Bitcoin price predictions: will the cryptocurrency recover in 2019?

Experts split on forecasts for the digital token over coming 12 months

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bitcoin investors have seen billions of dollars wiped off the cryptocurrency’s total value over the past year - but some are hoping for a recovery of fortunes in 2019.

Bitcoin began 2018 with a value of around $17,500 (£13,800) per coin, marginally lower than the all-time high of nearly $20,000 (£15,800) recorded in December 2017, according to ranking site CoinMarketCap.

However, by April the cryptocurrency has plummeted to around $6,800 (£5,370) and then continued falling to hit a low of $3,200 (£2,530) in December.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Following a slight rise in value, prices stood at around $3,800 (£3,000) as of 9am UK time today.

Several factors have been blamed for last year’s slump, which saw the total value of all bitcoins sinking from $327bn (£258bn) to $66bn (£52bn) - taking bitcoin “from the size from the size of Exxon Mobil to about the size of FedEx”, Quartz reports.

These factors include the announcement in September that investment giant Goldman Sachs was axing plans to launch a cryptocurrency trading desk. A hard fork in the bitcoin network - where the digital token splits to form two new currencies - then triggered mass sell-offs in November, says Forbes.

However, while the cryptocurrency market is currently in a “bearish” state, meaning more declines are predicted, some experts believe the cryptocurrency is set to claw back some of the value lost in 2018.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sonny Singh, commercial head of bitcoin payment service BitPay, told the Daily Express that he believes the digital currency may bounce back to around $20,000 by the end of the year.

But Calvin Ayre, founder of bitcoin spin-off bitcoin cash, suggests the cryptocurrency may “plummet to zero in 2019”, the newspaper reports.

That isn’t to say that the cryptocurrency market will collapse in 2019, but that bitcoin will be superseded by a superior alternative, adds David Thomas, a director at London-based cryptocurrency broker GlobalBlock.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

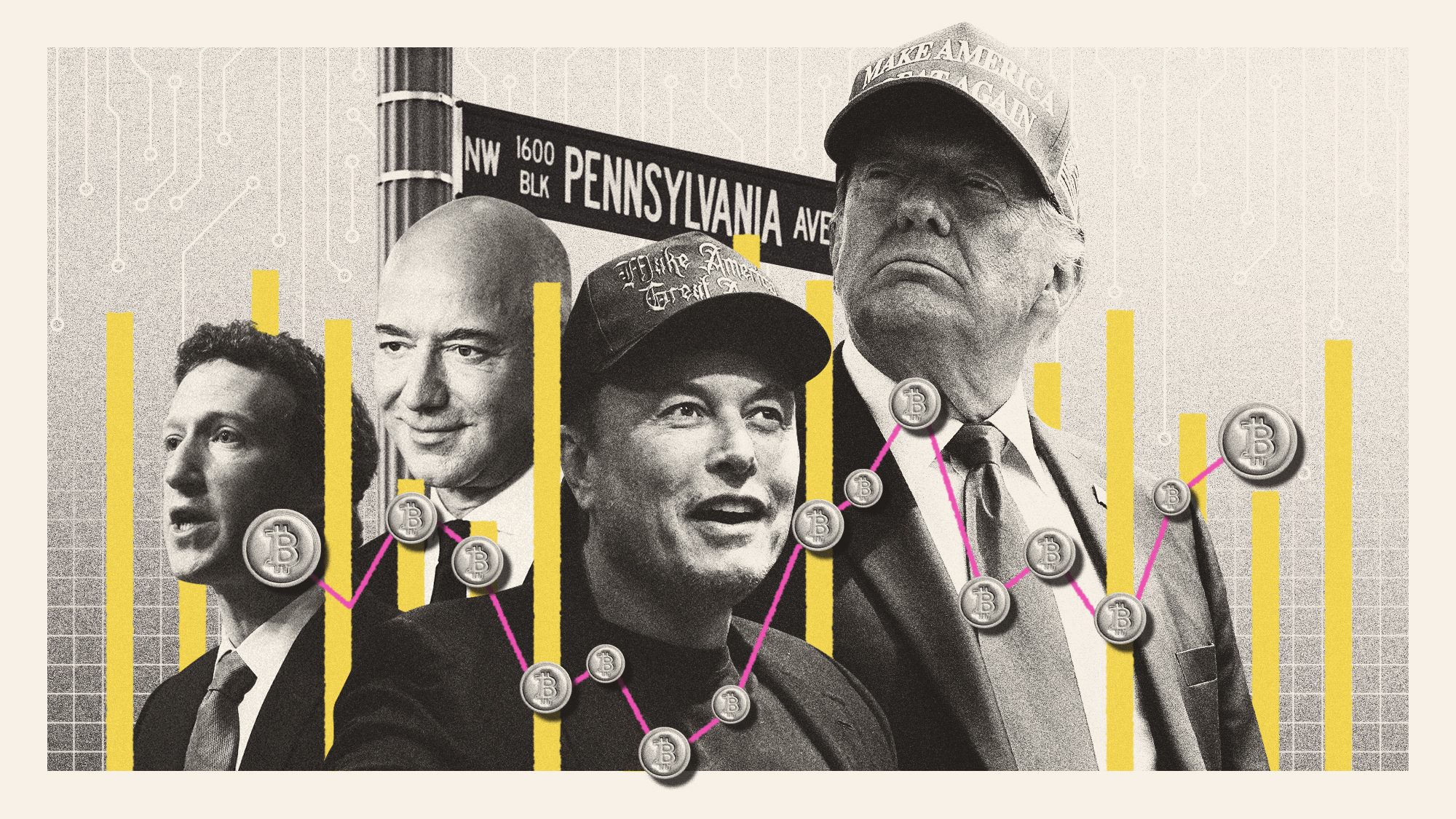

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts