Donald Trump wants to cut taxes and pay for them with tariffs

The GOP nominee plans to offset additional tax cuts with massive new levies on imported goods

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One of the enduring divisions between Democrats and Republicans in the United States is over how to use the tax code to achieve ideological goals. So it is no surprise that the major party nominees —- Democratic Vice President Kamala Harris and former Republican President Donald Trump — are offering sharply different visions of how they would use tax policy. In his third campaign for the presidency, Trump is promising further tax reductions but also pairing them with aggressive tariffs on imported goods, which function as a kind of tax on the importing company that is ultimately passed on to consumers.

More tax cuts are coming

One of Trump's signature legislative achievements as president was the 2017 Tax Cuts and Jobs Act (TCJA). Among other things, the TCJA permanently lowered the corporate tax rate to 21% from 35% for most companies. While the changes prolonged the U.S. economic expansion that ended abruptly with the COVID-19 pandemic in the spring of 2020, they also worsened America's structural budget deficit. Nevertheless, the Trump campaign has discussed another round of corporate tax-cutting, to a rate of 15% for domestic manufacturers, although neither this proposal nor any proposed policies related to individual or corporate tax rates are to be found in the campaign's official Agenda 47 policy pages.

In addition to corporate taxes, the Trump campaign wants to make further changes to the tax code for individuals and families. The TCJA "reduced statutory tax rates at almost all levels of taxable income," said a report by The Urban-Brookings Tax Policy Center, meaning that most Americans paid lower taxes after the law was implemented. Many of those provisions, however, expire at the end of 2025, and the Trump campaign wants Congress to make them permanent. That includes the TCJA's significant expansion of the standard tax deduction for individual and joint filers as well as the TCJA's alterations to the Estate Tax.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Additional deductions and how to offset them

The Trump campaign has reversed course on one TCJA change, which was to cap the State and Local Tax deduction (SALT) for homeowners at $10,000. The Trump campaign now promises to restore that deduction to where it was before the TCJA was passed. "I will turn it around, get SALT back, lower your Taxes, and so much more," said Trump in a September 17 post on Truth Social. Democrats, who have been trying to have the exemption restored for many years, seem to agree with the former president here.

Finally, Trump has proposed two new individual tax exemptions, one for income from tips for restaurant workers and others who draw a significant percentage of their income from gratuities, and another for overtime pay. While the proposals are meant to boost income for hourly wage-earners, critics argue that it would introduce another form of inequity in the tax code. "Overworked salaried employees wouldn't see a tax cut on their long workweeks," said Emily Peck in Axios.

The Trump campaign has promised to offset the revenue losses from these proposals with new tariffs on imported goods. The exact shape of those tariffs has been a moving target during the campaign. After weeks of promising a 10% blanket tariff on all imported goods, Trump recently raised the bar by floating the prospect of a 50% worldwide tariff during an interview in Chicago with John Micklethwait, the editor-in-chief of Bloomberg News. Trump argued that it would be an incentive for companies to relocate to the United States to avoid the new levy. "It must be hard for you to spend 25 years talking about tariffs being negative and then have somebody explain to you that you're totally wrong," said Trump when Micklethwait criticized the plan.

Most economists, though, are skeptical that Trump's proposed tariffs would help the economy. Even the lower-range tariff proposals could "cost a typical household in the middle of the income distribution at least $1,700 in increased taxes each year," said Kimberley Clausing and Mary Lovely in a Peterson Institute for International Economics report.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

David Faris is a professor of political science at Roosevelt University and the author of "It's Time to Fight Dirty: How Democrats Can Build a Lasting Majority in American Politics." He's a frequent contributor to Newsweek and Slate, and his work has appeared in The Washington Post, The New Republic and The Nation, among others.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

