Lobbying against pay transparency

And more of the week's best financial insight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

A good time to look for dividends

"Dividends can bolster your investing strategy in a down market," said Shawn Tully in Fortune. The focus in the market has returned to fundamentals, and that means "dividend stocks are the place to be." The dominance of fast-growing tech stocks that yielded paltry quarterly payments over the past decade has made many investors "forget that, over history, it's the dividend payers that performed best." From 1973 to 2021, companies that paid quarterly dividends "furnished annual returns of 9.6 percent a year, crushing nonpayers' record of 4.8 percent, and beating the overall market average of 8.2 percent." These companies tend to be "mature, stable businesses" that "don't have a big need for capital to invest." If you are hunting for value in this market, high-dividend stocks are the place to start.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

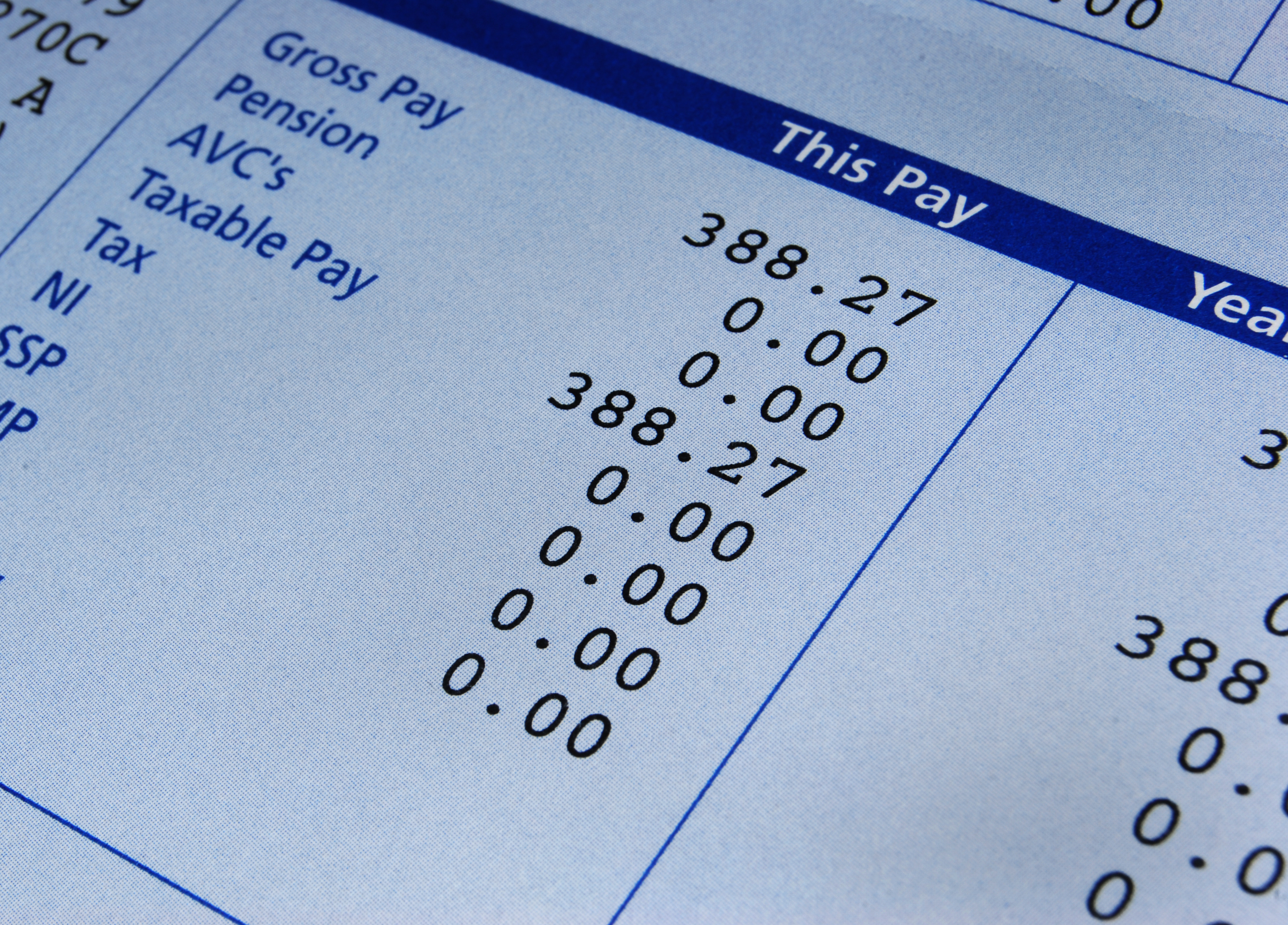

Lobbying against pay transparency

Businesses are pushing back against states' pay-transparency laws, said Pavithra Mohan in Fast Company. Legislation in several states now mandates that job postings include the compensation details, or require employers to "provide a pay range if an applicant requests it." Some places are going even further. A bill in New York City was recently amended after employers complained about a provision allowing prospective employees to sue companies that violated pay-transparency laws. California advocates are lobbying for a bill requiring employers to "publish data on contract workers and those hired through third-party vendors," who make up a large portion of the workforce in Silicon Valley. Pro-business groups have fiercely opposed the measure, calling it "public shaming" that could open them up to litigation.

Be wary of single-stock ETFs

A new set of exchange-traded funds are each tied to only a single stock, said Karen Langley in The Wall Street Journal. AXS Investments launched the first single-stock ETFs in the U.S. last week, "though similar products were already on the market in Europe." The funds "magnify exposure to individual stocks," including PayPal, Nike, Pfizer, and Nvidia, by using derivative contracts to multiply their daily returns. Another fund "seeks to produce the inverse of Tesla's return," so its shares can rapidly go up if Tesla's go down — and vice-versa. But beware: Aimed at retail traders, the funds in effect allow professional strategies that could leave ordinary investors exposed to substantial risks.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here