The daily business briefing: March 20, 2020

Two GOP senators reportedly dumped stocks after coronavirus briefings, economists' estimate of recession risk jumps, and more

- 1. At least 2 GOP senators dumped stocks after coronavirus briefings

- 2. Economists' estimate of recession risk rises sharply

- 3. Stock futures rise as volatility continues

- 4. Senate Republicans unveil relief bill seeking checks for U.S. adults

- 5. Stores add special hours for elderly shoppers to lower coronavirus infection risk

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. At least 2 GOP senators dumped stocks after coronavirus briefings

Senate Intelligence Committee Chair Richard Burr (R-N.C.) sold up to $1.56 million in stocks in February after receiving a briefing on the expected severity of the coronavirus outbreak. During that period, Burr was assuring the public that the Trump administration had everything under control, although a secret recording emerged in which he warned well-connected constituents to prepare for a dire economic situation. Burr called an NPR report on the matter a "tabloid-style hit piece," and a spokesman said the senator fully disclosed the trades. Sen. Kelly Loeffler (R-Ga.) also sold stock before the market crashed as the outbreak began spreading rapidly in the U.S. She bought $100,000 to $250,000 worth of shares in Citrix, a technology company that provides teleworking software.

2. Economists' estimate of recession risk rises sharply

Economic damage caused by the coronavirus crisis has resulted in a median 80 percent estimated chance that the U.S. will see a recession in the next 12 months, according to analysts polled by Reuters. A survey two weeks ago predicted a 30 percent chance. Economists mostly believe that the hit from the pandemic will be temporary but severe enough to end the longest U.S. expansion ever recorded. The Federal Reserve has made two emergency interest rate cuts, dropping rates to near zero, and resumed asset purchases to boost the economy. Economists expect a slight rebound later in the year. Michelle Meyer, U.S. economist at BofA Merrill Lynch, said she expected gross domestic product to contract by 12 percent in the second quarter, then return to growth in the third.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

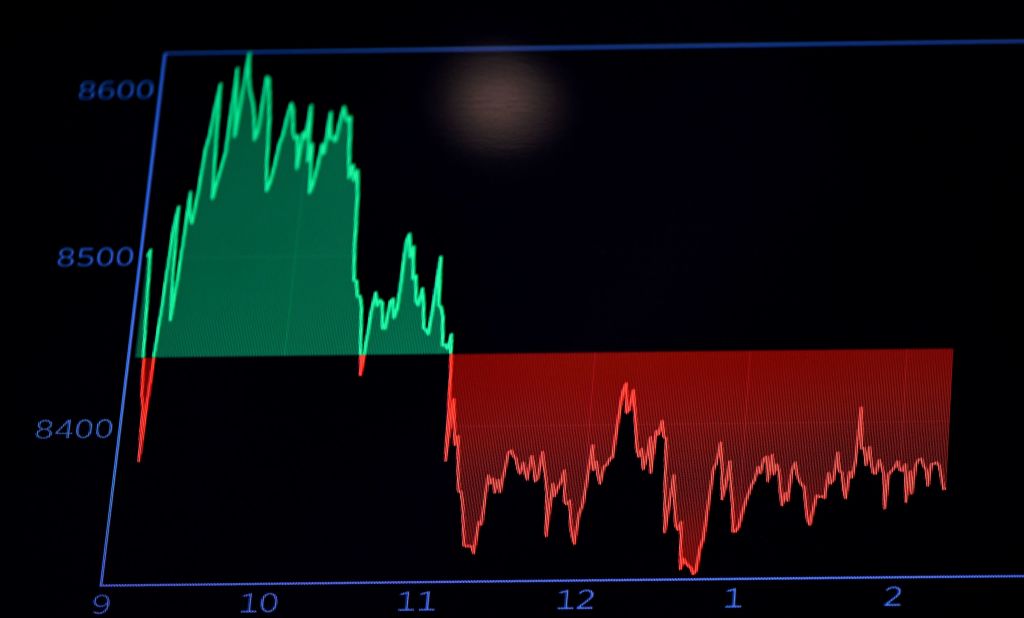

3. Stock futures rise as volatility continues

U.S. stock futures surged early Friday after closing higher on Thursday. At 5:30 a.m., futures for the Dow Jones Industrial Average were up by 4.6 percent. Those of the S&P 500 and the Nasdaq were 4.4 percent and 4.9 percent higher, respectively. Thursday's gains of nearly 1 percent for the Dow and 0.5 percent for the S&P 500 were relatively muted, coming after much larger swings in recent days as the coronavirus pandemic brought many businesses to a halt and ended Wall Street's longest bull market on record. Despite the gains, the Dow remained down 13.4 percent on the week as economists warned the unemployment rate could rise more due to the pandemic than it did in the last recession. "This is a body blow to the economy unlike anything we've experienced in recent memory," said Patrick Anderson, an economist in East Lansing, Michigan.

4. Senate Republicans unveil relief bill seeking checks for U.S. adults

Senate Majority Leader Mitch McConnell (R-Ky.) on Thursday introduced an emergency economic stimulus bill to counter economic damage from the coronavirus crisis. The legislation calls for sending $1,200 checks to most adults, along with $500 for every child, with the amounts decreasing for those making more than $75,000. The plan also includes loans for small businesses. Democrats say the plan doesn't go far enough to help individuals, and they want to bar corporations receiving bailouts from buying back their own stock. Treasury Secretary Steven Mnuchin and White House economic adviser Larry Kudlow are expected to meet with lawmakers from both parties on Friday to discuss a bipartisan deal.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stores add special hours for elderly shoppers to lower coronavirus infection risk

Target, Whole Foods, Walmart, Dollar General, and other grocery store chains have started offering shopping times reserved for senior citizens in order to reduce their risk of coronavirus infection. The death rate from COVID-19 is highest for elderly patients. Some older shoppers reported that the exclusive hours worked well in small shops but can backfire in larger stores. Roger Glenn Miller, 82, said he went to a Stop & Shop grocery store in Rhode Island on Thursday and found himself in a crowd of 200 seniors. "If you didn't have coronavirus before you got there, you probably do now," he said.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military