Luxury giants at war: Tiffany sues LVMH for ditching $16bn takeover

US jeweller files lawsuit in bid to force the French firm to complete axed merger

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Two major luxury goods companies are at war in a row over a stalled multibillion-dollar deal.

US jeweller Tiffany has filed a lawsuit against VMH Moet Hennessy Louis Vuitton (LVMH) after the French conglomerate pulled out of a $16bn (£12.3bn) takeover. LVMH “said it no longer wanted to buy Tiffany because the deal was being dragged into the middle of trade disputes between Paris and the Donald Trump administration”, The Wall Street Journal reports.

The French firm “also claimed that Covid chaos and violent protests across America have changed the situation”, The Telegraph adds.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In a statement released yesterday, LVMH said: “The board learned of a letter from the French European and foreign affairs minister which, in reaction to the threat of taxes on French products by the US, directed the group to defer the acquisition of Tiffany until after 6 January 2021.”

The French firm said Tiffany had also pushed for the deal’s completion date to be pushed back to 31 December - after the US elections take place.

But LVMH claims the requested delays rule out a deal, because of a previous agreement stating that the purchase must be completed no later than 24 November.

Tiffany & Co has refuted that claim, however, and “added that LVMH is not required to follow French state diktat in Paris’s squabble with Washington”, says The Telegraph.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Tiffany chair Roger Farah said: “We regret having to take this action but LVMH has left us no choice but to commence litigation to protect our company and our shareholders.

“Tiffany is confident it has complied with all of its obligations under the merger agreement and is committed to completing the transaction on the terms agreed to last year. Tiffany expects the same of LVMH.

“We believe that LVMH will seek to use any available means in an attempt to avoid closing the transaction on the agreed terms. But the simple facts are that there is no basis under French law for the foreign affairs minister to order a company to breach a valid and binding agreement.”

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

Why bosses are hiring etiquette coaches for Gen Z staff

Why bosses are hiring etiquette coaches for Gen Z staffUnder The Radar Employers claim young workers are disengaged at interviews and don't know how to behave in the office

-

Companies that have rolled back DEI initiatives

Companies that have rolled back DEI initiativesThe Explainer Walmart is the latest major brand to renege on its DEI policies

-

The government's growing concern over a potential US Steel takeover

The government's growing concern over a potential US Steel takeoverIn the Spotlight Japan's largest steelmaker, Nippon Steel, is attempting to buy the company

-

The nightmare before Christmas: is the party over for the office festive do?

The nightmare before Christmas: is the party over for the office festive do?Talking Point Seasonal cheer and morale-boosting benefits under threat from economic woes and employee disinterest – or dread

-

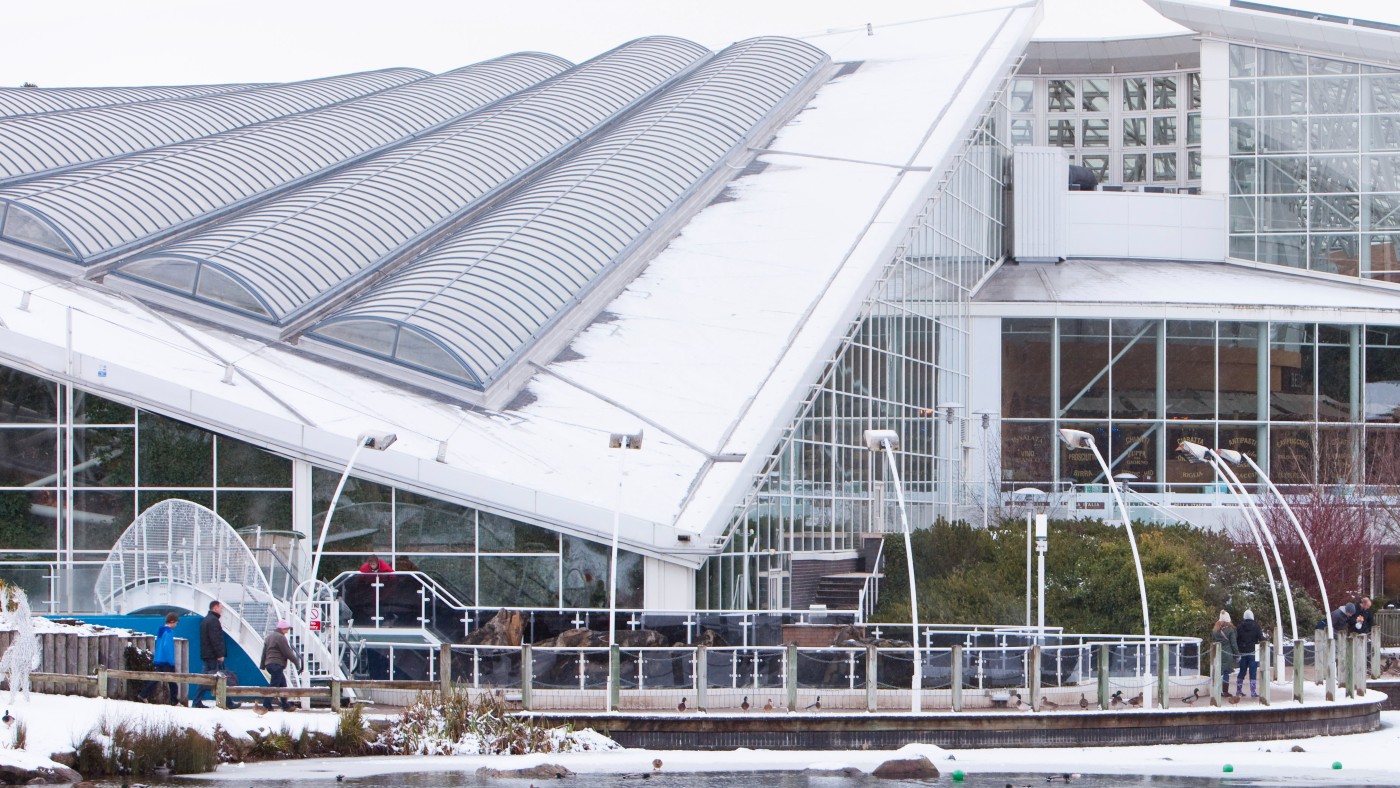

The rise and rise of Center Parcs: ‘the paradise machine’

The rise and rise of Center Parcs: ‘the paradise machine’In Depth The holiday resort chain is up for sale, with a price tag somewhere north of £4bn. What is the secret of its success?

-

Foreign investors go bargain-hunting as pound hits record lows

Foreign investors go bargain-hunting as pound hits record lowsBusiness Briefing The “UK is cheap” narrative has turned some of our best companies into 'sitting ducks'

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil