‘Dullness dividend’: can market psychology help Rishi Sunak out of fiscal hole?

Shift from ‘moron premium’ could help PM and chancellor improve public finances

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Business leaders and financial markets have reacted positively to Rishi Sunak’s first few days as prime minister, with commentators noting he has benefited from a “dullness dividend”.

Coined by City economist Simon French, the dullness dividend “is the value that investors would place on a vaguely competent, boring even, Prime Minister leading a stable Government with economic policies that add up”, said the Evening Standard’s business editor Jonathan Prynn.

It follows former PM Liz Truss and chancellor Kwasi Kwarteng’s disastrous mini-budget, which has resulted in the UK’s sovereign bonds, or “gilts”, still trading “at much higher yields than they did before the self-inflicted blow”, said The Economist. Dario Perkins of TS Lombard, an investment research firm, has dubbed this a “moron risk premium”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The government’s decision to delay the fiscal statement from 31 October until 17 November shows that “Sunak has the good will of the markets” in that “there is less immediate demand for the UK’s update on fiscal strategy”, said The Spectator’s Kate Andrews.

But it remains to be seen how much of an effect the transition in market psychology from “moron premium” to “dullness dividend” will have on government policy.

What did the papers say?

There is a tangible real-world effect to this “dullness dividend”, according to The Spectator’s Andrews. “The irony of Rishi Sunak is this: the most fiscally hawkish of all the leadership candidates (in both races this year) may need to implement the least amount of spending cuts and tax rises,” she wrote. This is because “the state of the public finances is largely improving, thanks to the cost of government borrowing falling fairly rapidly since it became obvious Sunak was going to enter No. 10”.

But despite a forecast of a positive economic tailwind, Sunak held a meeting with Jeremy Hunt, the chancellor, at which they agreed there was still a “massive fiscal black hole to fill and billions in headroom was needed”, reported the Telegraph.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“Markets have calmed somewhat, but the picture is still bleak,” a Treasury source told the paper. “People should not underestimate the scale of this challenge, or how tough the decisions will have to be. We’ve seen what happens when governments ignore this reality.”

The Financial Times (FT), meanwhile, was briefed by No. 10 that the government was exploring tax increases and public spending cuts worth up to £50bn a year to “fill a gaping hole in the public finances”. That figure comes from Treasury calculations “showing an initial fiscal hole of between £30bn and £40bn, which will require tax rises or spending cuts of about £45bn because attempts to fill it will worsen the economic outlook”, added the paper.

The FT noted that £50bn a year is around 2% of the current UK GDP and that reaching it primarily via spending cuts would see the return of “George Osborne’s austerity Budget of 2010”.

Put together these briefings appear to be a “concerted effort” by Downing Street to dampen spirits following “upbeat coverage suggesting that the size of the fiscal hole will end up being smaller thanks to the Sunak-Hunt ‘dullness dividend’”, said Politico’s London Playbook.

What next?

It appears that government policy will remain influenced by the financial markets for some time. Business “can cope with any shade of government so long as it’s clear in its direction and competent both in execution and in speaking the language markets understand”, said The Spectator’s Martin Vander Weyer.

Sunak as chancellor “scored high marks for competence; the financial community recognises him as one of their own”, he added. “But the capriciousness of events, politics and global economic forces waits to knock him off course.”

The government faces “a long and grinding slog to convince investors that gilts are once again a safe bet”, said The Economist, with the head of the Debt Management Office Robert Stheeman telling the Treasury Select Committee earlier this week that government borrowing costs could rise again as a result of the Bank of England’s quantitative tightening programme.

The Bank’s Monetary Policy Committee will meet to set interest rates on Thursday and the “£50bn figure would shrink if the Bank can persuade financial markets that the government’s fiscal plans allow it to raise interest rates by less than previously thought to tackle high inflation”, said the FT.

Sunak’s pledge to restore fiscal and financial responsibility may calm markets, but “standing by that commitment as the central bank raises interest rates to curb inflation makes a serious recession possible if not probable”, said Bloomberg.

By stabilising markets, Sunak and Hunt have bought themselves time and “will hope that market prices improve further, but the outlook is still much more difficult for the government than it appeared in the spring”, added the FT. “The autumn statement might have been delayed from Halloween, but it is still likely to frighten many voters and Tory MPs when it is delivered next month.”

Jamie Timson is the UK news editor, curating The Week UK's daily morning newsletter and setting the agenda for the day's news output. He was first a member of the team from 2015 to 2019, progressing from intern to senior staff writer, and then rejoined in September 2022. As a founding panellist on “The Week Unwrapped” podcast, he has discussed politics, foreign affairs and conspiracy theories, sometimes separately, sometimes all at once. In between working at The Week, Jamie was a senior press officer at the Department for Transport, with a penchant for crisis communications, working on Brexit, the response to Covid-19 and HS2, among others.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

Why is Tulsi Gabbard trying to relitigate the 2020 election now?

