Thames Water: is it time to renationalise?

The company has failed to negotiate terms with Ofwat that would reduce their debt

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The future of Britain's largest water utility is hanging in the balance following a breakdown in talks with the industry regulator, Ofwat.

For months, Thames Water's shareholders have been pushing, without success, for concessions in return for pumping more money into the debt-laden company. They want Thames to be allowed to increase bills by 56% by 2030 and pay lower environmental fines. Last week, they pulled the plug on a pledge to provide an initial cash bailout of £500m by the end of March, saying Ofwat's intransigence had made Thames Water "uninvestable".

The move came a day after England's water companies came under fire for record sewage discharges into rivers and coasts, which more than doubled last year compared with the year before. The pollution issue was highlighted on Saturday when rowers in the Oxford vs. Cambridge Boat Race criticised the high levels of E. coli in the Thames. The crews had been warned not to enter the water; several rowers said they'd fallen ill.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What did the commentators say?

The biggest problem facing Thames Water isn't crumbling pipes or exceptional rainfall, said The Independent. It's debt. The utility is "an operationally profitable business with high and steady margins", and it hasn't paid out a dividend since 2017. But due to debts run up by previous owners, it owes £18bn – a crippling burden in an era of higWhat the commentators saidher interest rates. It's not alone, said The Times. Since England's water utilities were privatised in 1989, the sector has taken on £60bn of debt while paying out £72bn in dividends. Thames Water is the second company to get into trouble – after Southern Water in 2021 – "and it won't be the last".

Thames Water is a mess, said The Observer, but it could also hold the key to reform. To build London's new "super sewer", due to open next year and expected to dramatically cut discharges, Thames was required to set up a stand-alone public benefit company, called Tideway. The firm is privately funded, but partly underwritten by the state. Thames Water's 16 million customers will pay an annual £25 surcharge on their bills for 20 years to pay for the sewer. This public-private partnership "should be the model for the entire sector".

"It took a sewage-plagued Boat Race to do it," said Marina Hyde in The Guardian, "but people can now see the appalling state of England's water industry and waterways." As Oxford's defeated captain, Lenny Jenkins, told an interviewer: "It would be a lot nicer if there wasn't as much poo in the water."

After the past week, it's hard to deny that privatising England's water utilities was a mistake, said Libby Purves in The Times. Entrusting profit-driven companies with a monopoly on essential services clearly doesn't work. "Scottish Water stayed public and is the most trusted and low-priced utility in Britain." Hard as it might be for the Tories to question Margaret Thatcher's legacy, they should accept that this form of privatisation is "a dead 1980s dream, fit to join Joan Collins's Dynasty shoulder pads in the dustbin of history".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"Privatisation wasn't in itself such a bad idea," said Jeremy Warner in The Daily Telegraph. It was pursued because water utilities, when they were publicly owned, were starved of the funding they needed to improve ageing infrastructure. Governments always had more pressing spending priorities and, for political reasons, were loath to raise water bills. Privatisation, it was hoped, would give water firms access to more funds. And indeed it did, said Nick Timothy in the same paper.

Since 1989, capital investment has been 84% higher, with water companies putting in £190bn. The problem came when reckless financiers, abetted by lax regulators, started using these companies as "cash machines", obscuring their activities behind convoluted corporate structures. The Government should let Thames Water go bust and start again with new investors. Capitalism is great at allocating capital and driving innovation, but for it to work properly, it must entail risk as well as reward. Such a course would require Thames's creditors to take "a brutal haircut", said Neil Collins on Reaction, but that's too bad. The alternative, conceding to a massive hike in water bills, would "effectively mean the consumer paying twice – once to enrich the previous shareholders, and once to clean up the mess they left behind".

What next?

Thames Water may end up being placed in special administration, a form of temporary nationalisation, reports The Guardian, but the Government is understood to be eager to avoid this outcome before the general election. The company has enough cash to meet its commitments until May 2025. However, it needs £3bn of equity by 2030 to fund its investment plan and maintain assets.

Its parent company, Kemble, needs to repay a £190m bank loan by the end of April, but currently lacks the funds to do so. New Thames investors are unlikely to emerge before that situation is resolved.

