Let's have open borders for people and closed borders for capital

The question isn't whether borders should be enforced, it's what they should be enforced against

"If you don't have borders, you don't have a country." President Trump and his many acolytes have asserted some version of this axiom countless times.

Coming from them, of course, it's a defense of the White House's vicious treatment of people coming into the U.S. simply to find a better life. But human beings aren't the only things that cross borders: goods, services, and financial capital do it all the time as well. A better response to Trump might not be to debate whether borders should be enforced, but rather enforced against what?

Specifically, the left-progressive position on borders should be something like: maximum enforcement against the movement of financial capital, moderate enforcement against goods and services, and minimal enforcement against people.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Let's start with financial capital, since its movement is arguably the most consequential and the least politically contested. Indeed, financial capital's freedom to move as it wishes in the modern global order is taken as a given: That business owners can liquefy a factory in Mississippi, for example, lay off the workers there, then plunk the money back down to open another factory halfway around the world in Vietnam, is treated as a sort of reality of nature — as inevitable as gravity. But it's not; it's a policy choice.

Capital controls, for instance, are taxes and regulations, meant to prevent — or at least slow down — people moving money either into or out of a country. For much of the 20th century, capital controls were commonplace across the globe. They were mostly used by poorer and developing nations, which can get yanked around by flows of private investment in and out of their borders. But they can also be used by wealthier and more developed countries to keep financial capital constrained and forced into investments within their own borders. China, for instance, still makes regular use of capital controls as part of its broader macroeconomic planning.

Starting in the 1980s, U.S.-backed international institutions pushed for and got the deconstruction of capital controls across most of the globe. In fact, the explicit ideological justification for this was that individual nations and communities should live in fear that wealthy capital owners could pull up stakes at any moment; it would make them more productive. But if the purpose of borders is to protect the cohesion and health of the social fabric, then arguably the most important thing borders should prevent is capital owners' freedom to dissolve, in the name of profits, the jobs and economic activity upon which Americans' communal life together depends.

Capital controls aren't the only possible solution to this problem. Ultimately, the problem of financial capital is the problem of who owns that capital — and thus decides where it goes. Sen. Elizabeth Warren (D-Mass.), for example, already has a bill that would give workers at a corporation the power to elect 40 percent of the board, and Sen. Bernie Sanders (I-Vt.) is working on a plan that would force companies to contribute some portion of their voting shares to funds controlled by workers. These are steps towards the overall goal of putting ownership rights over firms in the hands of the workers who actually give productive life to that capital.

What of international trade and competition? That's trickier. On the one hand, trade between countries really can be a win-win, providing one side with jobs and the other with a higher standard of living. But elite capitalists' tendency to invoke this (potential) reality most often serves as cover for their desire to construct global supply chains that maximally exploit natural resources and labor populations while serving nothing other than their own profits. Meanwhile, even if a company were 100-percent worker-owned, it could still get knocked out by competition from abroad, decimating livelihoods and towns and communities along the way.

Liberals and progressives should not favor hard nationalist barriers, necessarily; but judicious and pro-active management of trade flows in goods and services.

Tariffs can play a role here, protecting particularly important or vulnerable industries from being undercut. But we must also recognize that tariffs are often a poor and ineffective tool for balancing trade flows in the aggregate. Better to manage currency policy and relative currency values between nations, to keep the overall movement of goods and services as balanced as possible. This too will require regulating and managing the movement of financial capital, since its international flows mirror those of goods and services as a matter of basic accounting identities. Once again, Warren is hammering out the initial contours of a plan on this front.

Of course, so long as the U.S. dollar remains the world's currency of choice for foreign exchange and reserves, it's unlikely we'll ever get out of a trade deficit with the rest of the globe. But the jobs lost to trade deficits inherently open up the room — both in terms of finance and real resources available — for public investment to step into the breach. There are any number of practical paths we could use here: A national system of public banks could provide credit to both help firms and industry withstand international competition, or step in to a particularly community when competition has eliminated its previous employment. Federal subsidies could do the same. We should increase public hiring, vastly expand federal grant programs for community and business development, pour resources into government research and development, and even set up a national job guarantee.

Our purpose here should not be to freeze every industry in every city, or every factory in every town, into permanent stasis. Rather, it should be to ensure that when change does come, it comes on the terms of the people and communities who must live the change. And when creative destruction does happen in a particular place, new jobs and resources always stand ready to flood into that same place.

All of which brings us, finally, to immigration.

Racism is a real force in American history, both at the individual and social level. And the notion that a nation that does not impose borders on people specifically cannot "really" be a nation is based on a brittle, hostile, inward-looking cultism — the implicit belief that a community ceases to be a community the second it takes in people who do not look, speak, or think a particular way.

Yet there is also this: Americans are not wrong to feel displaced and disenfranchised; they are not wrong to feel their communities are fraying and dissolving, and the bonds that tie their neighbors and families and churches and towns together are coming apart at the seams. They are not even wrong to feel, at some vague instinctive level, that the refusal to enforce borders is somehow the cause of this rot. But it is the cross-border dance of the world's wealthiest and most powerful people, rather than its dispossessed, that is at fault.