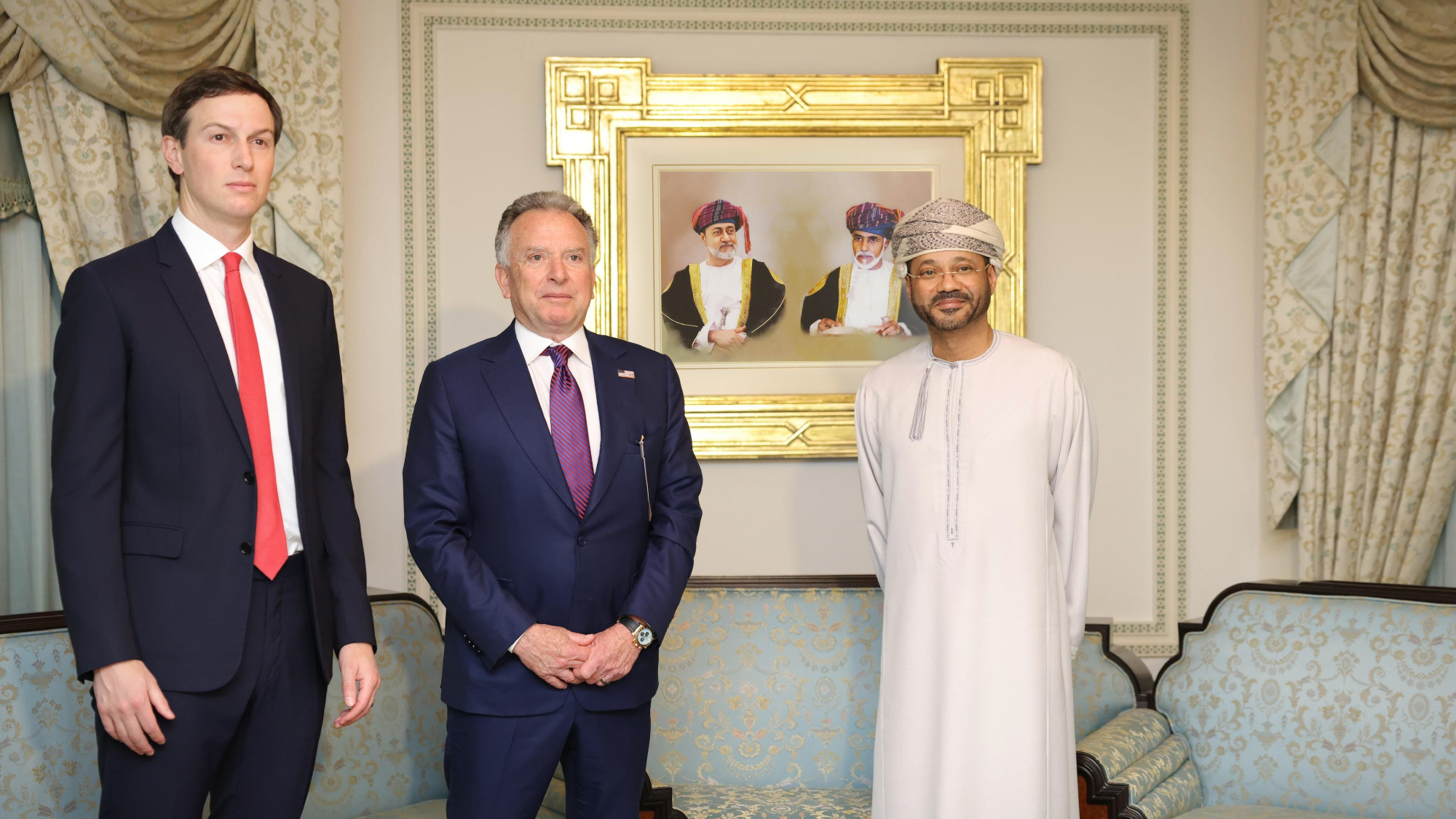

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

‘The forces he united still shape the Democratic Party’

‘The forces he united still shape the Democratic Party’Instant Opinion Opinion, comment and editorials of the day

-

Kurt Olsen: Trump’s ‘Stop the Steal’ lawyer playing a major White House role

Kurt Olsen: Trump’s ‘Stop the Steal’ lawyer playing a major White House roleIn the Spotlight Olsen reportedly has access to significant US intelligence

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed

-

House votes to end Trump’s Canada tariffs

House votes to end Trump’s Canada tariffsSpeed Read Six Republicans joined with Democrats to repeal the president’s tariffs