Interest rates: why the long era of ever-cheaper finance is finally over

Bank of England is warning that hikes are ahead as inflation soars

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Economics expert John Whittaker of Lancaster University on why an imminent rise in interest rates is needed to keep the UK economy on track

The Bank of England was widely expected to slightly increase its official bank rate on 4 November, but it decided to stick to the all-time low of 0.1%. However, the Bank has made it clear that a rise will soon be needed, and the recent increases in mortgage rates indicate that lenders agree. So why the decision to hold off?

The Bank of England is well aware of the distress that higher rates cause for borrowers and, in particular, for the biggest borrower in the land: the UK government. At the current level of national debt, roughly £2trn, every rise in rates by one percentage point pushes up the interest paid by the government on its bonds by £20bn per year over the long term.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Higher rates also have a dampening effect on the prices of property and financial assets such as shares. Indeed, this is one way in which monetary policy is believed to work: if people feel less wealthy, they spend less and this relieves the pressure on inflation.

On the other hand, what’s bad for borrowers is good for savers. As rates rise, bank deposits will be better rewarded and even the finances of our beleaguered pension funds should begin to look more healthy.

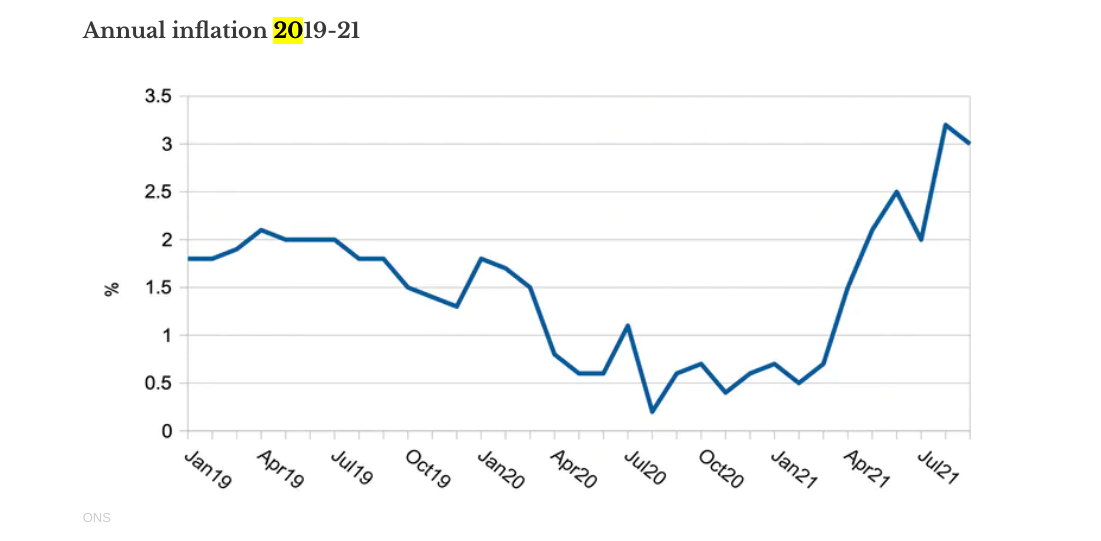

But regardless of who wins and who loses from higher interest rates, inflation is on the rise. The Bank does not want to lose credibility by letting it rise too far before tightening monetary policy.

The inflation dilemma

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

After rising for the past 12 months, UK inflation is currently 3.1%, and the Bank expects it could even reach an uncomfortable 5% by early next year – much higher than its 2% target. Yet the Bank maintains the view that this higher inflation will turn out to be temporary, arguing that it will fall back as the post-Covid excess demand for goods subsides and supply bottlenecks are worked out. Against that, energy prices are likely to remain higher, driven partly by climate initiatives; and if employers continue to have trouble filling vacancies, higher wages will also tend to push up prices.

The bottom line is that nobody really knows where inflation is heading, so the Bank is wrestling with the usual dilemma: does it raise rates now to forestall future inflation, or does it hold rates down to avoid jeopardising the economic recovery while hoping that inflation will subside by itself? It can’t have it both ways.