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

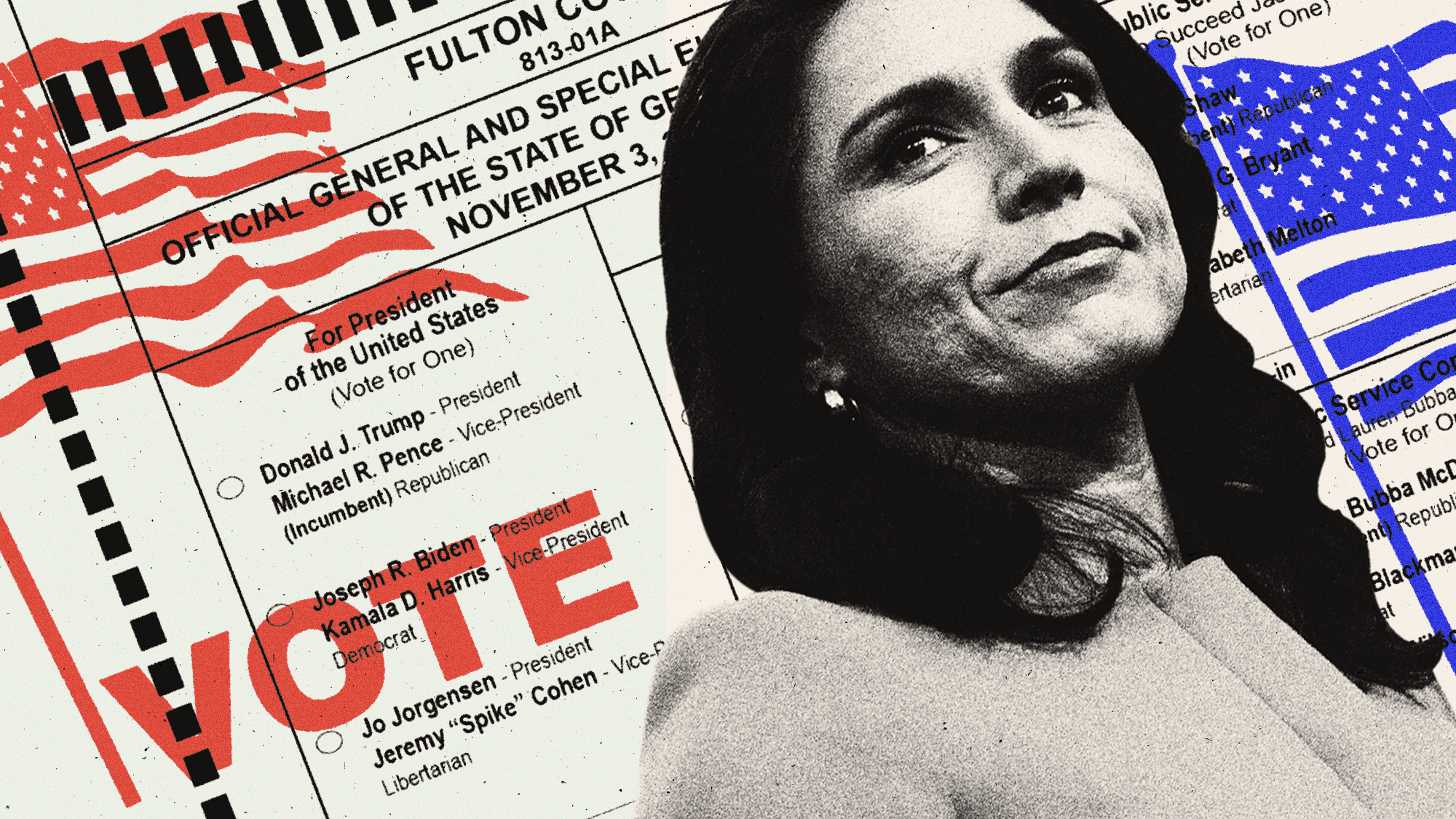

Why is Tulsi Gabbard trying to relitigate the 2020 election now?

Why is Tulsi Gabbard trying to relitigate the 2020 election now?Today's Big Question Trump has never conceded his loss that year

-

Will Democrats impeach Kristi Noem?

Will Democrats impeach Kristi Noem?Today’s Big Question Centrists, lefty activists also debate abolishing ICE

-

Do oil companies really want to invest in Venezuela?

Do oil companies really want to invest in Venezuela?Today’s Big Question Trump claims control over crude reserves, but challenges loom

-

What is China doing in Latin America?

What is China doing in Latin America?Today’s Big Question Beijing offers itself as an alternative to US dominance

-

Why is Trump killing off clean energy?

Why is Trump killing off clean energy?Today's Big Question The president halts offshore wind farm construction