The daily business briefing: November 10, 2022

Tesla shares plunge after Musk's latest share sale, Redfin closes its home-flipping unit, and more

- 1. Tesla shares fall to lowest level in 2 years after Musk sells more shares

- 2. Redfin shuts down house-flipping unit as housing market struggles

- 3. French company faces investigation over labor conditions at Qatar World Cup projects

- 4. Stock futures rise ahead of inflation data

- 5. China lockdown affects 5 million in export-hub Guangzhou

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

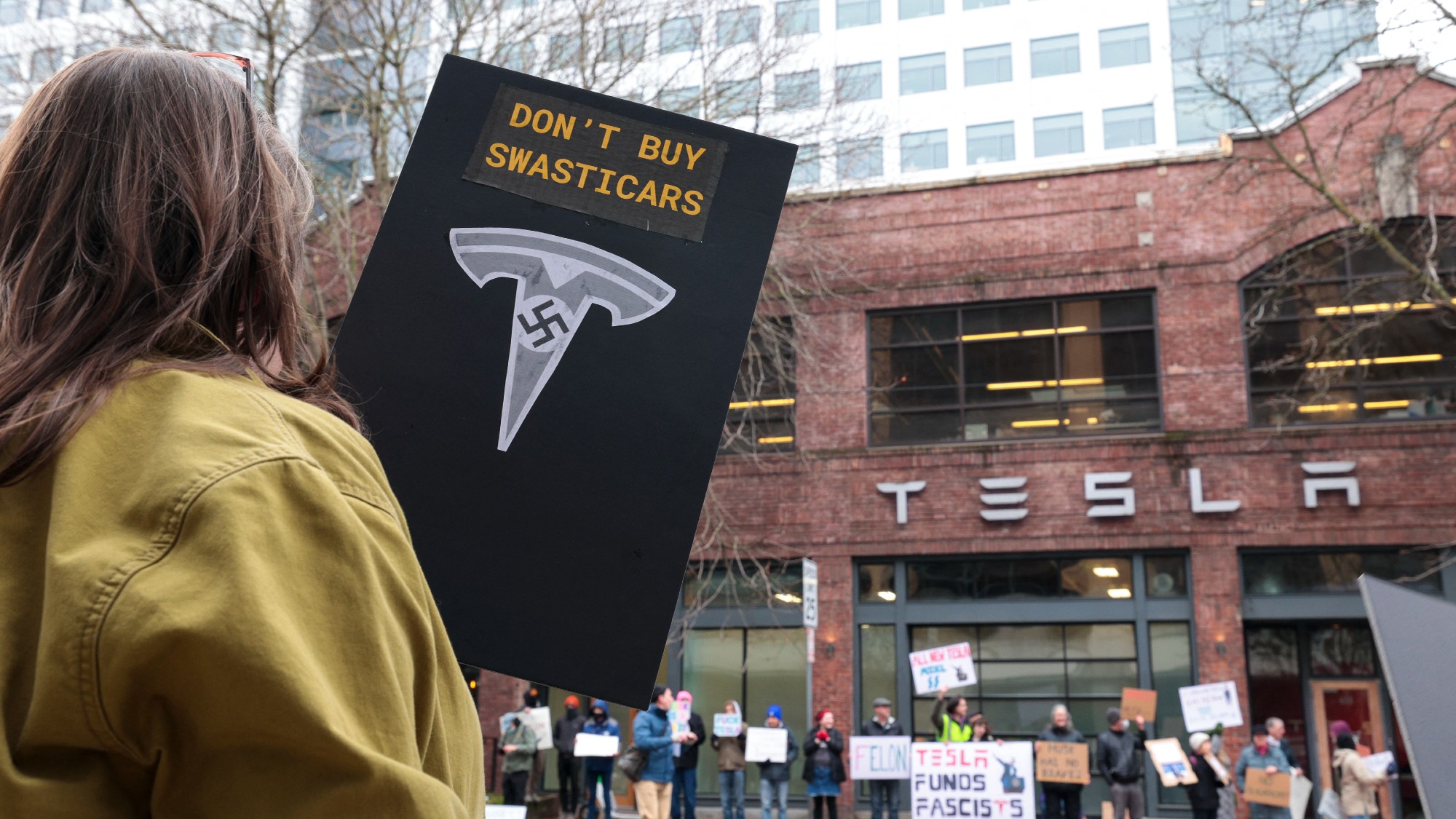

1. Tesla shares fall to lowest level in 2 years after Musk sells more shares

Tesla shares dropped 7.2 percent on Wednesday to their lowest level in two years after the news that CEO Elon Musk had sold another $3.95 billion worth of the electric-vehicle maker's stock. Musk's latest share sale fueled concerns about fallout at Tesla from his $44 billion deal to acquire Twitter. Some investors fear Musk will divert resources to Twitter, or spend too much time wrestling with the chaos at the social media company instead of focusing on Tesla, the world's most valuable automaker, according to analysts. "I think investors are concerned that this might not be the end of his stock sales," OANDA senior market analyst Ed Moya said. Tesla is down nearly 60 percent from its November 2021 record.

2. Redfin shuts down house-flipping unit as housing market struggles

Real estate company Redfin Corp. on Wednesday said it was laying off 13 percent of its workers and shutting down its home-flipping unit. Redfin's decision to close the RedfinNow home-flipping business, which has been losing money, came after larger rival Opendoor Technologies reported record losses last week after selling too many homes for less than their purchase price. Redfin, which had already laid off 8 percent of its workforce in June, said the home-flipping operations had become too risky as the real estate market, which boomed earlier in the pandemic, struggles with falling sales and rising mortgage rates.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. French company faces investigation over labor conditions at Qatar World Cup projects

A French judge has placed Vinci Construction Grands Projets, a subsidiary of French construction company Vinci, under formal investigation on preliminary charges of forced labor and other violations against migrant workers helping to build infrastructure needed in Qatar for the looming World Cup. The company said it did nothing wrong and would appeal. A human rights group, Sherpa, filed the initial complaint in 2015, and called the charges a breakthrough. The charges send "a strong signal for these economic players who profit from modern slavery," Sherpa president Sandra Cossart told The Associated Press. The allegations against the company include submitting workers to conditions incompatible with human dignity.

