What will the presidential election mean for corporate taxes?

Trump promises cuts. Biden said businesses should pay their 'fair share.'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The outcome of the 2024 presidential election will trigger a "colossal multi-trillion-dollar fight over taxes," said Semafor. Big chunks of Donald Trump's 2017 tax cut law will expire in 2025, giving whoever wins the election — both the White House and Congress — "the opportunity to rewrite much of the IRS code." Trump hasn't officially released a tax plan, though he recently told a gathering of CEOs that he plans new cuts to corporate taxes, while President Joe Biden has offered proposals "aimed at raising taxes on multinational corporations and the richest Americans."

It's not clear that Trump has the rest of the GOP on board to slash taxes for big business. "Anti-corporate sentiment is running high among increasingly populist-minded Republicans," said Politico. One influential Republican, Rep. Chip Roy (Texas), has even proposed raising the corporate tax rate from 21% to 25%. "There's a bubbling-up concern that we should not be doing the bidding of corporate America," Roy said. Corporate lobbyists are already rushing into the fray, with one executive saying that businesses shouldn't bear the brunt of tax increases "because those businesses are the ones that are creating jobs."

What did the commentators say?

"The time is now to curb the corrosive concentrations of extreme wealth and corporate power," Oxfam's Irit Tamir said at Fortune. While the official corporate tax rate is at 21%, the "effective" tax rate — what corporations actually pay after deductions — can be much lower: The pharmaceutical industry, for example, pays an effective tax rate of 11.6%. "This is far lower than what the average American pays." Any new tax structure that preserves low rates for corporations and the rich is "one that will further inequality in this country."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Who pays corporate taxes? Look in the mirror," Phil Gramm and Mike Solon said at The Wall Street Journal. The economics are simple: "When the corporate tax rate increases, corporations try to pass the cost on to consumers." One recent Treasury study even revealed that Americans pay more in corporate taxes than in individual taxes. This is why Congress should reject efforts to raise corporate taxes. "By taxing corporations, the Democrats are taxing the American people."

What next?

Like in 2020, Biden is running this year on a promise to make the wealthy and corporations pay their "fair share," said The New York Times. But so far in his first term he has actually cut taxes overall, for both businesses and individuals, to the tune of roughly $600 billion over four years. "It's reasonable to conclude from those numbers that the Biden tax policy hasn't been some kind of radical tax-raising program," said an expert at the Urban-Brookings Tax Policy Center. But that's in large part because Congress hasn't gone along with Biden's "most ambitious tax-raising plans" — and also because he has used corporate tax breaks to encourage the growth of industries like semiconductor and electric vehicle manufacturing.

Despite his promise of corporate tax cuts, Axios said, Trump may be having trouble getting traction with the CEOs of America's biggest companies. No leader of a Fortune 100 company has donated to the former president's campaign. Forty-two CEOs supported George W. Bush's last campaign in 2004. "Roughly two-thirds of CEOs are registered Republicans," said Axios, "but they're not MAGA."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

‘The mark’s significance is psychological, if that’

‘The mark’s significance is psychological, if that’Instant Opinion Opinion, comment and editorials of the day

-

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

Grand jury rejects charging 6 Democrats for ‘orders’ video

Grand jury rejects charging 6 Democrats for ‘orders’ videoSpeed Read The jury refused to indict Democratic lawmakers for a video in which they urged military members to resist illegal orders

