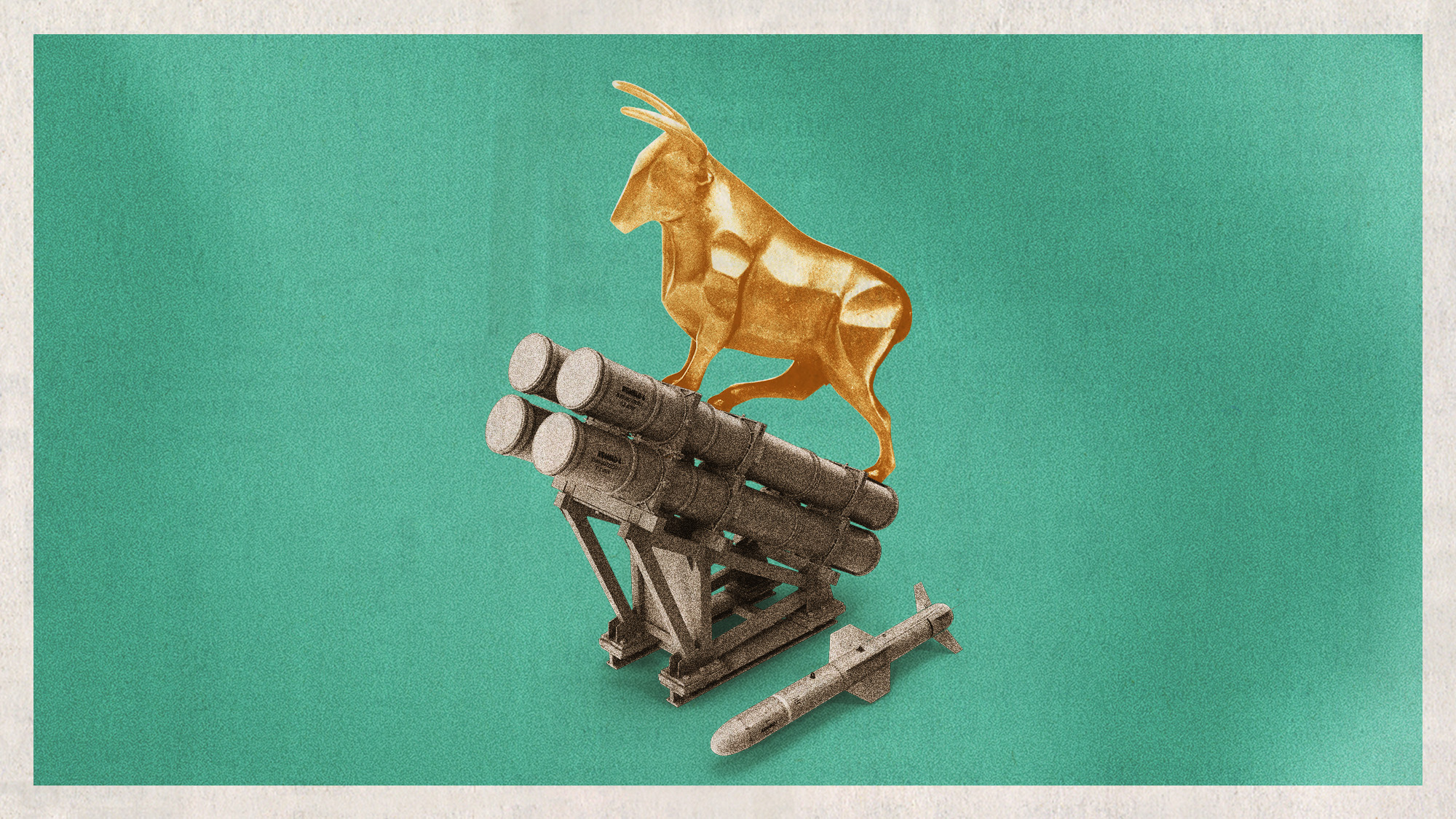

Will Republicans tax the rich?

Trump is waffling on the possibility of taxing wealthy earners

Republicans have never been known for their eagerness to raise taxes on high-income earners. So it is notable that GOP officials, including President Donald Trump, have in recent weeks openly contemplated the possibility of taxing the rich.