Capitalists' power and profits depend, first and foremost, on their freedom to move their financial resources across the world, to continuously reconstitute trade flows and supply chains as they see fit — no matter who or what is destroyed or cast aside in the process. The point of free movement in financial capital, and free flows of trade, is to give the capitalists precisely that unchecked power.

It isn't that elites never want to "import cheap labor," as the right-wingers accuse. It is that such "importation" is most useful as a convenient afterthought, and political ploy: It is wealthy elites' absolute power over the course and makeup of economic production that destroys places and lives, and then it is immigrants who take the blame for the blight.

More to the point, every flesh-and-blood person who comes to our country brings with them the intrinsic need for food, shelter, services, and everything else out of which jobs are made. There is no inherent reason why the supply of labor in America should ever outpace the demand for it, no matter how many people cross our borders. If it does, that is a choice by policymakers. And it was a choice made to benefit the elite captains of global finance capitalism — to ensure that no part of the American economy can live and flourish if it does not serve their profits.

"Keep, ancient lands, your storied pomp," as it says on the Statue of Liberty. "Give me your tired, your poor, your huddled masses yearning to breathe free, the wretched refuse of your teeming shore." Put bluntly, the United States is — or at least should be — the sanctuary for the world’s riff raff: The place where all those run over by global capitalism, tossed aside by wealth owners, and exploited by barons of industry can come, and enter into freedom and power.

American borders for capital? Yes. American borders for trade? To an extent. American borders for people? No.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

