How climate change is going to change the insurance industry

Some regions will soon be 'uninsurable'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As climate change brings about more extreme weather events, insurance companies are struggling to cover areas of growing risk. Over time, some regions may because highly unaffordable or even impossible to live in.

How is insurance coverage shifting?

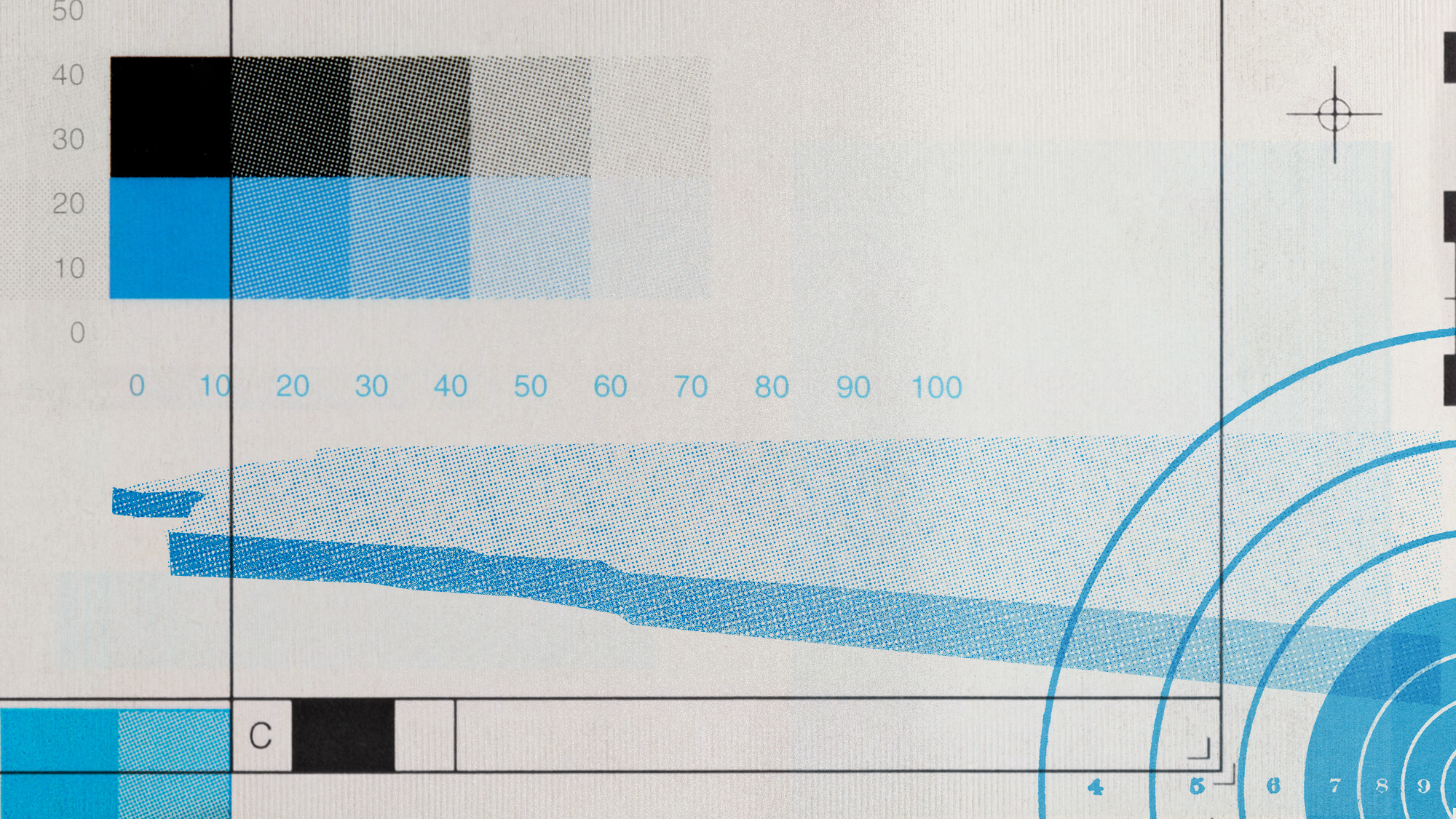

Climate change has put more places at risk for natural disasters, creating greater risk for insurance companies. Because of this, homeowners are facing “increasing insurance prices and reduced coverage due to high climate risks,” reported CBS News. A new report by the First Street Foundation found that close to 40 million properties across the U.S. are at risk of rising insurance rates and non-renewals, making up approximately one-quarter of all homes in the country.

