The daily business briefing: October 22, 2019

Johnson pushes for Parliament to approve Brexit deal after another setback, China seeks sanctions against U.S. in WTO case, and more

- 1. Boris Johnson pushes for Brexit vote after latest setback in Parliament

- 2. China seeks sanctions against U.S. in Obama-era WTO case

- 3. Drug companies agree to pay $260 million in last-minute opioid settlement

- 4. Saks owner Hudson's Bay taking company private

- 5. SoftBank to lend WeWork $5 billion, take control of company

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

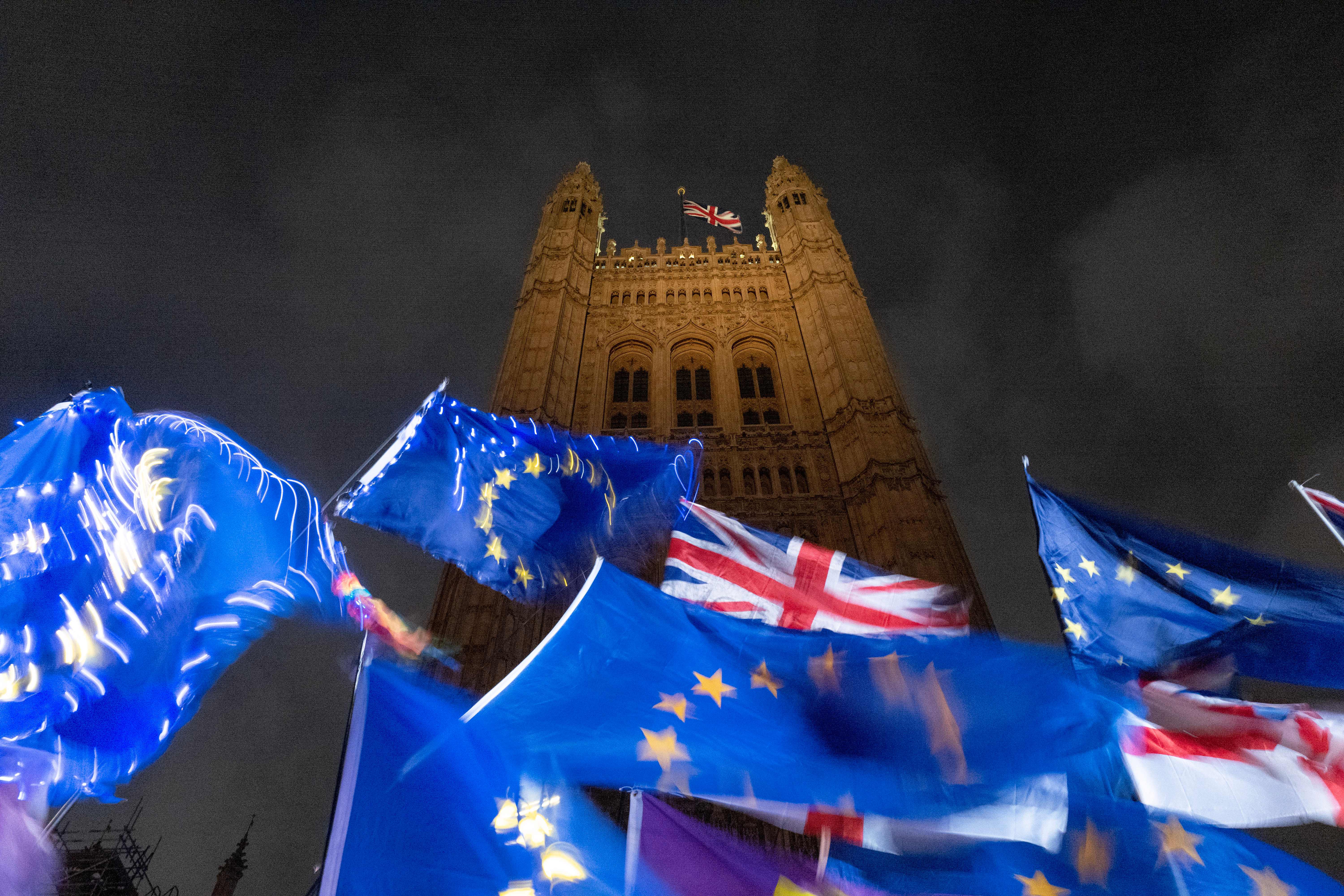

1. Boris Johnson pushes for Brexit vote after latest setback in Parliament

British Prime Minister Boris Johnson is pushing for Parliament approve his Brexit deal in Tuesday votes in what he has called a "do or die" moment ahead of Britain's scheduled Oct. 31 departure from the European Union. House of Commons Speaker John Bercow rejected Johnson's call for a Monday vote. Bercow said Johnson's Monday request was essentially the same as one Parliament rejected Saturday. "The house should not be continually bombarded with the requirement to consider the same matter over and over and over again," Bercow said. Lawmakers want more time to review the deal Johnson reached with the EU, which hasn't responded to a request for an extension Johnson was legally obliged to make after missing a deadline for winning Parliament's approval.

2. China seeks sanctions against U.S. in Obama-era WTO case

China is asking the World Trade Organization to sign off on $2.4 billion in retaliatory sanctions against the U.S. for failing to comply with a ruling in an Obama-era tariff case, Reuters reported Monday, citing a newly published document. The case involves China's challenge to 2012 U.S. anti-subsidy tariffs on exported Chinese solar panels, wind towers, and other products valued at $7.3 billion. WTO judges ruled in July that the U.S. had not fully complied with a ruling in the case, and the WTO's Dispute Settlement Body in August signaled to Beijing that it could go after compensatory sanctions. The U.S. then denied the validity of the findings, saying the WTO had applied "the wrong legal interpretation" in the dispute, and accused China of being a "serial offender" in the WTO subsidies agreement.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Drug companies agree to pay $260 million in last-minute opioid settlement

