The daily business briefing: September 12, 2018

Apple prepares to unveil a bigger, pricier iPhone, China pauses license applications from some U.S. firms, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Apple set to unveil bigger, pricier iPhone

Apple is preparing to introduce three new iPhones, including a bigger-screen model, an updated iPhone X, and a new entry-level equivalent of the iPhone 8 and 8 Plus. The smartphones are expected to be unveiled at an event in Cupertino on Wednesday. The new phone reportedly will be larger, with a 6.5-inch OLED screen, and a heftier price tag, making it Apple's biggest and most expensive iPhone yet. Apple may also introduce a fourth iteration of the Apple Watch, a new iPad, and a few surprise products. The predicted starting price for the new iPhone is $1,049, with the iPhone X at $949 and the entry-level phone starting at $749. Apple and other phone makers have been offering more expensive phones to meet consumer demand and wring more profit out of each device amid slowing sales.

The New York Times The Associated Press

2. China pauses license applications from some American companies

China is putting off accepting license applications from U.S. companies in financial services and other industries until it works out trade tensions with the U.S., The Associated Press reported Tuesday, citing a leader of the U.S.-China Business Council. "There seem to be domestic political pressures that are working against the perception of U.S. companies receiving benefits" during the trade war, the council's vice president for China operations, Jacob Parker, said. China matched President Trump's tariff hikes on $50 billion worth of Chinese goods, and has vowed to retaliate if Trump goes through with new levies he is considering on $200 billion more in imports from China. Due to its trade surplus with the U.S., however, China could run out of U.S. imports to penalize and resort to other ways to retaliate against future tariffs.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Job openings, quitting rates rise

Both job openings and the quitting rate rose in July, the Labor Department reported Tuesday. The number of open positions is at a record high compared to recent decades, and more people quit their jobs than any other time since 2001. The two statistics could push wage growth, as sustained labor market strength increases competition for qualified workers. Experts also warned that worker shortages could slow economic growth, and the Federal Reserve is now increasingly likely to raise interest rates later this month, for the third time this year. There are 6.82 million jobs waiting to be filled, which is 659,000 more positions than there are unemployed people. Quitting rates are sky-high — 3.58 million Americans quit their jobs, a rate of 2.4 percent.

4. FCC pauses clock on T-Mobile-Sprint deal to consider new information

The Federal Communications Commission said Tuesday that it was pausing the informal "shot clock" for the review of the planned $26 billion merger of T-Mobile and Sprint to provide more time to analyze new information the companies have submitted on the deal's benefits. The proposed merger, announced in April, would reduce the field of big players in the wireless market from four to three. The Justice Department also is reviewing it. The FCC said it also needed more time to consider new economic modeling information T-Mobile has promised. "The clock will remain stopped until the applicants have completed the record on which they intend to rely and a reasonable period of time has passed for staff and third-party review," the FCC said in a letter to officials at the companies.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures edge higher after Tuesday's gains

U.S. stock futures inched up early Wednesday, looking to add to Tuesday's gains as Apple unveils its latest iPhones, and data on producer prices comes out. Futures for the Dow Jones Industrial Average gained 0.1 percent, while those of the S&P 500 and the Nasdaq-100 rose by less than 0.1 percent, and 0.2 percent, respectively. The Dow and the S&P 500 gained about 0.4 percent on Tuesday, and the Nasdaq Composite rose by 0.6 percent. The three U.S. gauges have remained strong thanks to the strengthening economy even as trade tensions between the U.S. and its partners, including China, have weighed down global stocks.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

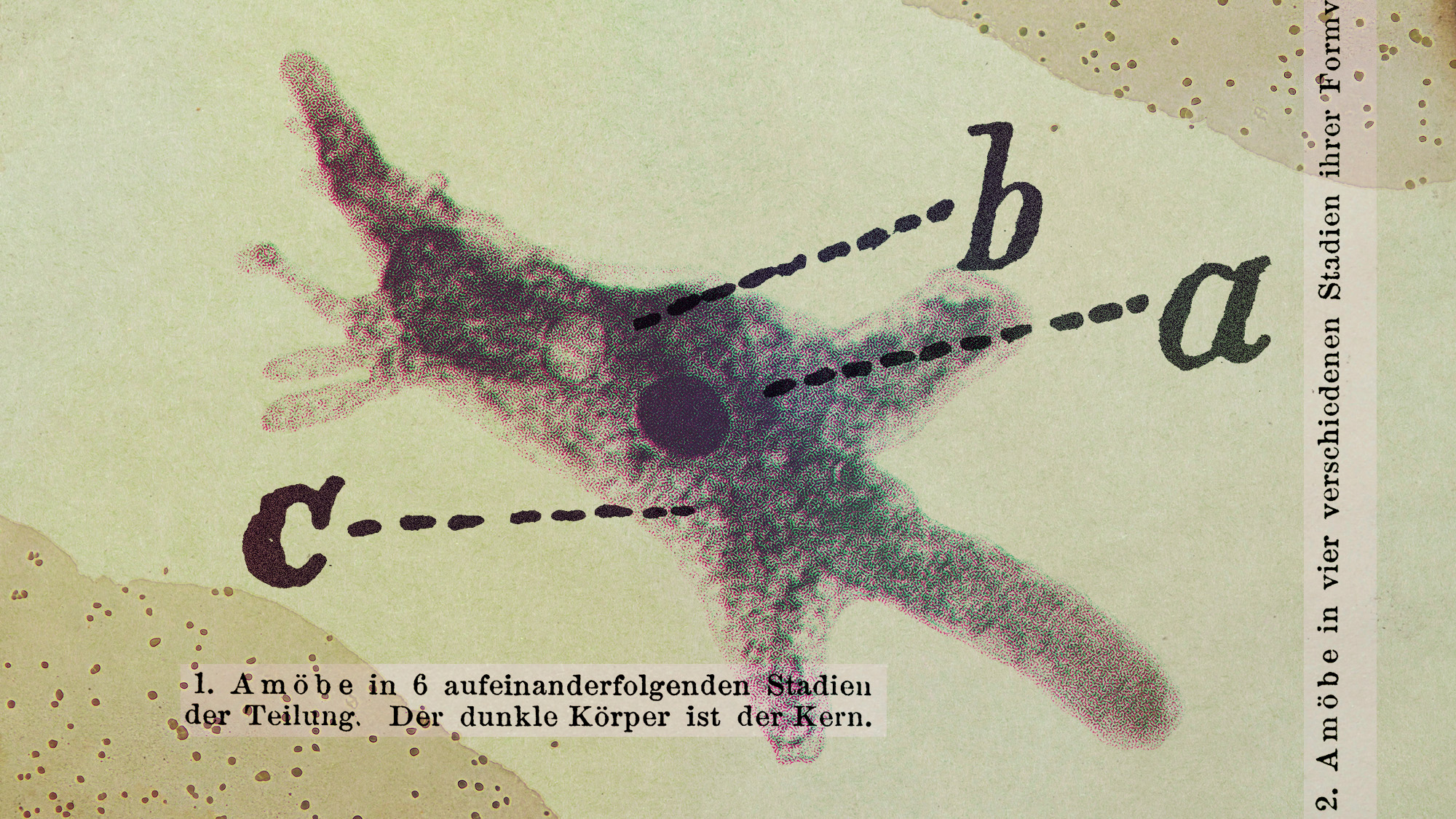

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military