This same dilemma is echoed in other countries. In the United States, the position is similarly troubling, with inflation already at 5.4% against a 2% target. Yet the Federal Reserve also continues to insist that the current high inflation is temporary, thereby justifying keeping its official interest rate (the Fed funds rate) near zero.

Yet the Fed is not completely sitting on its hands; it has announced that it will start “tapering” its quantitative easing (QE) programme, in which it is creating US$120bn (£89bn) a month to buy US government bonds and other financial assets to help prop up the economy. From the middle of November, it will scale this back by US$15bn each month. This is at least an acknowledgement by the Fed that its excessively stimulatory monetary policy must eventually come to an end.

Back in the UK, the Bank of England has accumulated £800bn of government debt as a result of its own QE asset purchases, designed to stimulate demand particularly since the outbreak of Covid. At some stage, the Bank will need to begin offloading this debt.

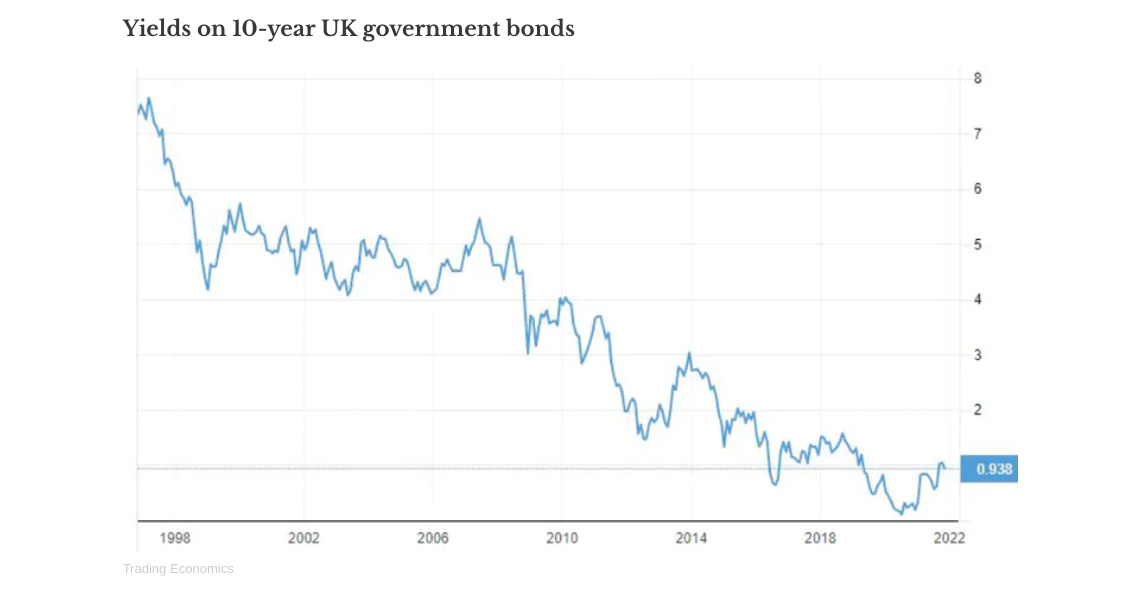

Its choices of when and how to do this present the Bank with arguably an even bigger dilemma than the bank rate, because unwinding QE will drive up yields on bonds – thus directly raising interest costs for the government and all other long-term borrowers.

In fact, yields have already started rising after many years of decline (see chart above). This is a sign that investors think that monetary policy needs to become tighter to curb inflation (by raising official rates and reversing QE) – which also explains why mortgage rates have already been rising.

This all confirms that the long era of ever-cheaper finance is finally over. The future will be tougher thanks to higher interest rates, or higher inflation, or both.

John Whittaker, senior teaching fellow in economics, Lancaster University.

This article is republished from The Conversation under a Creative Commons licence. Read the original article.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Is $140,000 the real poverty line?

Is $140,000 the real poverty line?Feature Financial hardship is wearing Americans down, and the break-even point for many families keeps rising

-

Fast food is no longer affordable for low-income Americans

Fast food is no longer affordable for low-income AmericansThe explainer Cheap meals are getting farther out of reach

-

Would a 50-year mortgage make home ownership attainable?

Would a 50-year mortgage make home ownership attainable?Today's Big Question Trump critics say the proposal is bad policy

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.