Trump last week asked House Speaker Mike Johnson to "include a tax hike on rich Americans" as part of a big new fiscal bill, said The New York Times. The proposal would create a new tax bracket for households making more than $2.5 million a year, charging income above that rate at 39.6%. But the president has gone back and forth on the issue, also sounding a note of caution, said CNN. "Republicans should probably not do it," Trump wrote on Truth Social, "but I'm OK if they do!!!"

That Republicans are even considering such a possibility is a "curveball for the ages," said Slate. The usual cycle of power is that "Republicans take power and cut the top rate," while Democrats "come in and raise it back." If a GOP-controlled Congress approved higher taxes on wealthy earners, it could scramble American politics by "stifling one of Democrats' central critiques of Republican governance."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What did the commentators say?

"Raising taxes on the wealthy shouldn't be Republican heresy," said Charles Lane at The Free Press. The idea has heightened the divide between anti-tax traditionalists like Grover Norquist and MAGA populists like Steve Bannon. Trump is waffling "between what he thinks is good policy and good politics." But a tax hike for the rich would be a "significant new step toward rebranding the Republicans as the party of the working class."

Don't be fooled. GOP politicians "promise to raise taxes on the rich routinely," said Jonathan Chait at The Atlantic. Trump made the promise "many times" during the 2016 campaign but never followed through during his first term. Republicans understand that "reducing taxes for the affluent is unpopular," so they "obscure their intentions." In truth, low taxes are the "force that holds Trump's coalition together." The president might entertain the possibility in public, "but you can bet your last dollar it won't happen."

What next?

There is skepticism among Republicans who have spent their careers opposing tax increases of any kind, said Axios. Senate Finance Chair Mike Crapo (R-Idaho) said he is "not excited about the proposal" but added that Trump's backing may force the issue. The president's support would be a "big factor that we have to take into consideration," Crapo said.

The tax hike would affect "pass-through businesses" in which earnings are reported on the owners' individual forms and "are subject to the individual income tax," said MarketWatch. One analysis found that 90% of American businesses are organized as pass-throughs. But other experts say the effect of the proposed hike would be minimal, said Axios. Only about "about 0.1% to 0.2%" of taxpayers would be affected, though that would include "jumbo paychecks" earned by "high-paid doctors, some professional athletes and executives."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

The former largest iceberg is turning blue. It’s a bad sign.

The former largest iceberg is turning blue. It’s a bad sign.Under the radar It is quickly melting away

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Scoundrels, spies and squires in January TV

Scoundrels, spies and squires in January TVthe week recommends This month’s new releases include ‘The Pitt,’ ‘Industry,’ ‘Ponies’ and ‘A Knight of the Seven Kingdoms’

-

Why is Trump threatening defense firms?

Why is Trump threatening defense firms?Talking Points CEO pay and stock buybacks will be restricted

-

Kelly sues Hegseth, Pentagon over censure

Kelly sues Hegseth, Pentagon over censureSpeed Read Hegseth’s censure was ‘unlawful and unconstitutional,’ Kelly said

-

Do oil companies really want to invest in Venezuela?

Do oil companies really want to invest in Venezuela?Today’s Big Question Trump claims control over crude reserves, but challenges loom

-

House approves ACA credits in rebuke to GOP leaders

House approves ACA credits in rebuke to GOP leadersSpeed Read Seventeen GOP lawmakers joined all Democrats in the vote

-

Jack Smith: Trump ‘caused’ Jan. 6 riot

Jack Smith: Trump ‘caused’ Jan. 6 riotSpeed Read

-

Wave of cancellations prompts Kennedy Center turmoil

Wave of cancellations prompts Kennedy Center turmoilIN THE SPOTLIGHT Accusations and allegations fly as artists begin backing off their regularly scheduled appearances

-

Why is Trump’s alleged strike on Venezuela shrouded in so much secrecy?

Why is Trump’s alleged strike on Venezuela shrouded in so much secrecy?TODAY'S BIG QUESTION Trump’s comments have raised more questions than answers about what his administration is doing in the Southern Hemisphere

-

Vance’s ‘next move will reveal whether the conservative movement can move past Trump’

Vance’s ‘next move will reveal whether the conservative movement can move past Trump’Instant Opinion Opinion, comment and editorials of the day