4. Stock futures rise ahead of inflation data

U.S. stock futures edged higher early Thursday as investors continue to digest the mixed results from Tuesday's midterm elections and await fresh inflation data. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.2 percent and 0.3 percent, respectively, at 6:30 a.m. ET. Nasdaq futures were up 0.5 percent. The Dow and the S&P 500 plunged 2.0 percent and 2.1 percent, respectively, on Wednesday, and the tech-heavy Nasdaq dropped 2.5 percent as uncertainty over which party had won control of the House and Senate dragged down stocks. Investors had been betting Republicans would take control, dividing power in Washington and creating the kind of gridlock markets like. Crypto exchange Binance's decision to drop plans to acquire rival FTX also dragged down tech stocks on Wednesday, and sent bitcoin's price to a two-year low.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. China lockdown affects 5 million in export-hub Guangzhou

China has locked down large sections of the southern city of Guangzhou as authorities try to keep a widening COVID-19 outbreak from getting worse. The restrictions, which affect more than five million of the manufacturing hub's 19 million residents, came after Guangzhou reported 3,007 new infections on Wednesday, a relatively high figure under China's zero-COVID standards that accounted for a third of new cases nationwide. Local authorities hope to avoid the kind of citywide lockdown that devastated Shanghai, and dragged down China's economy, earlier this year. China has continued to use snap lockdowns and mass testing to prevent outbreaks from spreading, as other countries ease coronavirus restrictions. But the heavy costs have sparked an intensifying outcry.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Musk wins $1 trillion Tesla pay package

Musk wins $1 trillion Tesla pay packageSpeed Read The package would expand his stake in the company to 25%

-

How Tesla can make Elon Musk the world’s first trillionaire

How Tesla can make Elon Musk the world’s first trillionaireIn The Spotlight The package agreed by the Tesla board outlines several key milestones over a 10-year period

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

How could Tesla replace Elon Musk?

How could Tesla replace Elon Musk?Today's Big Question The company's CEO is its 'greatest asset and gravest risk'

-

Elon Musk: has he made Tesla toxic?

Elon Musk: has he made Tesla toxic?Talking Point Musk's political antics have given him the 'reverse Midas touch' when it comes to his EV empire