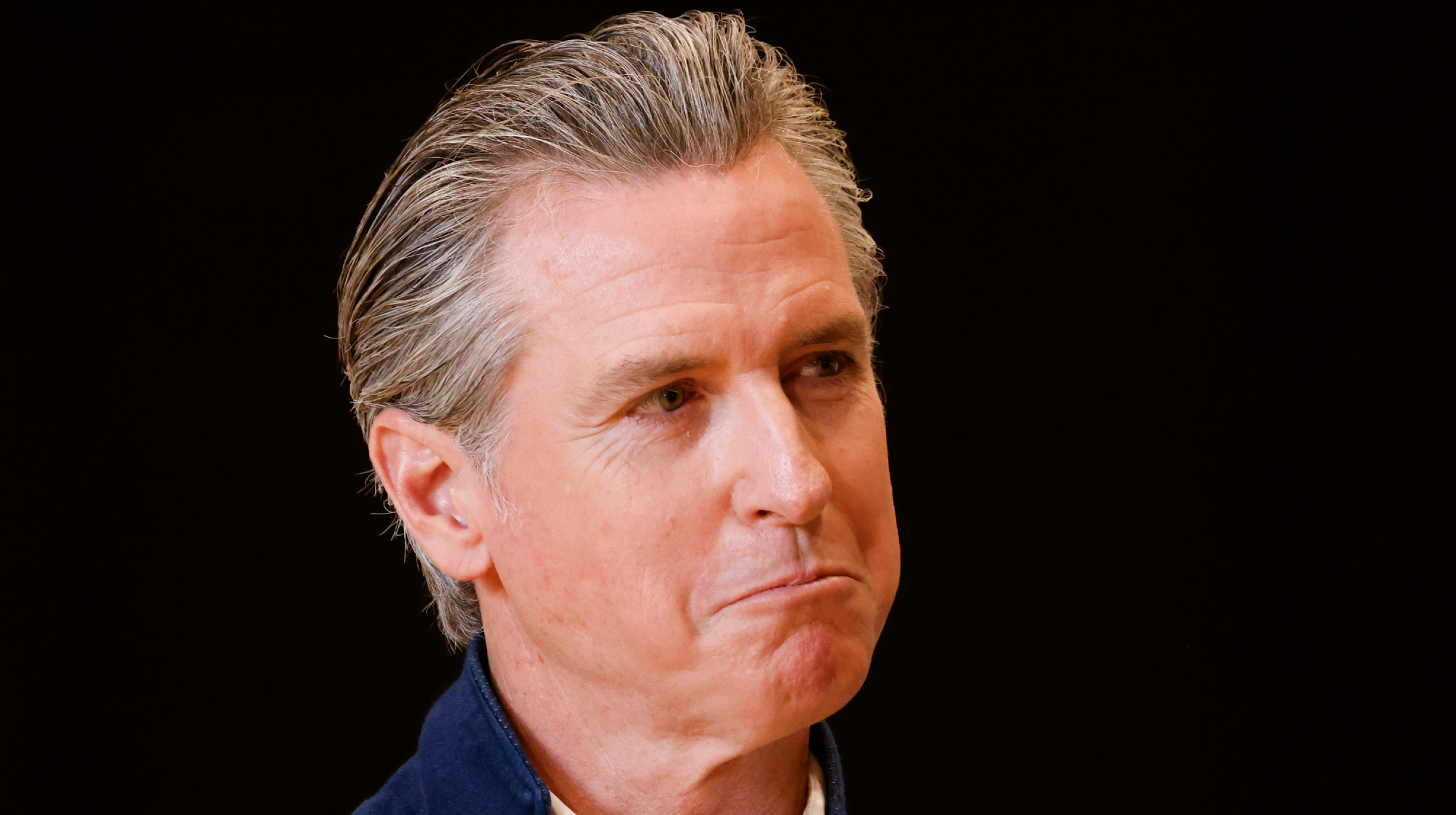

Gavin Newsom mulls California redistricting to counter Texas gerrymandering

Gavin Newsom mulls California redistricting to counter Texas gerrymanderingTALKING POINTS A controversial plan has become a major flashpoint among Democrats struggling for traction in the Trump era

-

6 perfect gifts for travel lovers

6 perfect gifts for travel loversThe Week Recommends The best trip is the one that lives on and on

-

How can you get the maximum Social Security retirement benefit?

How can you get the maximum Social Security retirement benefit?the explainer These steps can help boost the Social Security amount you receive

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

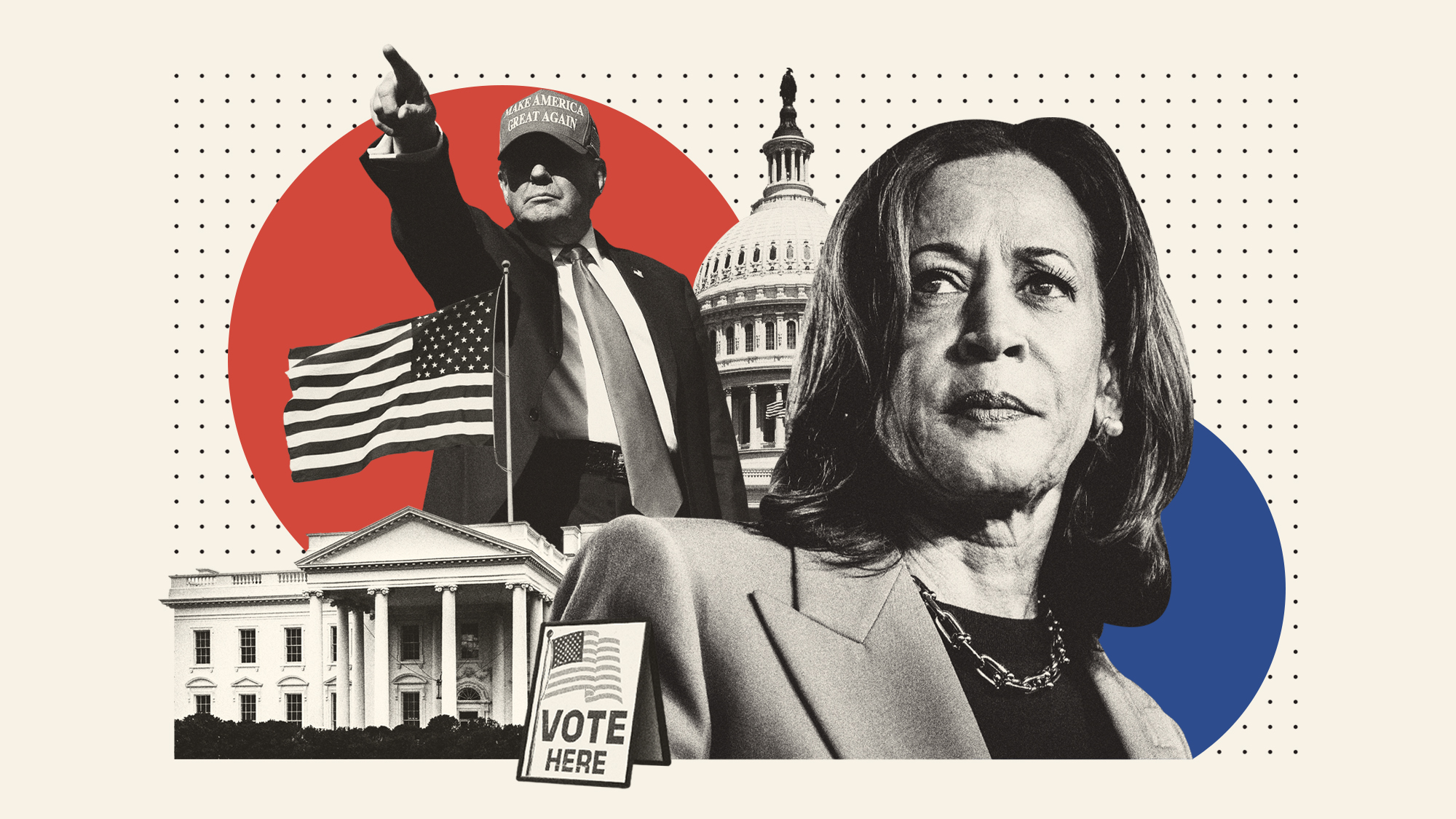

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?