-

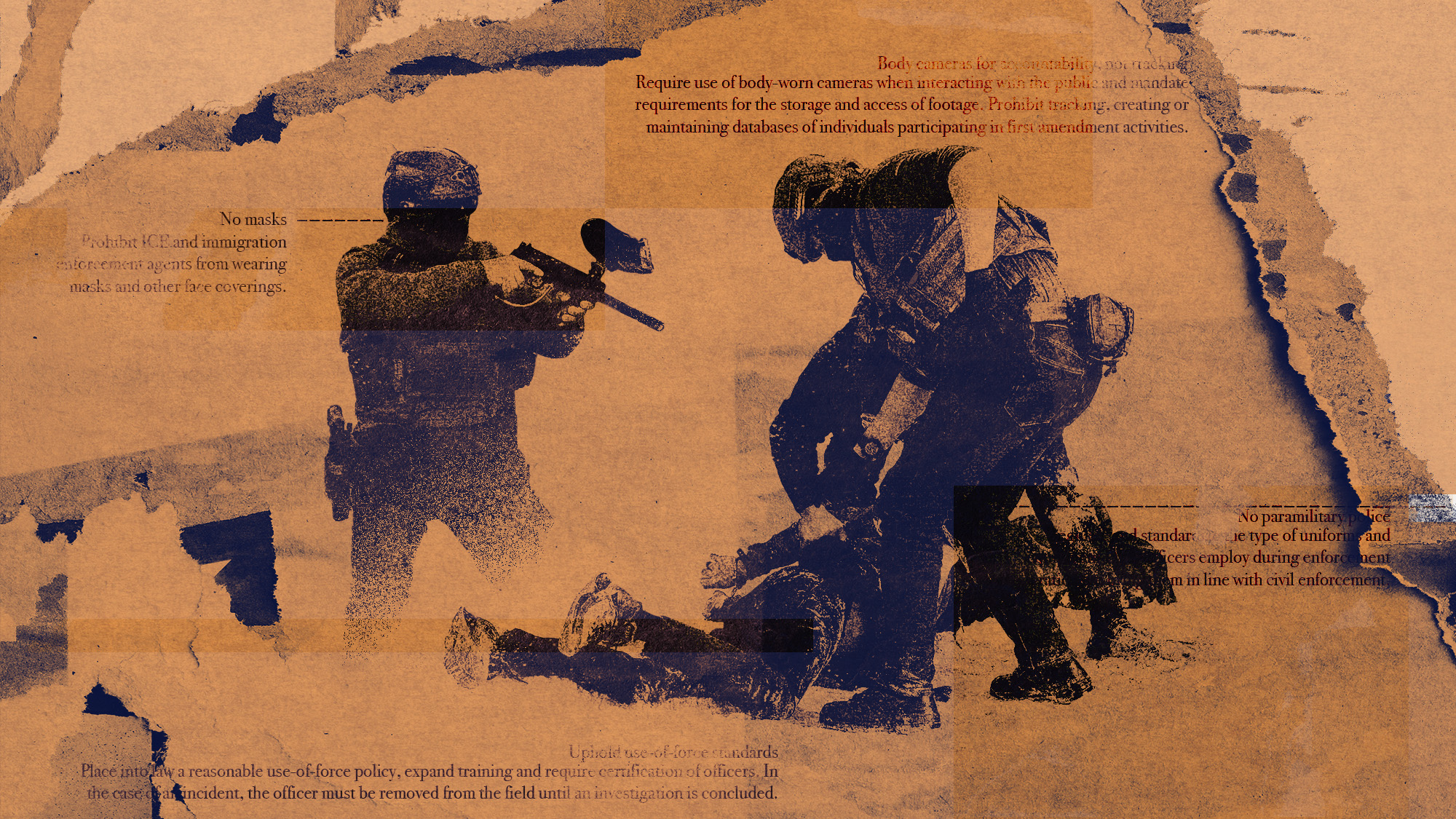

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

Democrats push for ICE accountability

Democrats push for ICE accountabilityFeature U.S. citizens shot and violently detained by immigration agents testify at Capitol Hill hearing

-

Big-time money squabbles: the conflict over California’s proposed billionaire tax

Big-time money squabbles: the conflict over California’s proposed billionaire taxTalking Points Californians worth more than $1.1 billion would pay a one-time 5% tax

-

Will Peter Mandelson and Andrew testify to US Congress?

Will Peter Mandelson and Andrew testify to US Congress?Today's Big Question Could political pressure overcome legal obstacles and force either man to give evidence over their relationship with Jeffrey Epstein?