The rotten center of the infrastructure debate

Democratic moderates want to put tax cuts for the rich before the climate

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Biden's pandemic rescue package money is going out, and the Democratic Party is turning its attention to its next package of legislation. This is reportedly going to be a big package of mostly infrastructure, costing something like $4 trillion over a decade, counterbalanced by $3.5 trillion in tax hikes on the wealthy — aiming "to confront global climate change, rebuild the nation's infrastructure, revive domestic manufacturing, and transform U.S. child care, among other goals," reports Jeff Stein at The Washington Post. Moderates like Sen. Joe Manchin (D-W.V.) have been signaling for weeks now that they consider the tax hikes to be an essential part of any package in order to avoid borrowing too much.

But now other moderates are already starting to fuss over the scale of the proposal, and particularly the tax hikes. Rep. Scott Peters (D-Calif.) told Axios that increasing the headline corporate tax rate from 21 percent to 28 percent was too much, and instead it should be only 25 percent. Reps. Josh Gottheimer (D-N.J.) and Rep. Tom Suozzi (D-N.Y.) not only fretted about tax hikes, but also demanded a big tax cut for the rich — namely, the restoration of the federal deduction for state and local taxes (or SALT), which was capped in the Trump tax cuts. "No SALT, no dice," said Gottheimer. (Senate Majority Leader Chuck Schumer has been asking for this as well for years.)

In short, Democratic moderates are holding climate policy hostage to get a tax cut for the rich.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The SALT deduction is a good window into the politics of Democratic moderates in blue states. The SALT cap stipulates that tax filers can now only deduct $10,000 in state and local tax payments from their income for the purposes of federal tax liability. For instance, if you live in New York City, you used to be able to write off whatever you paid in taxes to the state and city governments, thus reducing your federal taxable income and your tax bill, but after the Trump tax cut in 2017, now you can only write off 10 grand.

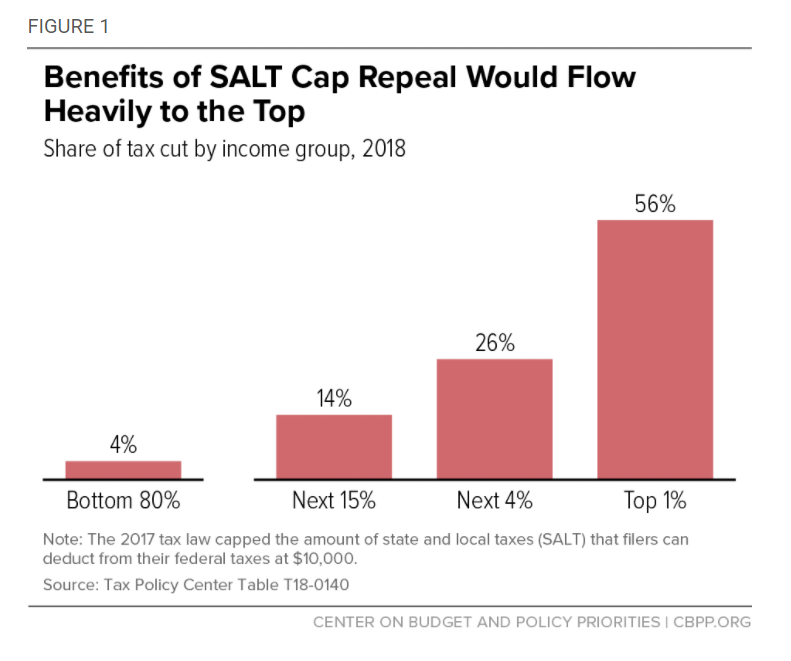

The deduction is effectively a roundabout subsidy of high-tax blue states (because it lessens the burden of paying their often higher taxes), and capping it was a gleeful Republican finger into the eye of places like Maryland, New York, and California. But the benefits of removing the cap would be extraordinarily regressive. It would cost about $357 billion over just five years, and according to the Center on Budget and Policy Priorities, over half of that money would be collected by the top 1 percent. Meanwhile, the bottom four-fifths of Americans would get basically nothing:

There are a number of lessons to be learned here. First, we see who moderate Democrats really respond to — namely, their local donor class of wealthy and upper-middle-class liberals. There are a modest number of arguably middle-class people affected by the SALT cap, but even in New Jersey and New York the vast majority of people hit by this are very comfortable or better. Moreover, if Democrats wanted to throw a bone to union pipefitters in Long Island (or whoever) paying huge property tax bills thanks to old homes that have appreciated a lot, they could easily just increase the cap a bit so the top one percent doesn't get the lion's share of the benefit. But Gottheimer and Suozzi want to remove the cap entirely, because that's what local oligarchs want.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

We also see that these moderates are not at all serious about making sure this infrastructure bill is paid for. Here we are in a debate that started with them supposedly fretting about the budget deficit, but — just like Paul Ryan used to do — their first demand is a huge tax cut mainly for the stinking rich. It makes for a curious contrast indeed with how many of these same people demanded that the coronavirus relief checks be cut down for people making over $75,000 because they didn't "need" them.

Finally, we see once again how moderates don't have a coherent set of policy beliefs. Aside from being a cat's paw for the donor class, they are just expressing the classic moderate neurosis where they nip away at whatever Biden proposes so they can say they scored a win over the left wing of the party (namely, making the bill worse for no reason). Peters did not even pretend to argue why 25 percent would be "the right spot," because he probably just picked a number roughly halfway between current law and what Biden suggested.

That shows the wisdom of Biden aiming high. He would be smart to include a few utopian goodies that he is willing to trade away, otherwise people like Gottheimer and Peters are liable to cut into the meat of the bill doing their silly routine. For instance, if Biden started by proposing a corporate tax rate of 40 percent and a top marginal income tax rate of 50 percent, he might get the 28 percent and 39.6 percent respective rates that he actually wants, once moderates extract their pound of flesh.

Perhaps moderates can be bought off with some combination of earmarks and an increase in the SALT cap. Or perhaps they will bring down the whole thing and end up losing all their seats in 2022, as their Blue Dog predecessors did in 2010. Given how thin the Democratic margins are in both the House and Senate, it is their decision.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred