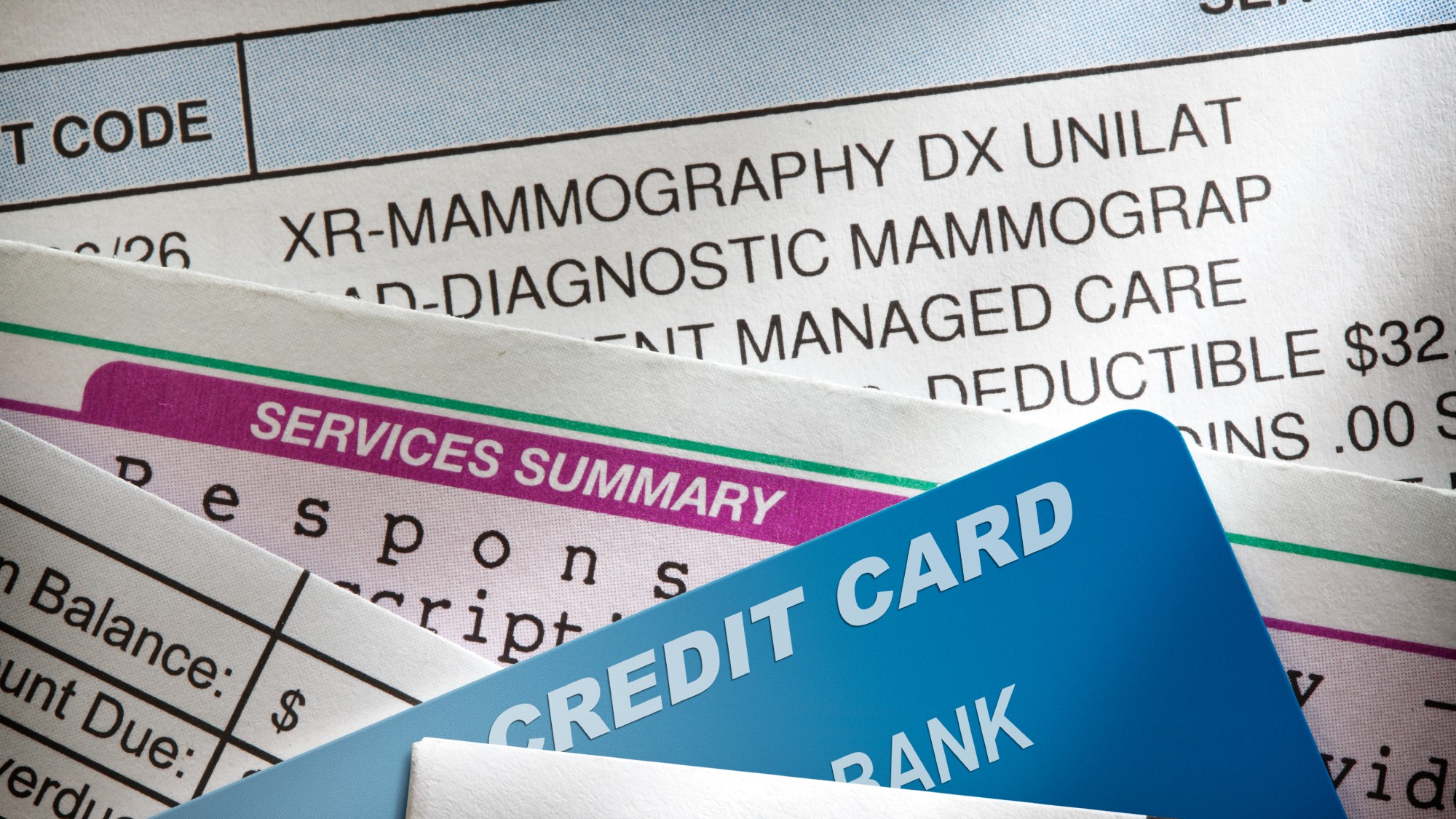

How to deal with medical debt

You can negotiate, ask for a payment plan, or find a medical bill advocate

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

This month, the Biden administration announced a proposal that would offer a big break to those dealing with medical debt: removing it from the credit reports of millions of Americans. This would shield those with this type of debt from impacts to their credit, "making it easier for them to qualify for car, home and small-business loans," said The New York Times.

The bad news? The proposed rule would "most likely not take effect until early next year," and it wouldn't do anything to help relieve the medical debt itself. Further, it could lead to "unintended consequences: hospitals, for example, might be more likely to try to pursue debt in other ways — such as suing patients, garnishing their wages or cutting off care — because they no longer have the tactic of reporting to credit bureaus," said the Times.

In other words, medical debt will remain a problem to contend with. Here are some tips for how to deal.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Triple-check the bill for errors or other issues

Before you start stressing about how you will pay your bill, make sure it's actually correct. Often, "medical bills are rife with errors" — "one study from Medical Billing Advocates of America estimates up to 80% of medical bills contain errors," said CNBC.

When going over charges, you will want to "gather up all of your bills and insurance explanation of benefits (EOB) forms and review them for duplicate billing, unauthorized charges and errors," said Experian. Also "make sure your insurance company has paid for all covered expenses and that your medical provider has accounted for their payments."

If you are unsure what a charge is for, "contact the biller to request an itemized list of services and providers of your care," said CNBC.

Try negotiating your costs

"Don't make the mistake of taking your medical bills at face value," said NerdWallet, as you "can always try to negotiate the total cost first."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

To do this, you will want to "speak with your healthcare provider’s medical billing manager — the person who actually has the authority to lower your bill" — ideally before your bill is already delinquent or in collections, said Investopedia.

Not sure where to start? Turn to a website "such as NewChoiceHealth.com or HealthcareBluebook.com to get an idea of what you should be paying," or see if your insurer's website offers a "tool that provides an estimated cost of care for various procedures," said Investopedia.

Get a payment plan if possible

Another option if you are overwhelmed by the amount owed is to see if you can get on a payment plan that breaks up the sum into smaller payments over time. "Many medical providers, including physicians, dentists and hospitals, can work out a no- or low-interest payment plan for your medical bills," said NerdWallet. "This is one of the simplest and most common ways to resolve a bill you can't afford in one payment."

Just make sure you "agree to monthly payments that you can truly afford to make regularly," said CNBC. Get whatever agreement you reach in writing.

Ask about income-driven hardship plans

For those with "low incomes and high levels of debt," another option may be an income-driven hardship plan, said Experian. Similar to a payment plan, this can divide your balance "into smaller, more manageable payments" — but first, "they may forgive a portion of your debt."

If your provider does not offer this form of assistance, you also may be able to access it through public programs or charities.

Tap a medical bill advocate for guidance

If you are struggling to sort out your medical bills solo, you can enlist a medical bill advocate, who "can help you wade through the sea of information, file appeals with your insurance company and negotiate with your medical provider to lower your debt and create a workable payment plan," said Experian.

Keep in mind, however, that this assistance is not free of charge. "Some advocates charge hour rates which can be as much as $100 or more," said Investopedia, while "others will charge about 25% to 35% of the amount they were able to reduce your bill."

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money