Dallas and Boston Fed presidents resign amid scrutiny over stock trades

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve banks of Dallas and Boston said Monday that their presidents are stepping down amid scrutiny over their stock-trading during the COVID-19 pandemic. Dallas Fed President Robert Kaplan acknowledged the controversy in a statement Monday afternoon, saying he decided to retire because "unfortunately, the recent focus on my financial disclosure risks becoming a distraction to the Federal Reserve's execution of that vital work." Boston Fed President Eric Rosengren said earlier Monday he was stepping down nine months early for health reasons.

Kaplan and Rosengren are both 64, and most regional Fed leaders have to retire at 65. But the recent disclosures that they had traded stocks and other investments that could be seen as interfering with their policy-setting responsibilities prompted Federal Reserve Chairman Jerome Powell to announce a "thorough-going and comprehensive review" of Fed ethics rules last week. Nobody on the Fed's rate-setting committee "is happy to be — to be in this situation, to be having these questions raised," he said. "It's something we take very, very seriously."

Both regional Fed presidents decided to resign separately and were not forced to resign by Powell, The Wall Street Journal reports.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

According to financial disclosure forms submitted at the beginning of the month, Kaplan traded stocks and funds worth many millions of dollars, including investments in stock-market futures and interest rate funds. Rosengren, who publicly commented on concerns about the commercial real estate sector last year, made smaller investments in stocks and other investments related tor real estate. Both men said they followed Fed ethics rules but would sell their stocks to avoid the appearance of a conflict of interest.

That may be too late, and especially with the pandemic-related investments, "the public is understandably not in any kind of mood to give the benefit of the doubt," government ethics expert Walter Shaub told The Washington Post. "Whether they acted innocently is beside the point here," Shaub said. "They undermined public confidence, and they needed to go."

The 12 regional Fed banks are managed by private boards of directors that will pick the replacements for Kaplan and Rosengren, with oversight from the Federal Reserve in Washington.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

Trump sues IRS for $10B over tax record leaks

Trump sues IRS for $10B over tax record leaksSpeed Read The president is claiming ‘reputational and financial harm’ from leaks of his tax information between 2018 and 2020

-

Trump, Senate Democrats reach DHS funding deal

Trump, Senate Democrats reach DHS funding dealSpeed Read The deal will fund most of the government through September and the Department of Homeland Security for two weeks

-

Fed holds rates steady, bucking Trump pressure

Fed holds rates steady, bucking Trump pressureSpeed Read The Federal Reserve voted to keep its benchmark interest rate unchanged

-

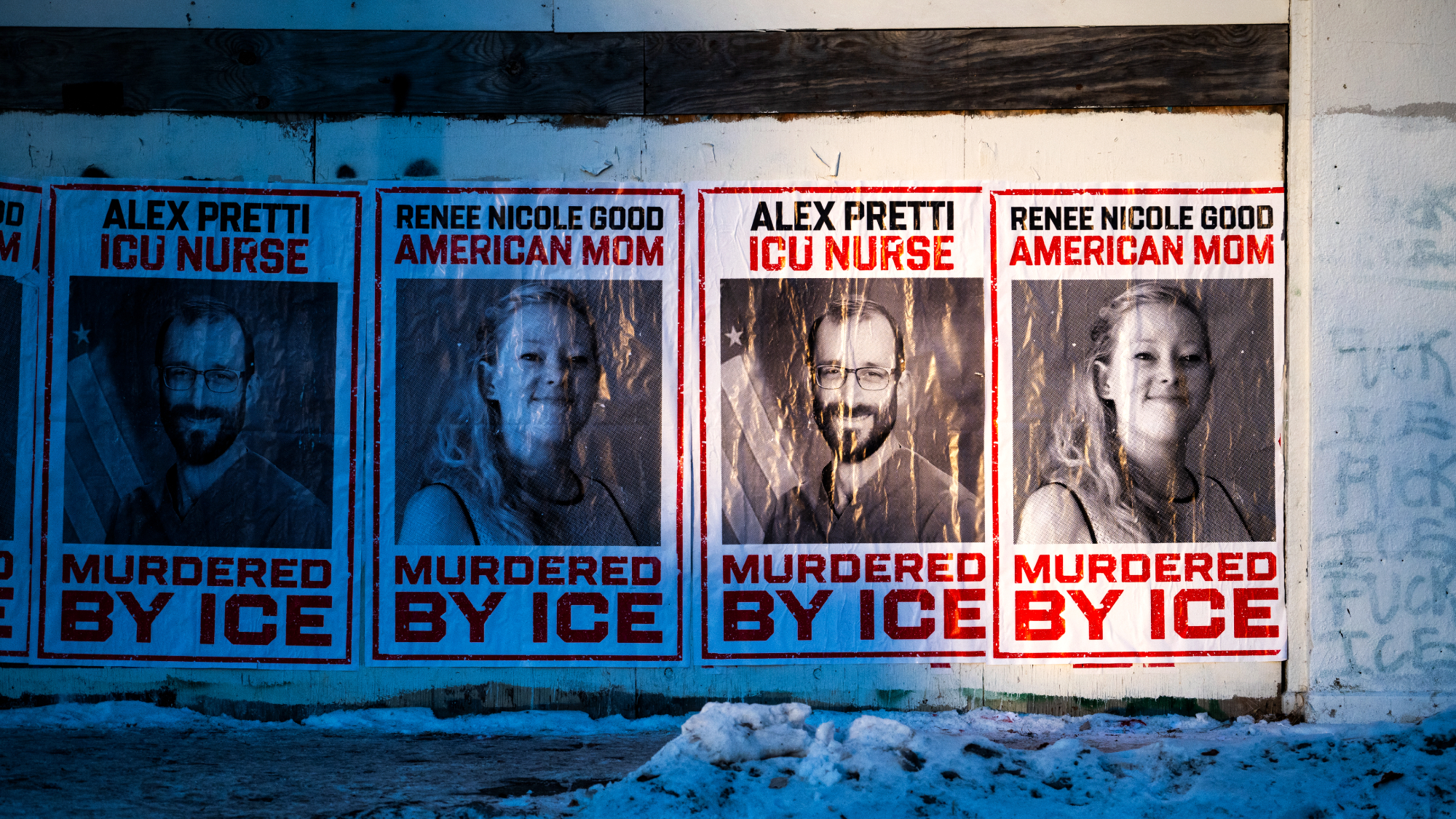

Judge slams ICE violations amid growing backlash

Judge slams ICE violations amid growing backlashSpeed Read ‘ICE is not a law unto itself,’ said a federal judge after the agency violated at least 96 court orders

-

Businesses are caught in the middle of ICE activities

Businesses are caught in the middle of ICE activitiesIn the Spotlight Many companies are being forced to choose a side in the ICE debate

-

Rep. Ilhan Omar attacked with unknown liquid

Rep. Ilhan Omar attacked with unknown liquidSpeed Read This ‘small agitator isn’t going to intimidate me from doing my work’

-

Democrats pledge Noem impeachment if not fired

Democrats pledge Noem impeachment if not firedSpeed Read Trump is publicly defending the Homeland Security secretary

-

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK