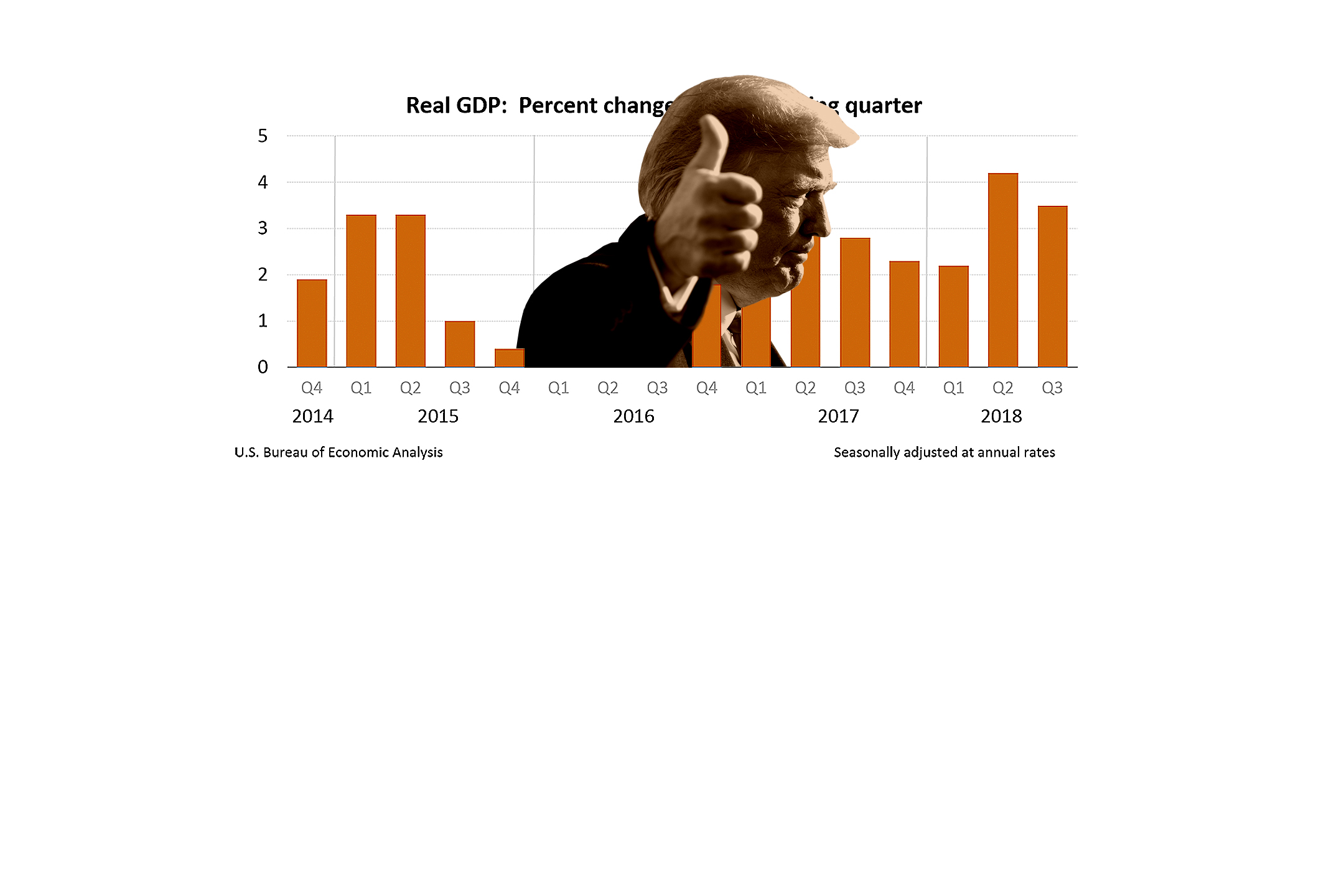

With fewer new workers available and productivity growth only modest, GDP growth may slow even as the unemployment rate falls and wages continue to grow. The fading stimulus and higher rates also play a role. Goldman sees growth slowing from 2.9 percent this year to 2.6 percent in 2019 and 1.6 percent in 2020. But it also sees the jobless rate nearing 3 percent. Same for megabank JPMorgan: slower GDP growth even as unemployment falls and wages rise. Trump may fail in his promise to grow the economy way faster than President Obama, but jobs and wages probably matter more to voters.

Now all of this assumes the Fed is able to pilot the economy to a recession-avoiding "soft landing." Its record doing so is not good. And an escalation in the U.S.-China trade war would also slow growth and generate many unpredictable consequences. But expansions don't die of old age or even necessarily of policy miscues. The Trump White House might be right when it declares there's almost zero chance of a recession next year.

If Democrats want to win in two years, telling voters how bad the Trump economy is when it might be better than the one Obama left them sounds like a losing message.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.