Why is Tulsi Gabbard trying to relitigate the 2020 election now?Today's Big Question Trump has never conceded his loss that year

-

Will Democrats impeach Kristi Noem?

Will Democrats impeach Kristi Noem?Today’s Big Question Centrists, lefty activists also debate abolishing ICE

-

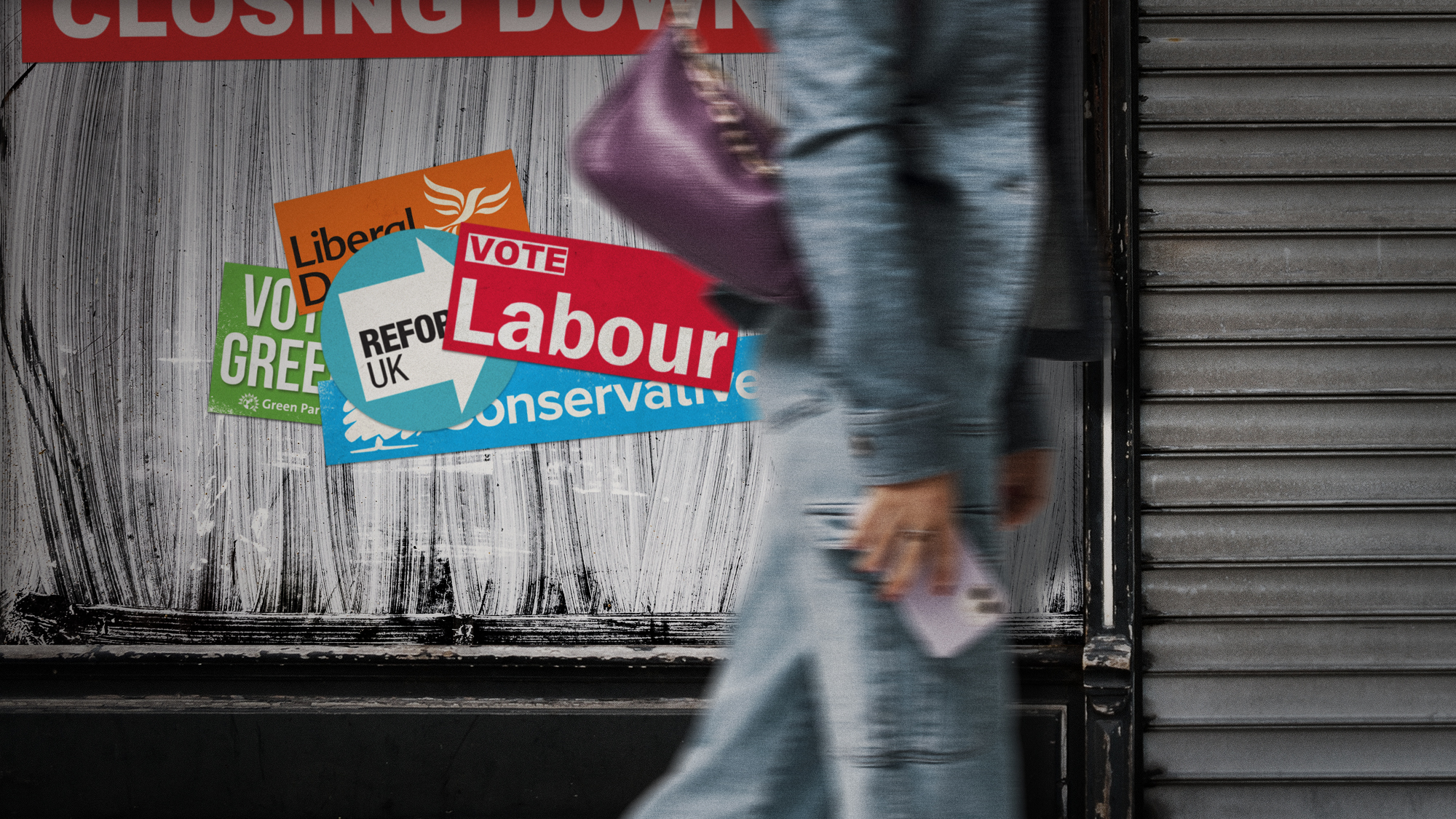

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Do oil companies really want to invest in Venezuela?

Do oil companies really want to invest in Venezuela?Today’s Big Question Trump claims control over crude reserves, but challenges loom