“Some places may be impacted very minimally, but other places could see massive increases in insurance premiums in the coming years,” Jeremy Porter, co-author of the report, told CBS News. Regions prone to wildfires, flooding and strong storms are more at risk. California, Florida, and Louisiana are some of the most affected regions however, the signs are beginning to show even in inland states like West Virginia.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Climate change “is a problem that is already here,” Todd Bevington, managing director at the insurance broker VIU by HUB, told The Associated Press. In his 30 years of doing insurance, he said “I’ve never seen the market turn this quickly or significantly.” In some cases, insurance policy price increases can be “absolutely crippling” with some even seeing 80% increases, First Street CEO Matthew Eby told CBS.

In other cases, homeowners are opting to forego insurance altogether as some regions become essentially “uninsurable,” according to the report. “Without the ability to insure properties in high-risk areas with relatively affordable policies, homeowners will not be able to afford the cost of ownership associated with homes in those areas,” and property values will deflate. On the flip side, other regions “may now also exist in an ‘insurance bubble,’ meaning that homes may be overvalued as insurance is underpricing the climate change-related risk in those regions,” per CBS.

Why is this happening?

It comes down to the fact that climate risk is becoming increasingly difficult to predict. “You can no longer rely on 100 years of wildfire data to price risk when the unprecedented has happened,” Lara Mowery, global head of distribution at reinsurance firm Guy Carpenter & Co., told AP. In turn, insurance companies have raised rates. “Mother Nature is busting through the front door of American families,” Roy Wright, CEO of the Institute for Business and Home Safety, told The Atlantic.

However, even high premiums are likely insufficient in accounting for the risk. “Major home insurers in some locations are concluding that no premium — or at least no premium that customers are willing to pay and state regulators are likely to permit — will cover the potential losses,” wrote The Atlantic.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Insurance rates due to climate change also play a significant role in the lack of affordable housing. Previously, regions with higher climate risks were largely less expensive to live in, however, considering insurance costs, their affordability has decreased, Forbes reported. “Local and state governments must prioritize building resilient housing in places with low disaster risks and insurance costs.”

Devika Rao has worked as a staff writer at The Week since 2022, covering science, the environment, climate and business. She previously worked as a policy associate for a nonprofit organization advocating for environmental action from a business perspective.

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

The environmental cost of GLP-1s

The environmental cost of GLP-1sThe explainer Producing the drugs is a dirty process

-

The plan to wall off the ‘Doomsday’ glacier

The plan to wall off the ‘Doomsday’ glacierUnder the Radar Massive barrier could ‘slow the rate of ice loss’ from Thwaites Glacier, whose total collapse would have devastating consequences

-

Can the UK take any more rain?

Can the UK take any more rain?Today’s Big Question An Atlantic jet stream is ‘stuck’ over British skies, leading to ‘biblical’ downpours and more than 40 consecutive days of rain in some areas

-

As temperatures rise, US incomes fall

As temperatures rise, US incomes fallUnder the radar Elevated temperatures are capable of affecting the entire economy

-

The world is entering an ‘era of water bankruptcy’

The world is entering an ‘era of water bankruptcy’The explainer Water might soon be more valuable than gold

-

Climate change could lead to a reptile ‘sexpocalypse’

Climate change could lead to a reptile ‘sexpocalypse’Under the radar The gender gap has hit the animal kingdom

-

Why scientists want to create self-fertilizing crops

Why scientists want to create self-fertilizing cropsUnder the radar Nutrients without the negatives

-

The former largest iceberg is turning blue. It’s a bad sign.

The former largest iceberg is turning blue. It’s a bad sign.Under the radar It is quickly melting away