Brexit vote one year on: The winners and losers

Steep fall in the pound and a general sense of uncertainty have driven business trends

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Today is the first anniversary of the vote for Brexit - the day former Ukip leader Nigel Farage named: "Independence day."

But the UK has not left EU yet. In fact, it only began the formal process of negotiating its departure this week.

That doesn't mean businesses and the economy are not showing the profound effects of the referendum result: indeed, there is a stark divide in how people and companies have fared in the past 12 months.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Broker Hargreaves Lansdown said the most notable driving force is the 15 per cent slump in the pound since the Brexit result, says The Guardian.

Added to that is the general sense of uncertainty over what the future holds, which has begun to filter down into noticeable economic trends.

So, who are the Brexit winners and losers so far?

Winners

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Those who have done well out in the past 12 months are those in a position to benefit directly or indirectly from the slump in the pound.

Britain's tourism sector is one example, with record numbers of visitors coming to the UK earlier this year, says the Guardian. With the pound worth less, flights, hotels and spending money is cheaper for overseas tourists.

More Brits are also likely to be staying at home for their holiday, as the cost of travelling and spending time abroad has conversely risen.

Manufacturers have had a "double benefit", Martin Beck of Oxford Economics told the BBC. Exports orders are up due to costs for overseas buyers falling, while trade with the single market, the UK's main export market, remains tariff-free.

Britain's manufacturing order book is stronger than at any time since 1988, City AM reports.

Then there are firms which are listed on the UK stock market and so report earnings in pounds, but make the majority of their money overseas. Their businesses have been unaffected, but reported earnings have been inflated.

Hargreaves Lansdown says the biggest gainers on the UK benchmark index in the past year all conform to this model, comprising miners Glencore and Antofagasta, drinks firm Coca-Cola, investor group 3i and global hotels giant Intercontinental.

Investors in the FTSE 100 have therefore benefitted from its 23 per cent advance overall in the past year.

However, much of this effect has been due to the pound's fall and for dollar investors, the FTSE 100 is barely changed from its level on 23 June 2016.

Losers

Sterling's decline also has ill-effects.

Holidaymakers who have already booked a foreign trip or who don't have the option of changing to a "staycation", because they have family overseas, for example, will find their visits have become much more expensive.

This has a knock-on effect for the likes of easyjet and Ryanair, which have reported profits falling this year, including because of the negative currency effect, says the Daily Telegraph.

Then there are the UK-based businesses which are having to import goods at a greater expense since the pound's fall and rely on UK consumer spending, which is being affected by that same inflationary effect.

This has hit companies such as Dixons Carphone, which owns Carphone Warehouse and Currys PC World. Its share price has fallen 30 per cent in the past year, costing it a place in the FTSE 100 of the UK's most valuable listed companies.

Clothing retailer Next has also taken a hefty blow, as has Premier Foods, the maker of Mr Kipling cakes, which has struggled with a major rise in input costs.

That inflationary surge - consumer price rises are now running at an annual rate of close to three per cent - is also hurting household income more widely. Wage growth is slowing amid economic uncertainty and real wages after inflation are in decline.

The ripple-effect of that uncertainty is perhaps most notable in the property market, where Brexit has exacerbated a decline in transactions and house price growth has eased significantly.

Housebuilders initially led the Brexit-related market losses but have recovered more recently. However, estate agents dependent on activity levels remaining high have not enjoyed a similar bounce back, with London-focused Foxtons down 43 per cent.

What is the net effect?

Economically speaking, the results of the Brexit vote has been a mixed bag but overall, the UK has defied some of the gloomier forecasts.

However, economic growth is slowing and economists are almost unanimously predicting that expansion will be slower than it would otherwise have been in the years ahead - and could be so for decades to come.

Investors who picked the winners will have done well from the upheaval on markets and as markets are generally higher, even passive investors will have gained.

Nevertheless, on average, most British workers are experiencing a fall in real wages which will hit the poorest most.

In that respect and given the weakened economic prospects for the near future, by most measures it is hard to see the last year as anything but a net loss.

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

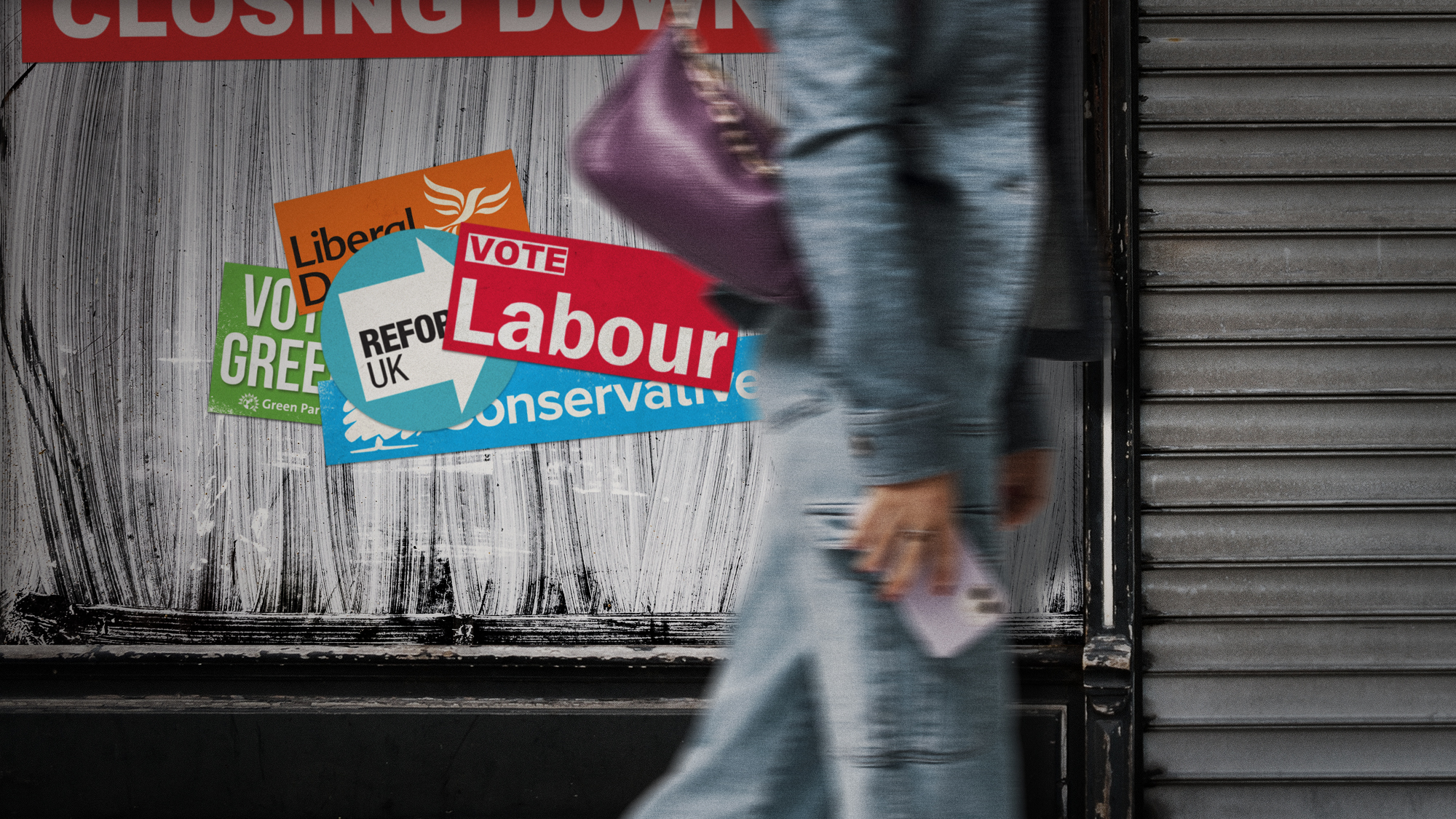

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Biggest political break-ups and make-ups of 2025

Biggest political break-ups and make-ups of 2025The Explainer From Trump and Musk to the UK and the EU, Christmas wouldn’t be Christmas without a round-up of the year’s relationship drama

-

‘The menu’s other highlights smack of the surreal’

‘The menu’s other highlights smack of the surreal’Instant Opinion Opinion, comment and editorials of the day

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

Taking the low road: why the SNP is still standing strong

Taking the low road: why the SNP is still standing strongTalking Point Party is on track for a fifth consecutive victory in May’s Holyrood election, despite controversies and plummeting support

-

Is Britain turning into ‘Trump’s America’?

Is Britain turning into ‘Trump’s America’?Today’s Big Question Direction of UK politics reflects influence and funding from across the pond

-

What difference will the 'historic' UK-Germany treaty make?

What difference will the 'historic' UK-Germany treaty make?Today's Big Question Europe's two biggest economies sign first treaty since WWII, underscoring 'triangle alliance' with France amid growing Russian threat and US distance