Under a last-minute deal reached Monday, four drug companies will pay two Ohio counties over the firms' role in the opioid epidemic. Distributors McKesson Corp., AmerisourceBergen, and Cardinal Health settled for $215 million, while manufacturer Teva Pharmaceuticals will pay $20 million and provide $25 million of anti-addiction medication. The deal came shortly before opening arguments were to begin in what was to be the first federal opioid trial. The counties accused the companies of fueling addictions to the powerful painkillers by failing to monitor and flag large, suspicious orders. Another defendant, pharmacy chain Walgreens, wasn't included in the settlement, and its case was postponed. The trial was expected to be a test case for more than 2,300 opioid lawsuits brought by state and local governments.

4. Saks owner Hudson's Bay taking company private

Saks Fifth Avenue owner Hudson's Bay said Monday that it is taking the struggling luxury department store chain private in an attempt to revive it. The deal is expected to be closed by early next year. Hudson's Bay, like other brick-and-mortar retailers, has struggled against online competition and shifting tastes. The Canadian company already has sold off some of its businesses, including Lord & Taylor, but Saks Fifth Avenue has done relatively well despite its own problems with declining sales. Hudson's Bay said the shareholder group taking the company private, which includes Executive Chairman Richard Baker, would buy common shares at $7.86 per share in cash, up from a June offer of $7.21 and making the deal worth more than $1.4 billion.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. SoftBank to lend WeWork $5 billion, take control of company

SoftBank Group Corp. has offered $5 billion in debt financing for WeWork in a deal that would give it control of the company, Reuters and CNBC reported Monday, citing people familiar with the matter. Without the infusion, WeWork could run out of cash as early as November. The office sharing startup's fortunes have plummeted in recent weeks. Investor objections forced out co-founder and former CEO Adam Neumann, although he now serves as board chairman, and the office-sharing startup had to cancel plans for a September initial public offering of stock. SoftBank also is accelerating a $1.5 billion equity commitment made in January that valued the company at $47 billion. SoftBank is trying to renegotiate it with a valuation around $8 billion.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military