How U.S. insurance companies are blocking COVID-19 mutation surveillance

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The United States is not at the top of its game when it comes to coronavirus sequencing, which makes tracking COVID-19 mutations a challenge, Bloomberg reports. That's a real concern as the Delta variant and other potentially concerning variants spread around the U.S. and the world.

Part of the reason the U.S. lags behind other countries when it comes to mutation surveillance is because sequencing positive tests isn't mandatory, Jade Fulce, a spokeswoman for the Centers for Disease Control and Prevention, told Bloomberg. Therefore, the agency doesn't receive sufficient data from specific states or jurisdictions, forcing scientists to rely on "geographically broad regions," instead.

Per Bloomberg, health insurers may need to enter the fray to "achieve truly widespread adoption" of sequencing. Right now, they don't pay for it because even in the case that a mutated form of the coronavirus is discovered in a patient (federal regulations prevent labs from telling doctors what variant their patients have unless they're participating in a study, so this is rare), mutations don't alter treatment plans. "It's not approved as a medical health activity," James Crawford, senior vice president of laboratory services at the New York-based health-care provider Northwell Health, told Bloomberg. "We have not bridged that gap."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If sequencing does increase, though, and researchers begin to identify interventions specific to mutated forms of the virus, insurance companies would have reason to cover the process, Bloomberg reports. Read more at Bloomberg.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Tim is a staff writer at The Week and has contributed to Bedford and Bowery and The New York Transatlantic. He is a graduate of Occidental College and NYU's journalism school. Tim enjoys writing about baseball, Europe, and extinct megafauna. He lives in New York City.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

A Nipah virus outbreak in India has brought back Covid-era surveillance

A Nipah virus outbreak in India has brought back Covid-era surveillanceUnder the radar The disease can spread through animals and humans

-

Trump HHS slashes advised child vaccinations

Trump HHS slashes advised child vaccinationsSpeed Read In a widely condemned move, the CDC will now recommend that children get vaccinated against 11 communicable diseases, not 17

-

Covid-19 mRNA vaccines could help fight cancer

Covid-19 mRNA vaccines could help fight cancerUnder the radar They boost the immune system

-

FDA OKs generic abortion pill, riling the right

FDA OKs generic abortion pill, riling the rightSpeed Read The drug in question is a generic version of mifepristone, used to carry out two-thirds of US abortions

-

The new Stratus Covid strain – and why it’s on the rise

The new Stratus Covid strain – and why it’s on the riseThe Explainer ‘No evidence’ new variant is more dangerous or that vaccines won’t work against it, say UK health experts

-

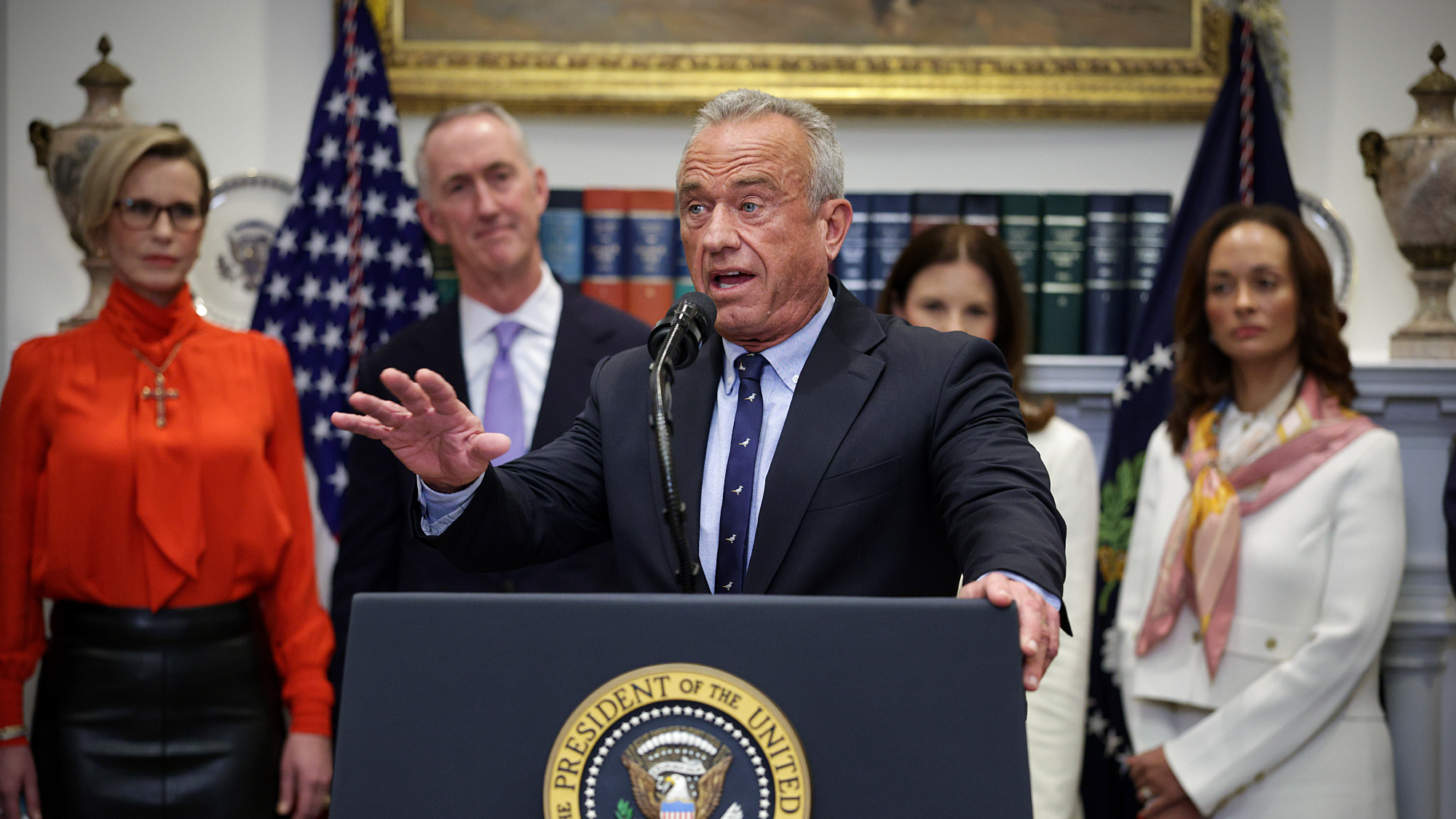

RFK Jr. vaccine panel advises restricting MMRV shot

RFK Jr. vaccine panel advises restricting MMRV shotSpeed Read The committee voted to restrict access to a childhood vaccine against chickenpox

-

Texas declares end to measles outbreak

Texas declares end to measles outbreakSpeed Read The vaccine-preventable disease is still spreading in neighboring states, Mexico and Canada

-

RFK Jr. shuts down mRNA vaccine funding at agency

RFK Jr. shuts down mRNA vaccine funding at agencySpeed Read The decision canceled or modified 22 projects, primarily for work on vaccines and therapeutics for respiratory viruses