Why Democrats should cut taxes. Yes, cut them.

The rich deserve a tax hike. But everyone else needs a tax cut.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Democrats are very keen to hike taxes on the rich. Rep. Alexandria Ocasio-Cortez (D-N.Y.) wants to tax incomes over $10 million at 70 percent. Sen. Elizabeth Warren (D-Mass.) is pushing a new wealth tax. Sen. Bernie Sanders (I-Vt.) has a new bill to dramatically hike the estate tax.

These ideas are all overdue. But Democrats should consider breaking new ground in another direction, too: Cutting taxes for everyone else.

The political appeal of reducing taxes for most non-wealthy Americans should be obvious. But there's also an important economic rationale for doing it: By any reasonable measure of how jobs and wages are performing, taxes on the poor, the working class and the middle class are too high. More to the point, they've been too high for decades.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Here's how the theory works: Federal spending adds to aggregate demand in the economy, while taxes take aggregate demand out. If there's too much aggregate demand, inflation takes off and interest rates rise to choke off further growth. But if there's too little aggregate demand, the economy is undercooked: Unemployment is chronically high, wages for most workers stagnate, and inequality rises as the wealthy gobble up whatever growth is actually occurring.

Now, there's a good argument the U.S. hasn't been at genuinely full capacity since World War II. At a minimum, we were much closer to full capacity in the 20 or so years immediately after the war than we have been over the last 40 years. Even now, with unemployment at multi-decade lows, wage growth remains sluggish, and inflation and interest rates are about as low as they've ever been.

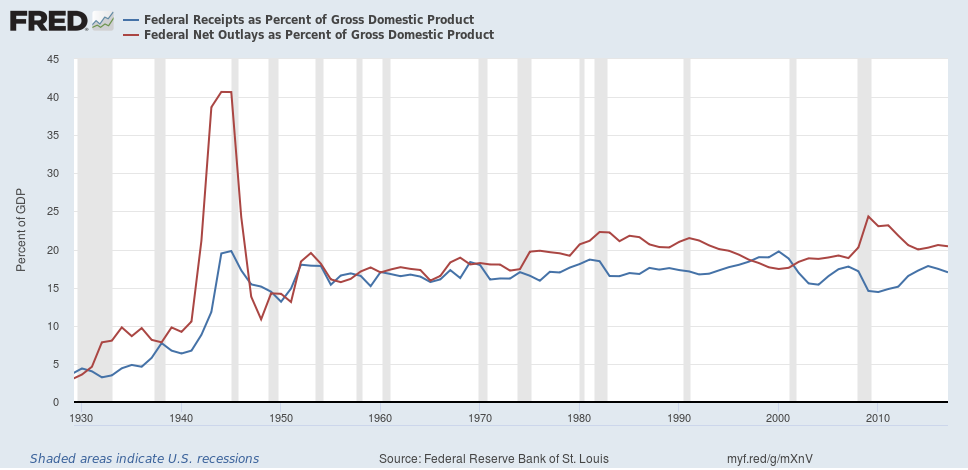

What's remarkable is that, over the course of this long post-war decay, how much demand the federal government was adding or subtracting from the economy didn't change all that much. Federal spending (the red line below) and tax revenue (the blue line) both stayed relatively stable and close together as a percentage of GDP from 1950 on.

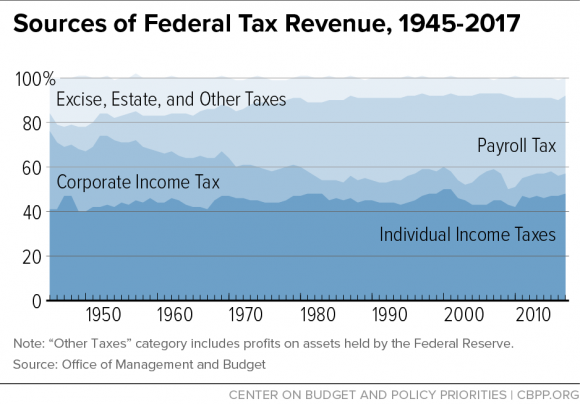

What did change was the makeup of tax revenue. The corporate income tax, capital gains taxes, and the estate tax — all of which concentrate their fire on the wealthy — were dramatically reduced over the last few decades. Meanwhile, payroll taxes exploded from around 10 percent of all federal tax revenue to around 35 percent today. And since payroll taxes are applied at a flat rate (and they cut off for higher incomes) they're regressive rather than progressive; the burden of paying them falls harder on the poor and the middle class than on the rich.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The one complication here is income taxes. As a portion of overall tax receipts, they haven't changed much. But the rich actually pay a bigger portion of income taxes today than they did a few decades ago. Partially, that's because we've introduced a lot more carve-outs for lower-income Americans into the tax code. But it's also because inequality has gotten much worse: The rich contribute more to income tax revenues because they make a lot more money than they used to.

At any rate, whatever relief less fortunate Americans got from the income tax, regressive payroll taxes have flooded into the breach.

Finally, when it comes to their effect on aggregate demand, not all taxes are created equal. Giving an extra dollar to a poor or middle-class person — or taking one away from them — will have a much bigger impact on their consumption than giving a dollar to or taking one from a rich person. Thus, taxes on Americans of lesser means have a bigger impact on aggregate demand.

In other words, given government spending levels, America should actually cut taxes dramatically if it wants to get back to something like the post-World War II economy. And those tax cuts should focus on the bottom two-thirds of households, and especially the bottom third. Roughly 45 percent of filers already pay no income tax, thanks to all the aforementioned carve-outs, so this will effectively mean slashing payroll taxes. The best scenario would be to just get rid of payroll taxes entirely and fold their fiscal role into the income tax.

Meanwhile, if Democrats intend to dramatically hike taxes on the wealthy (and they should, though more for reasons of justice than budget necessity), that's a reason to cut taxes for lower-income Americans even more. Taxes on the wealthy constrain aggregate demand less than taxes on the poor, but they do reduce it somewhat. And our goal here is to increase aggregate demand.

Now, another option would be to spend a lot more instead.

Given all the talk about Medicare-for-all and a job guarantee and a Green New Deal, Democrats may very well do just that if they retake power in 2020. This leads to the argument that they should embrace higher taxes as a political strategy, rather than indulge the "traditional American anti-tax phobia," as my colleague Ryan Cooper put it.

I'm sympathetic, but they should also ask why U.S. politics became so poisonous towards taxes in the first place.

From a macroeconomic perspective, most Americans really have been taxed too much for decades, even as they've endured sluggish growth and stagnant wages. That probably has a lot to do with it! Furthermore, consider how Americans' attitudes towards taxes might change if full employment were a regular and reliable occurrence, as opposed to a memory from a bygone era.

Democrats need to do two things at once. Yes, they should push for a much more generous welfare state and much bigger public investment. But they should also reset the tax system and return to something consistent with maximum economic capacity.

In the words of their nemesis, Democrats need to cut, cut, cut.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

A dreamy long weekend on the Amalfi Coast

A dreamy long weekend on the Amalfi CoastThe Week Recommends History, pasta, scenic views – this sun-drenched stretch of Italy’s southern coast has it all

-

Can foster care overhaul stop ‘exodus’ of carers?

Can foster care overhaul stop ‘exodus’ of carers?Today’s Big Question Government announces plans to modernise ‘broken’ system and recruit more carers, but fostering remains unevenly paid and highly stressful

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred